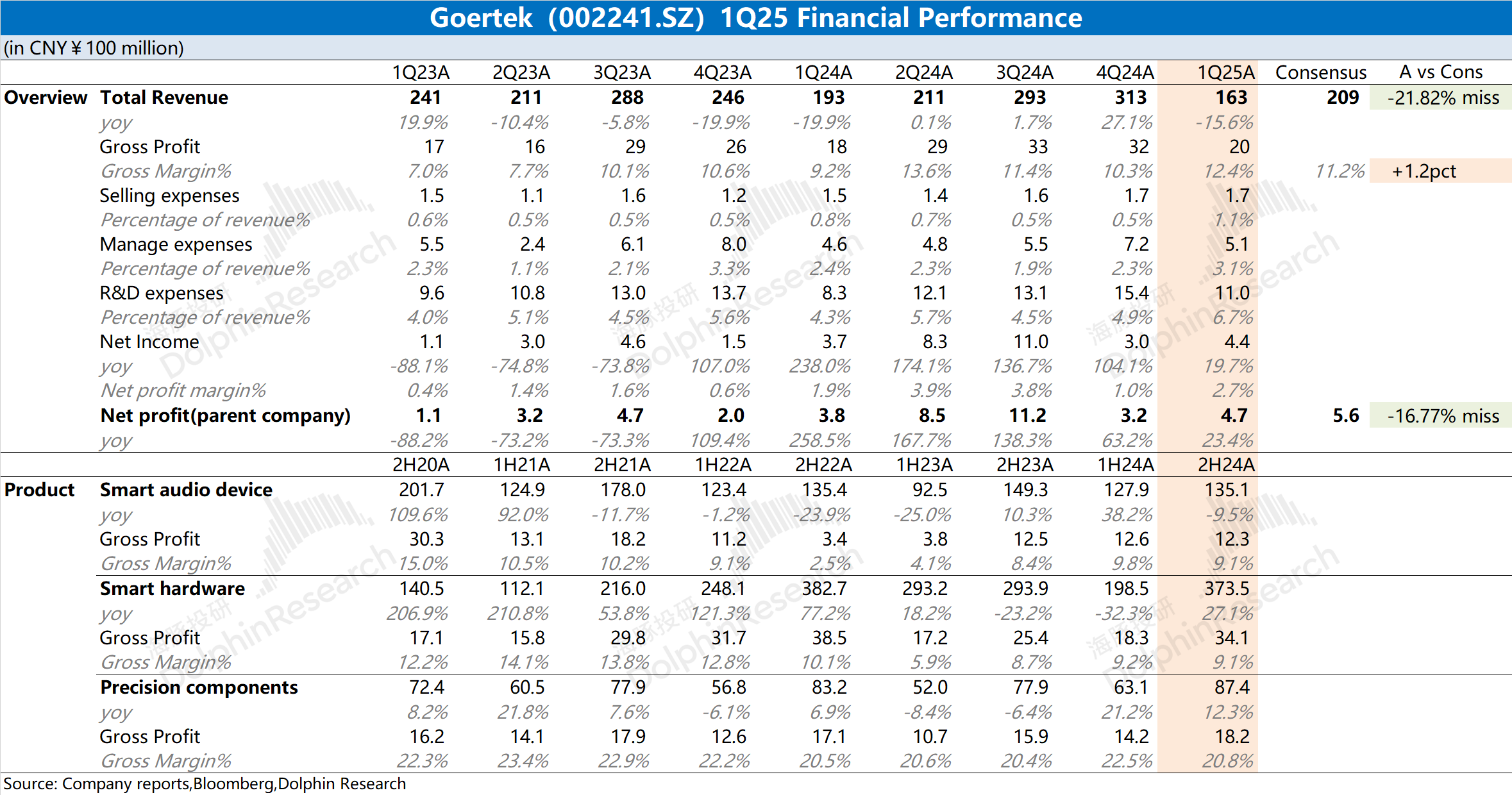

$Goertek(002241.SZ)Quick Interpretation: The company's financial report this time is not ideal, with revenue declining by double digits again this quarter. The growth in the company's profits is mainly driven by non-operational factors such as investment income.

Previously, the company's annual report showed a significant improvement in the fourth quarter's performance, mainly driven by the low-cost version of Quest 3S and Apple's new product AirPods 4, which led to good market expectations for the first quarter. However, the company's Q1 revenue has declined again, further indicating weak downstream demand.

In addition, the company has production capacity in both Vietnam and China. The continuous adjustment of tariff policies may also bring additional cost burdens to the company, and its operational side will continue to face pressure.

The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.