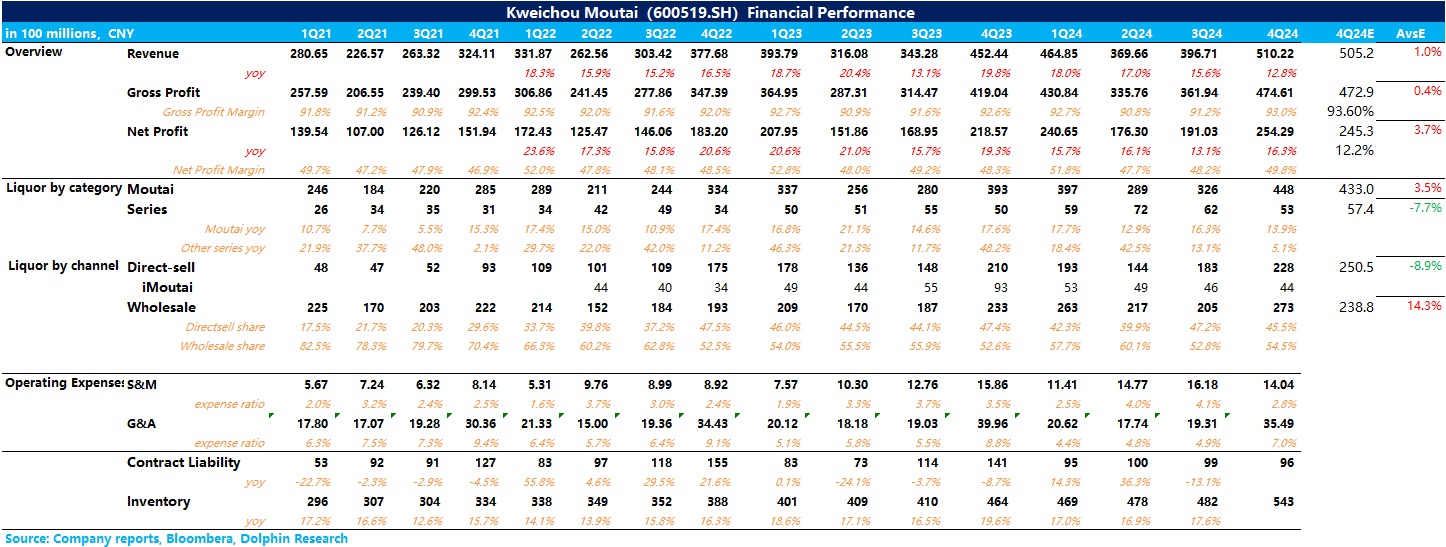

$Moutai(600519.SH) 4Q24 performance Quick Interpretation: Moutai's Q4 performance was overall quite good, slightly better than the guidance in the 2024 annual production and operation announcement released in January this year.

Among them, Moutai liquor achieved annual sales of 46,000 tons, a year-on-year increase of 10.2%, with a price per ton increase of 4.6% year-on-year. The sales exceeded market expectations, mainly attributed to Moutai increasing the supply of aged liquor. Looking at the performance for the single fourth quarter, Moutai liquor achieved revenue of 44.8 billion yuan, a year-on-year increase of 13.9%, exceeding market expectations by 3.5 percentage points. This was mainly due to Moutai increasing the supply of non-standard liquor in the fourth quarter, while series liquor achieved revenue of 5.29 billion yuan, a year-on-year increase of 5.15%, which fell short of market expectations, mainly due to the company's continued suspension of deliveries for Moutai 1935 at the end of the year to control inventory and stabilize prices.

By channel, the direct sales ratio in 4Q24 was 45.5%, maintaining a high level compared to Q3, mainly because the company increased the supply of non-standard products (such as 1000ml Feitian, cultural and creative products, etc.) in Q4 (non-standard products are often supplied through direct sales channels). In addition, the slowdown in the growth of series liquor also caused the proportion of distribution channels to temporarily decline (series liquor currently has a higher proportion in distribution channels).

In terms of gross margin, due to the improvement in product structure, the Q4 gross margin reached 93%, a three-year high. On the expense side, due to increased marketing investment in series liquor throughout the year, the marketing expense ratio slightly increased, while the administrative expense ratio steadily decreased, resulting in a final net profit margin of 49.8%, remaining stable. For more details, please refer to Dolphin Research's subsequent financial report commentary.

The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.