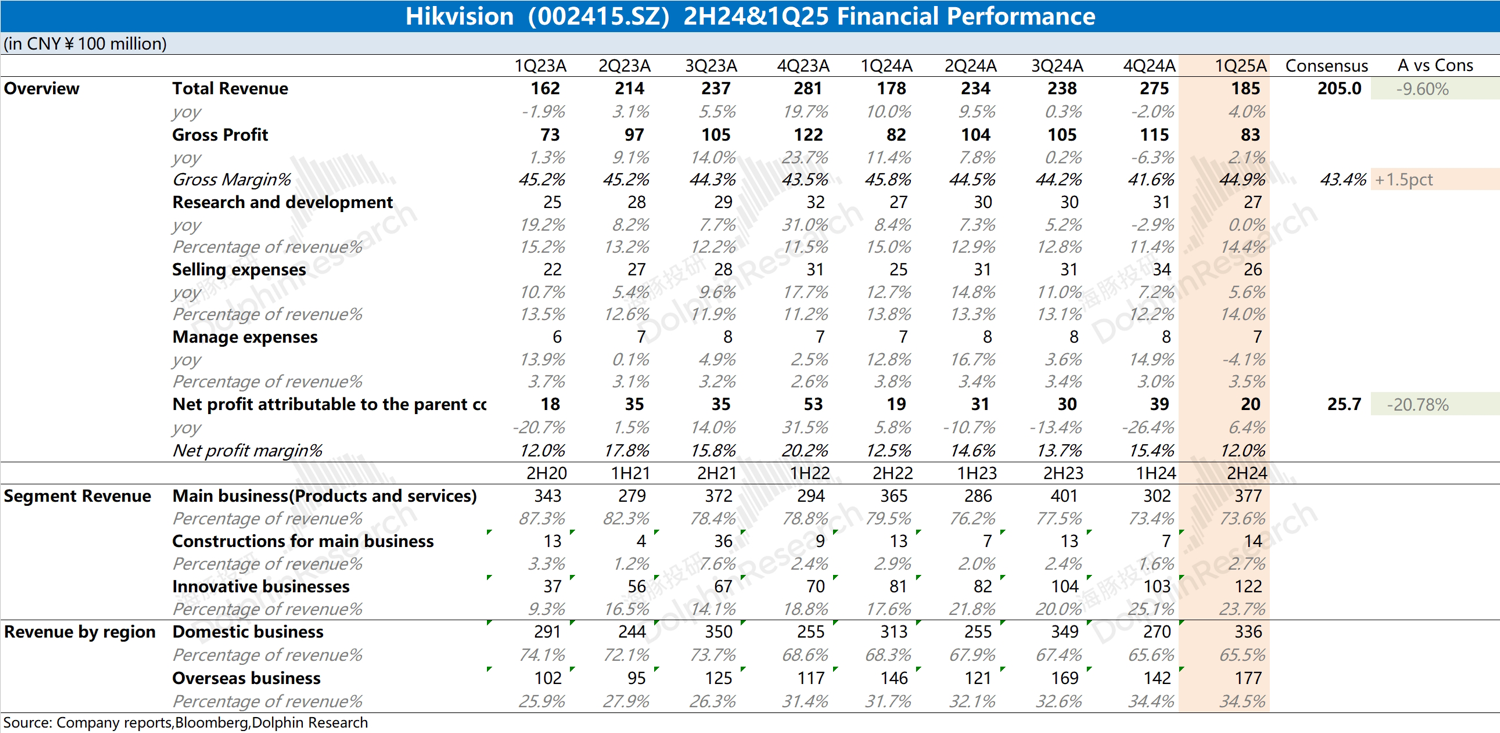

$HIKVISION(002415.SZ) Quick Interpretation: The company's recent performance has not improved, with a slight increase in Q1 revenue and a continued year-on-year decline in gross margin. The growth in Q1 was mainly driven by innovative businesses and overseas operations, while domestic business remains sluggish.

Since the company released its annual report and Q1 results together, the 2024 annual report provided more information. The decline in domestic core business is the main pressure on the company's current operations. Affected by factors such as government finances, the PBG business fell by 14.4% again in 2H24; the enterprise segment (EBG and SMBG) also saw varying degrees of decline. The innovative business is one of the few bright spots, maintaining double-digit growth.

Due to the continued sluggishness of the domestic core business, the market has lowered its expectations for the company. The current market focus is on the bottoming out of the domestic core business and the empowerment of AI large models. Apart from the innovative business maintaining double-digit growth, there were no signs of improvement in this financial report, and the company's operations have yet to emerge from the bottom.

The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.