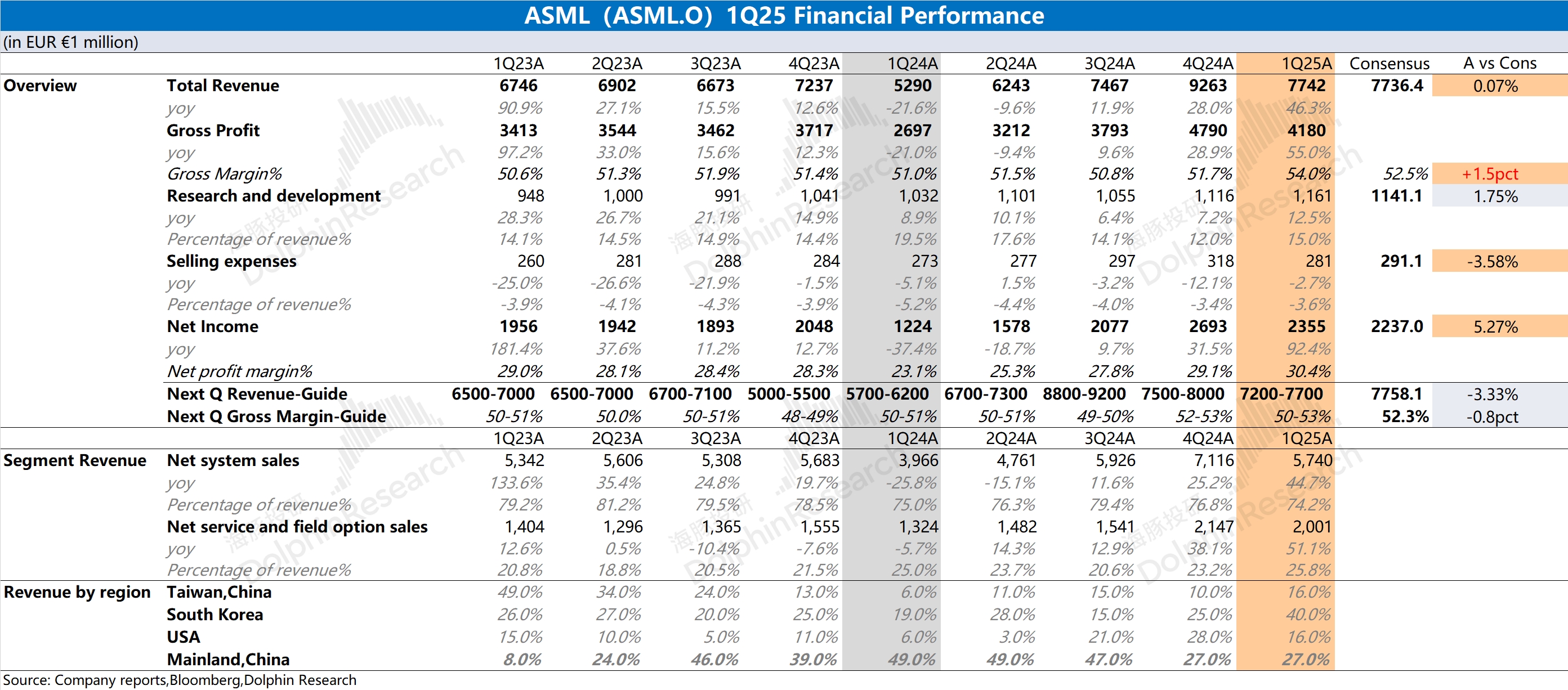

$ASML(ASML.US) 1Q25AQuick Interpretation: This quarter's revenue and gross margin both met the company's previous guidance. The better-than-expected gross margin improvement was mainly driven by structural factors such as the increased proportion of service revenue and EUV revenue. The company's operating expenses remained relatively stable, resulting in solid profitability this quarter.

Looking at the company's guidance for the next quarter, both revenue and gross margin are expected to decline. Although some Korean customers still have strong demand expectations, the company's net bookings for Q1 were only €3.94 billion (market expectation: €4 billion+), which is unlikely to boost market confidence.

Currently, the company maintains its full-year revenue growth guidance of €30-35 billion, but it also faces pressures and challenges. On one hand, the global semiconductor end-market recovery shows signs of weakness again; on the other hand, "tariff policies" have added uncertainty.

Overall, the company's quarterly earnings met expectations, but its guidance for the next quarter appears weak. Under the current uncertainties, if the company fails to inject strong confidence into the market, it will likely face significant impact and volatility. For more details, stay tuned for Dolphin Research's follow-up analysis and earnings call coverage.

The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.