$NIO(NIO.US) 4Q24 Quick Interpretation: Overall, Nio once again delivered disappointing results, and the guidance for Q1 2025 is also quite average. Specifically:

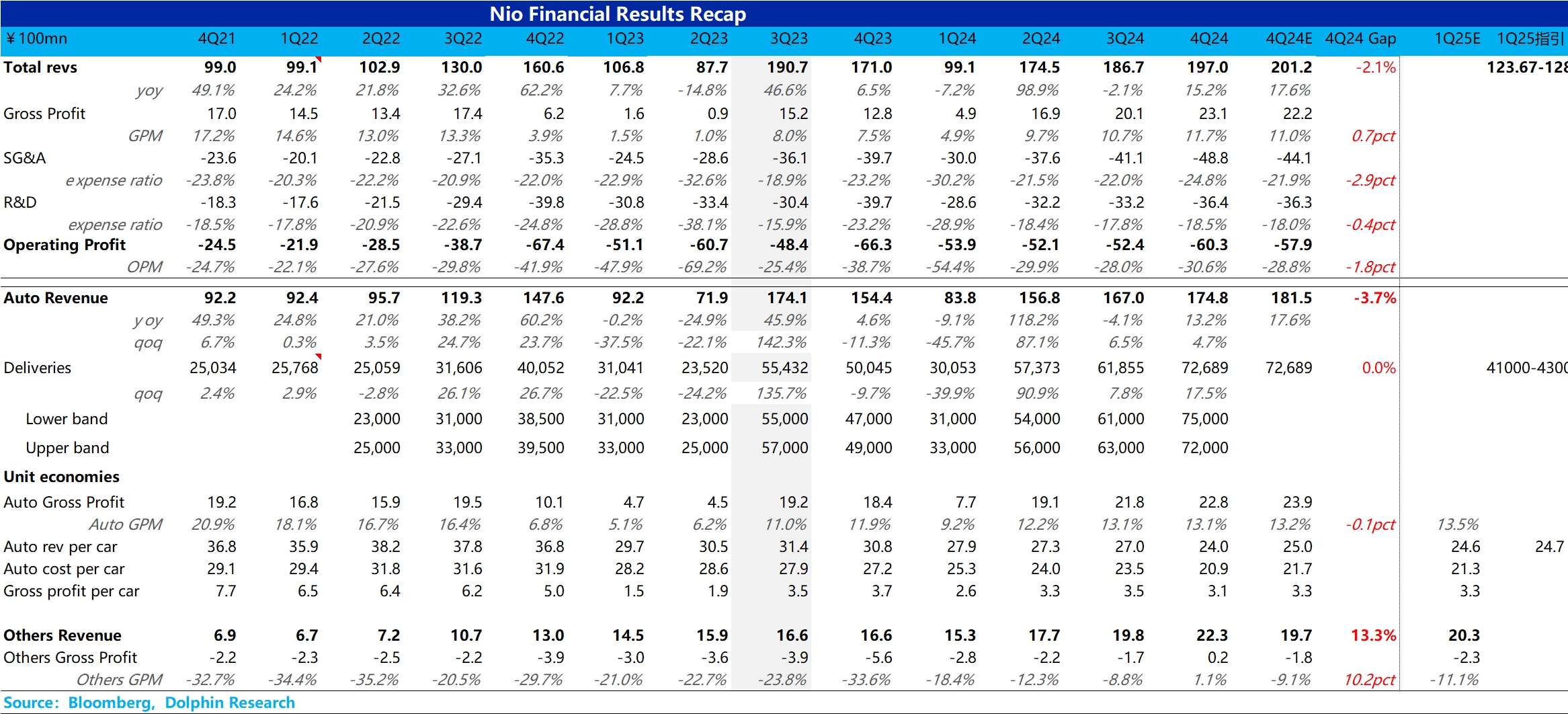

① In the fourth quarter, the top-line revenue missed market expectations, with a total revenue of 19.7 billion, while the market expectation was still at 20.1 billion, resulting in an expectation gap of about 400 million. The market remains concerned about Nio's automotive business, with automotive revenue this quarter at 17.5 billion, while the market expectation was still at 18.2 billion, totaling nearly 700 million in expectation gap, primarily due to lower-than-expected vehicle sales revenue.

This quarter's vehicle sales revenue saw a significant decline, dropping from 270,000 in the previous quarter to 240,000 this quarter, while the market expectation was around 250,000. Although this quarter faced negative impacts from delivery structure (the proportion of the lowest-priced model, the ET5, increased), the market had already priced in this factor, yet the final results still fell short of expectations, reflecting possibly increased actual promotional discounts.

Regarding gross margin, although the overall gross margin this quarter beat market expectations, it was mainly due to other businesses turning profitable. The core automotive business, barely met market expectations, also missing Nio's previous guidance of a 15% gross margin for the automotive business in Q4.

② Similarly, in terms of operating profit and bottom-line net profit, both also missed market expectations. The operating profit missed expectations due to continued high growth in selling and administrative expenses this quarter, which increased by 770 million to 4.9 billion this quarter, exceeding market expectations of 4.4 billion. With Q4 sales barely exceeding the lower limit of guidance and vehicle prices still declining, the market is not accepting these high growth selling and administrative expenses, continuing to question Nio's most concerning cost control ability.

In terms of bottom-line net profit, in addition to the aforementioned disappointing operating profit, this quarter also included -500 million in non-recurring income and -170 million in interest and investment income. Although not part of the core business, this undoubtedly adds to the woes of Nio, which is already facing huge losses. A detailed explanation will be provided in the earnings call.

③ Regarding the market's most concerned guidance for Q1 2025, it barely aligns with market expectations. In terms of sales expectations, the Q1 sales guidance is 41,000 to 43,000 units, implying March sales of 13,900 to 15,900 units. Dolphin Research estimates that Nio can only operate close to the lower limit of guidance, which means an increase of less than 800 units compared to February sales, while the revenue guidance implies a selling price expectation of about 247,000, barely aligning with the market expectation of 246,000.

The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.