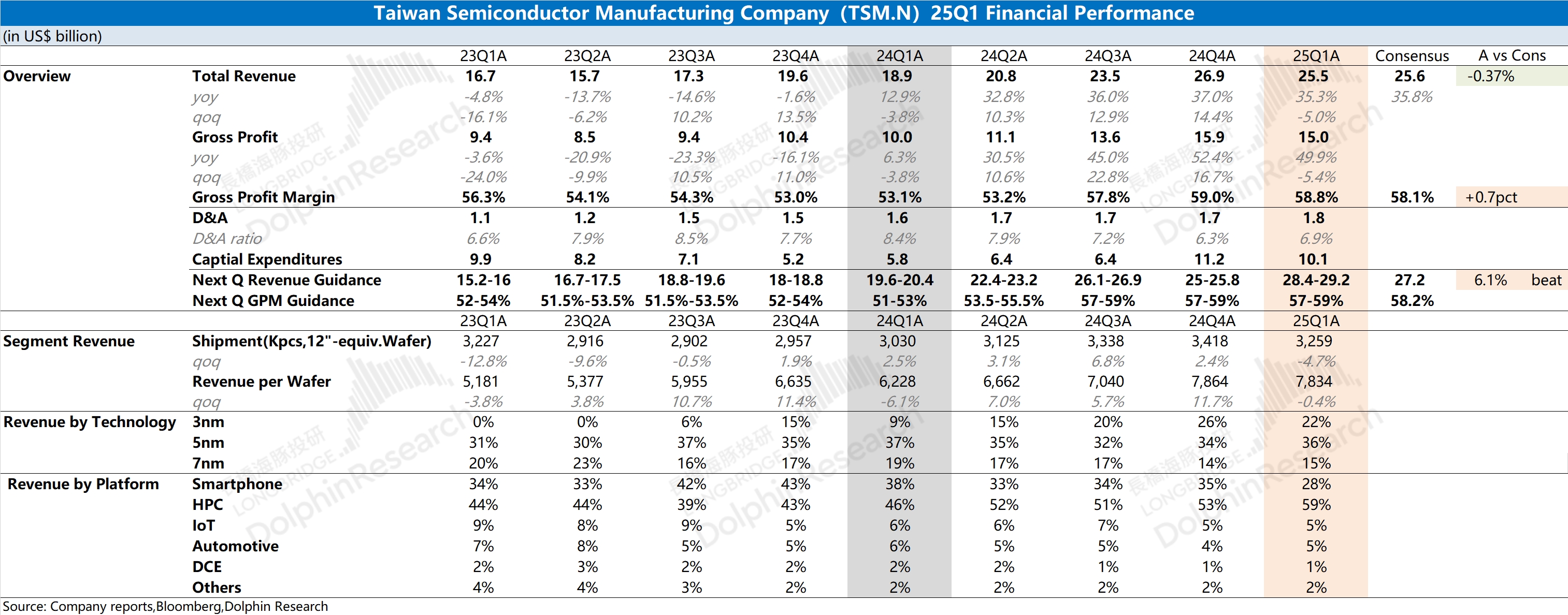

$Taiwan Semiconductor(TSM.US) Quick Interpretation: The company's revenue and gross margin this quarter were not bad. Although some of the company's production capacity was affected by the earthquake in the first quarter, the two core metrics still met previous guidance. The gross margin was close to the upper limit of the guidance, mainly driven by AI demand and full production of advanced processes.

Specifically, the revenue share of advanced processes remained above 70% this quarter, with strong demand for 3nm and 5nm. High-performance computing was the main growth driver, accounting for nearly 60% of total revenue.

Compared to the first quarter data, the company's guidance for the second quarter is even better. The company expects second-quarter revenue to reach $28.4-29.2 billion, with gross margin maintained in the 57-59% range. Benefiting from AI demand, the high-performance computing business will continue to drive performance growth.

Recently, due to tariff concerns, market expectations for the company and the industry have been somewhat cautious. However, the company maintained its full-year revenue growth target (around 25%) and capital expenditure target ($38-42 billion), further stabilizing market confidence.

With increased demand from Qualcomm and Intel's outsourcing business, the company is continuously consolidating its leading position in advanced process manufacturing. Leveraging its "bargaining power" in the supply chain, the company can partially offset impacts while maintaining relatively stable operational performance.

The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.