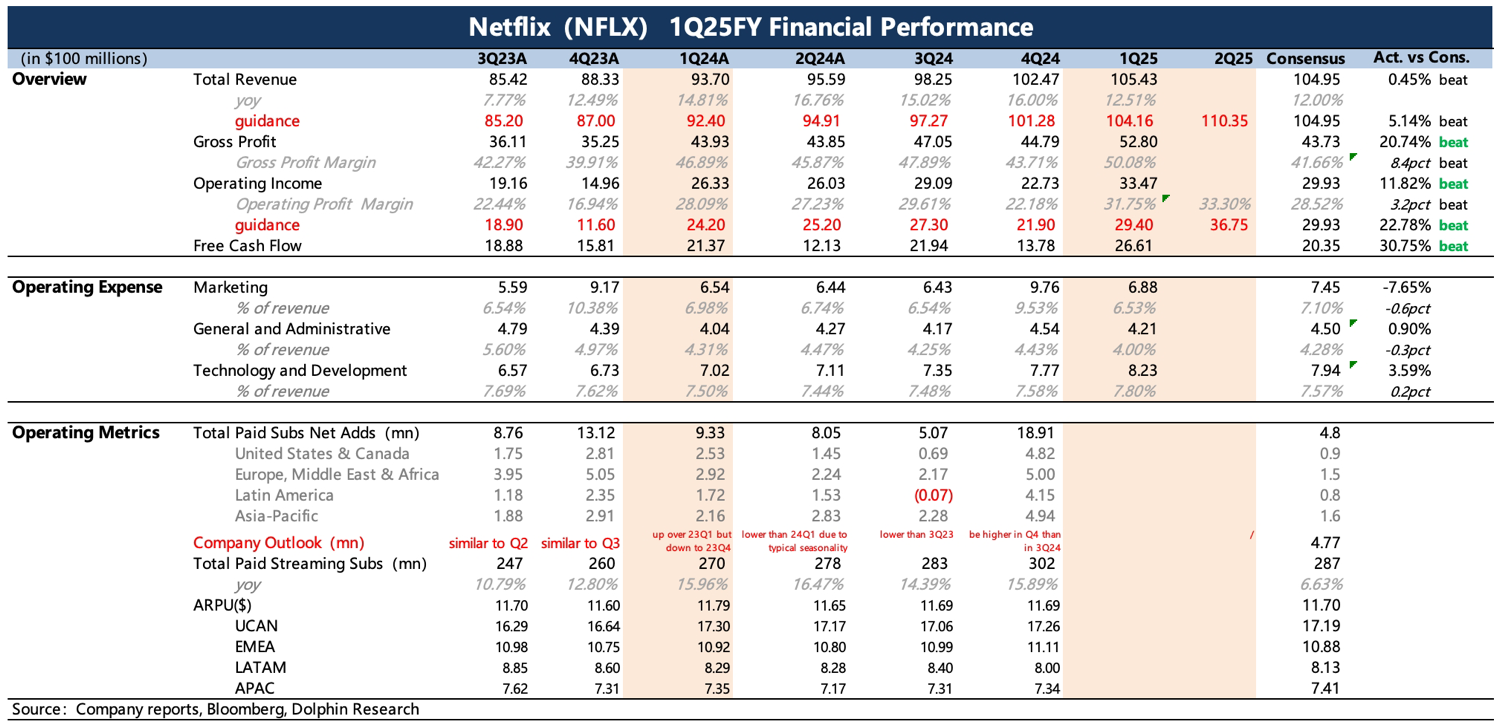

$Netflix(NFLX.US)1Q25 Quick Interpretation: First-quarter performance exceeded expectations, with the main highlight being profitability. Meanwhile, management's guidance for the second quarter was also higher than market expectations. In this "turbulent" year, the company did not adjust its full-year revenue guidance, which to some extent demonstrates operational confidence and confirms the current "safe haven" attribute of subscription streaming services being relatively less sensitive to macro conditions. On the other hand, with the significant beat in Q1 and no adjustment to the full-year target, this may also reflect some cautious considerations by management.

1. Profit exceeded expectations in gross margin. First-quarter gross margin continued to rise significantly, driven not only by the sustained popularity of hit shows but also by price increases in multiple regions and the advancement of high-margin advertising. Management's guidance for Q2 profitability is even higher, with operating margin rising to 33% (QoQ +1.5pct), though the full-year operating margin guidance remains at 29% for now.

2. Subscriber growth likely came mainly from Europe and Asia. Starting this year, the company no longer discloses subscriber numbers, so Dolphin Research could only estimate the approximate subscriber growth based on regional price increases. According to estimates, overall subscription revenue grew 12.5% YoY (16% YoY on a currency-neutral basis), slightly above expectations, with revenue growth primarily driven by an increase in subscribers.

Europe and Asia saw more growth, benefiting from locally popular content during the quarter. In North America, as the core region for price hikes, subscriber growth was sluggish, with estimates even suggesting a decline (QoQ). However, this is a short-term impact, and the company expects North American revenue growth to accelerate in Q2.

3. Cash flow hit a record high. First-quarter free cash flow (Non-GAAP) reached nearly $2.7 billion, up 25% YoY. With monetization at its peak due to the content cycle, content investment growth slowed YoY.

Based on typical investment patterns, spending will accelerate in the second half of the year. However, given the relatively turbulent macro environment this year, Dolphin Research believes the original $18 billion content budget may not be fully spent due to cautious control. Competitors may face the same issue, but generally, this situation tends to favor the current market leader.

The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.