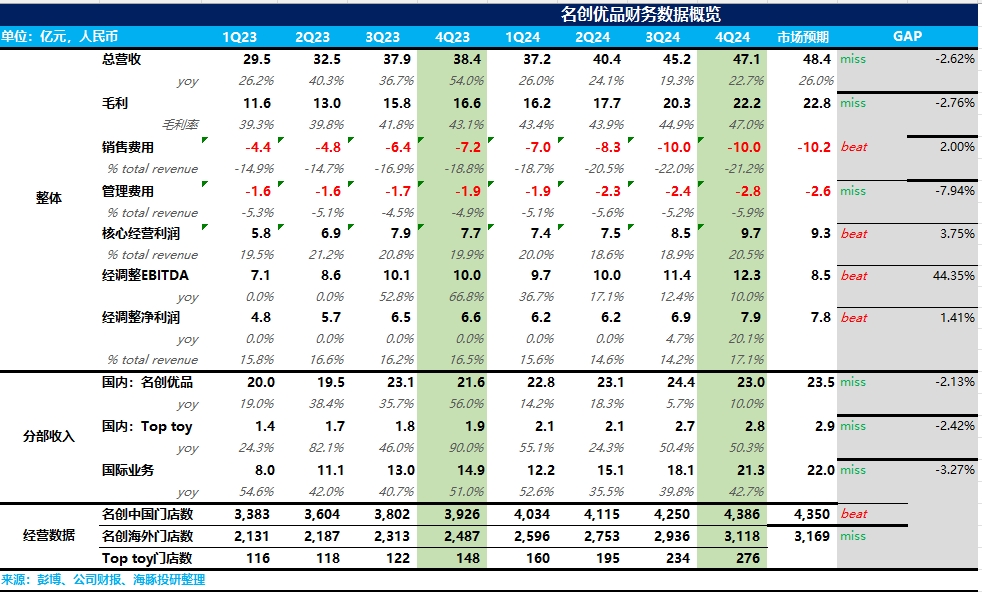

$Miniso(MNSO.US) 4Q24 Quick Interpretation: Overall, this quarter Miniso showed some divergence, with revenue slightly below expectations while profits exceeded market expectations.

First, on the revenue side, domestic growth was 10% year-on-year, accelerating compared to Q3 and returning to double-digit growth. Overseas growth was high at 43% year-on-year, with revenue accounting for 45%, a record high. However, domestic and overseas growth rates were slightly lower than Bloomberg's consensus expectations.

In terms of store opening pace, the domestic market remained stable overall, increasing the effort to open stores in third-tier and below cities, while overseas is still in an accelerated store opening phase, mainly focusing on direct-operated stores in Europe and the United States, with the proportion of overseas direct-operated stores rising to 16% (the proportion of direct-operated stores has been increasing quarter-on-quarter since Q1 2023). According to Dolphin Research's estimates, the dilution effect of new store openings on single-store revenue in the domestic market continues, with both Miniso and Top Toy showing a slight downward trend in average single-store revenue. Overseas, due to the low base of store numbers, single-store revenue is still in a climbing phase.

Regarding gross margin, with the advancement of the IP retail strategy and the increasing proportion of IP-related products, combined with the rapid expansion of overseas direct-operated stores (which have about 20% higher gross margins compared to the agency market), Q4 gross margin reached 47%, a new high. On the expense side, the sales expense ratio slightly declined, while the management expense ratio increased slightly, remaining stable overall, and adjusted EBITDA significantly exceeded market expectations.

The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.