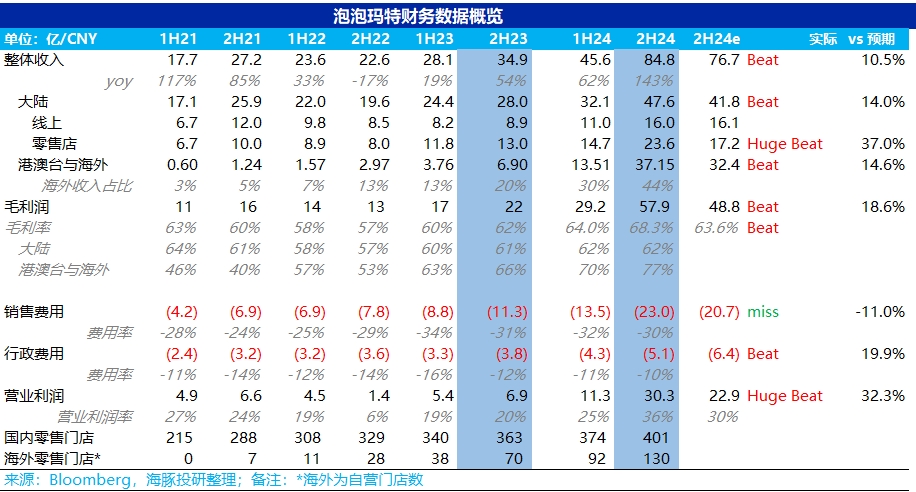

$POP MART(09992.HK) 24H2 Performance Quick Interpretation: Overall, Pop Mart's performance in the second half of the year is quite impressive, with overseas operations continuing the explosive growth momentum from Q3 into Q4. What surprised Dolphin Research even more is that domestic offline retail stores accelerated in Q4 compared to Q3, ultimately achieving a year-on-year growth of 70% in the second half, significantly exceeding market expectations.

1. Overseas growth continues, and domestic performance shines even brighter. Since Pop Mart had already reported explosive overseas performance in Q3 (440%-445%), the overall growth rate for the second half of the year (438%) suggests a slight deceleration in Q4 compared to Q3, but it still indicates that the company has maintained high growth momentum overseas. However, what exceeded Dolphin Research's expectations was the performance of domestic offline stores, which accelerated again in Q4 compared to Q3 (55%-60%) despite a generally sluggish consumption environment, achieving a high growth of 70% in the second half, further highlighting Pop Mart's uniqueness.

2. The monsters surpass Molly to become the largest IP. In terms of IP, Molly, as Pop Mart's initial classic IP, maintains strong vitality through a diversified product mix. Due to the explosive popularity of Labubu, The Monsters series continues to experience explosive growth, surpassing Molly to become the company's largest IP. Plush toys have seen explosive growth. In terms of categories, the proportion of blind boxes, represented by figurines, continues to decline, replaced by the explosive growth of the higher-margin plush toy series, with its share increasing significantly from less than 10% in the first half to 30%.

3. Gross margin reaches a historical high. Due to the explosive growth of high-margin overseas business and the improvement in product structure, the company's gross margin for 24H2 reached 68%, setting a new historical high.

4. Expense ratio continues to decline. In the second half of the year, the company has also become more refined in its expense allocation, increasing more efficient online marketing and optimizing personnel, resulting in a decrease in both sales and management expense ratios, with core operating profits exceeding market expectations.

The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.