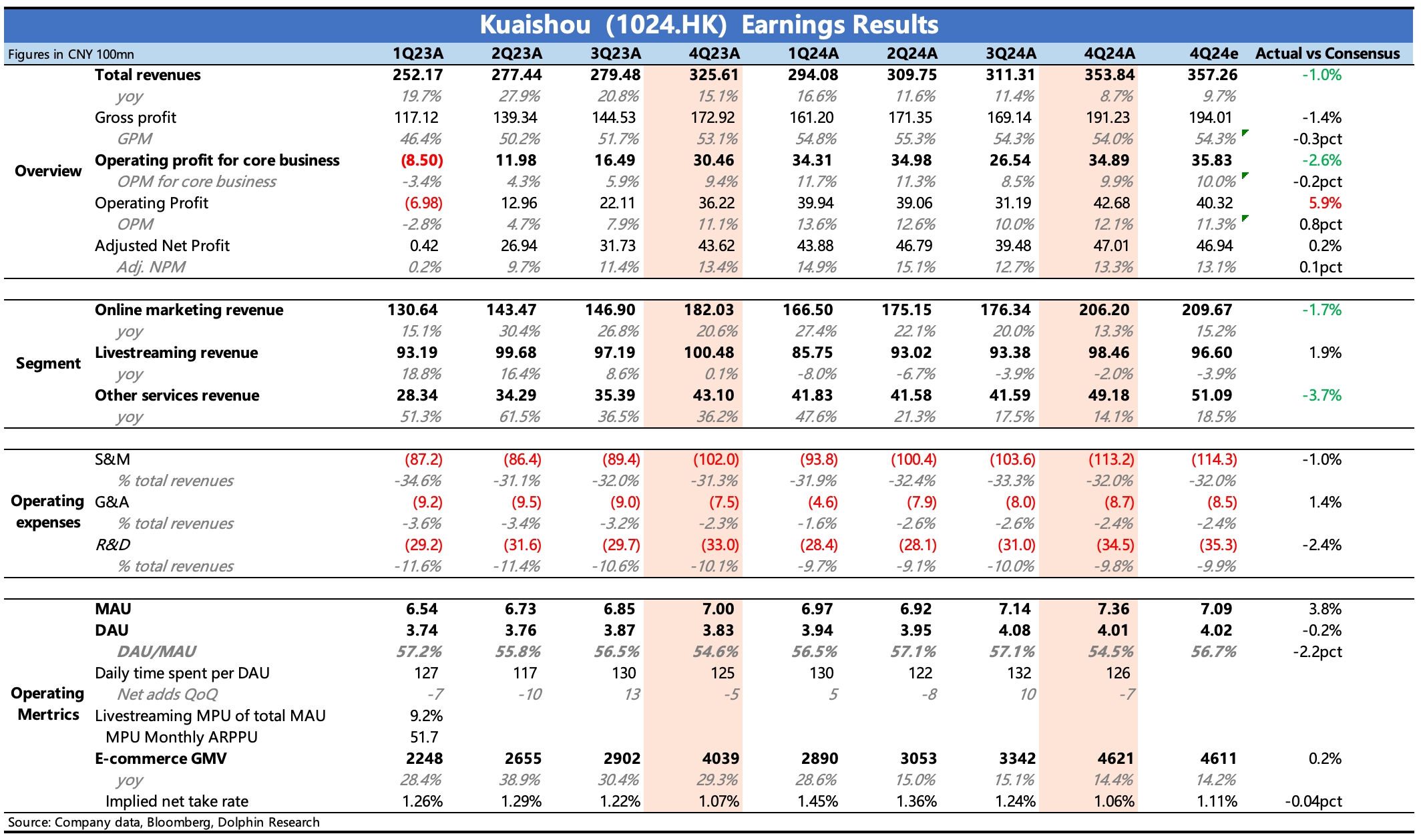

$KUAISHOU-W(01024.HK) Q4 2024 Financial Report Quick Interpretation: Q4 performance is not good, with slight misses in core advertising and e-commerce commission revenues. Gross margin remains flat, and although expenses continue to be controlled, the operating profit of the core business is still below expectations.

1. User growth slows, gradually reaching a peak: In the fourth quarter, MAU and DAU continued to expand at a low single-digit growth rate, with daily average time spent remaining flat. According to QM data, user metrics are weaker than Douyin, WeChat Video Accounts, and Xiaohongshu, indicating significant competitive diversion.

2. Advertising continues to slow: In the fourth quarter, advertising growth was 13%, with a rapid slowdown compared to the previous quarter, influenced by the broader environment, but competition also had a significant impact. Dolphin Research's rough breakdown shows that e-commerce advertising followed GMV changes, with growth slightly slowing to 14% compared to Q3, while external advertising dropped from nearly 25% to around 15%, mainly driven by short dramas and games.

3. E-commerce: In the fourth quarter, GMV grew 14% year-on-year, with a net increase of 10 billion compared to Q3, mainly relying on increased user penetration, meaning more shopping users (monthly average shopping users reached 143 million, with penetration rate rising to 19.5%, adding 7 million new shopping users during Double 11). The average transaction value should remain flat. The average commission rate calculated for Q4 was 1.06%, slightly lower than last year's level, with a trend differing from the previous three quarters, mainly due to the company's efforts to attract more new merchant collaborations, leaning towards more policy support (such as high point rebates, etc.).

4. Live streaming rebounds beyond expectations: Throughout last year, live streaming was actively adjusting, and in the fourth quarter, with the continued increase in game live streaming buffering the impact, the actual income from rewards showed a slight rebound beyond expectations, and it is expected to return to low-speed positive growth this year.

5. Stable expense control: In the fourth quarter, gross margin remained flat, and expenses were slightly controlled compared to market expectations, with overall profit margins slowly improving. The final adjusted net profit was in line with expectations, but there were fluctuations in foreign exchange gains and losses and wealth management, which interfered with the actual profit performance of the core business, which still showed a slight miss.

6. Currently, Kuaishou's valuation is not high compared to peers, so the conference call will focus on management's outlook for this year's business, including some business changes brought by AI (cost-saving and efficiency-enhancing). If the outlook is positive, it may temporarily alleviate some funding concerns, and as technology sentiment improves in the future, there will continue to be interest in Kuaishou's relatively low valuation and AI attributes in the short to medium term.

The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.