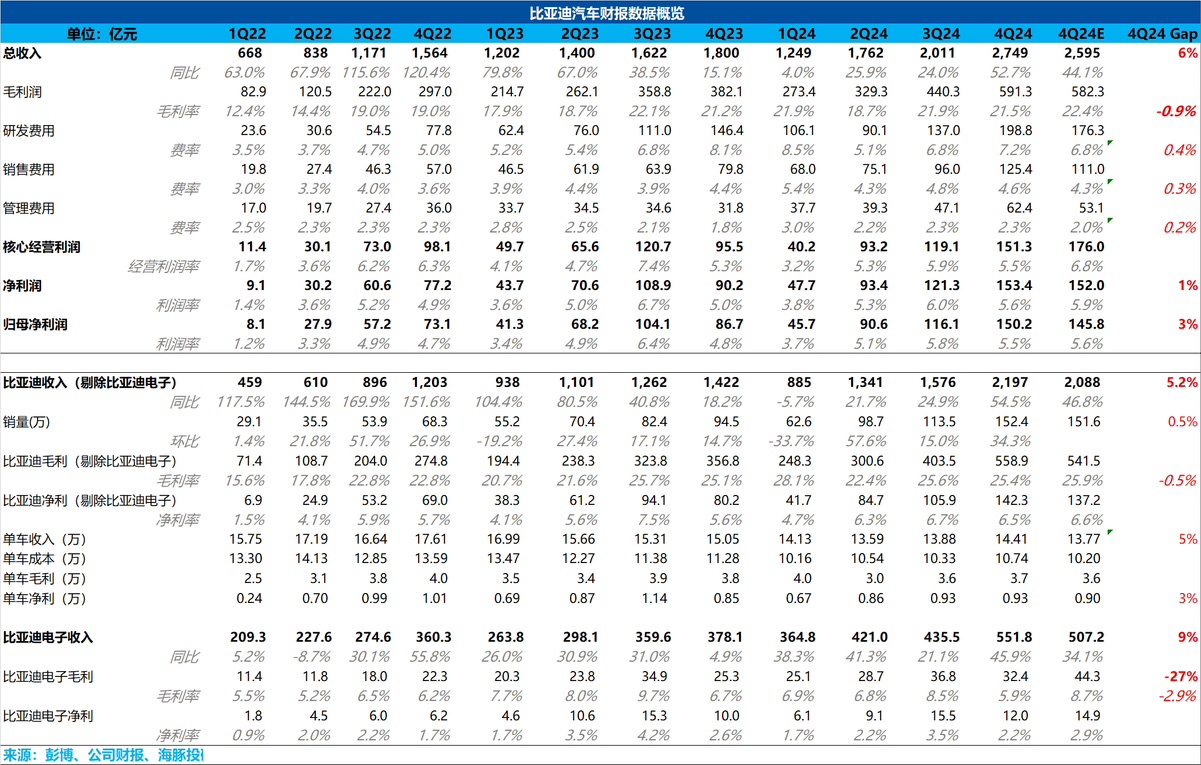

$BYD(002594.SZ) Quick Interpretation: Overall, BYD's performance in the fourth quarter is quite good, with total revenue exceeding market expectations. If we look solely at the core car sales revenue (including a rough estimate of battery business), this quarter also surpassed market expectations, with car sales revenue of 219.7 billion, exceeding the market expectation of 208.8 billion. The main reason for the outperformance is that BYD's revenue per vehicle showed an upward trend this quarter, while the market expected a downward trend due to BYD's price cuts at the end of the year (although the price cut was not significant), and the proportion of high-end and overseas sales remained the same as the previous quarter. Surprisingly, BYD's revenue per vehicle increased by 5,000 yuan to 144,000 yuan, exceeding the market expectation of 137,000 yuan. Dolphin Research believes this may be driven by a slight increase in the proportion of high-end sales in the fourth quarter.

In terms of core automotive gross margin this quarter, the market expected that due to the release of scale effects, BYD's automotive gross margin would show a quarter-on-quarter increase (up 0.3 percentage points to 25.9%). However, BYD's automotive gross margin this quarter was 25.4%, slightly lower than the market expectation of 25.9%, but still within a reasonable margin of error.

This quarter's R&D expenses indeed aligned with Dolphin Research's previous expectations. As car sales brought a significant increase in cash flow, BYD is rapidly catching up on its homework for the second half of the competition around intelligent driving, especially in preparation for the equalization of intelligent driving in 2025. This high increase in R&D investment can also be understood by the market.

In terms of bottom-line net profit, although there was a significant increase in expenses (especially R&D expenses), the contribution from other income of 5 billion also helped BYD's net profit attributable to shareholders exceed market expectations. $BYD COMPANY(01211.HK)

The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.