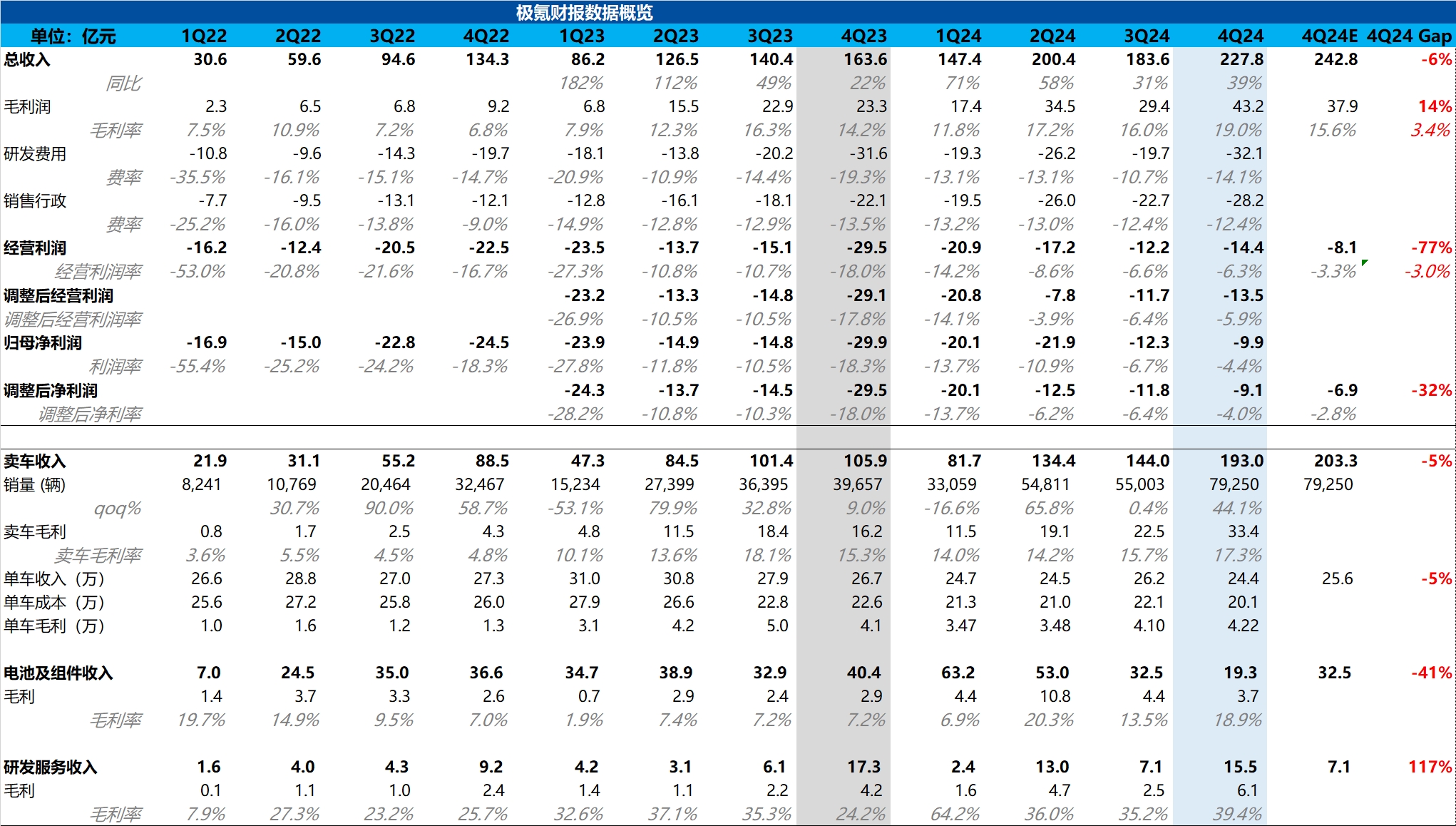

$ZEEKR Intelligent Tech(ZK.US) Quick Interpretation: Overall, ZEEKR's fourth-quarter financial report performed relatively mediocre, even falling short of market expectations. The points of missing market expectations are concentrated in two aspects:

① Fourth-quarter revenue was 22.78 billion, lower than the market expectation of 24.28 billion, with a gap of nearly 1.5 billion. However, the battery and components business declined by 1.3 billion compared to the previous quarter (due to a decrease in sales of battery packs and electric drive units and a drop in unit prices). Although the R&D and service business increased by 800 million quarter-on-quarter (due to the acceptance of a series of R&D projects at the end of the year, confirming the peak period), the total revenue from these two businesses ultimately declined by 500 million quarter-on-quarter. Since these two businesses mainly supply themselves (serving companies within the Geely system), the market will not pay special attention to these two businesses until external supply volume is seen, so the core remains in the automotive business.

In this quarter, the car sales business generated 19.3 billion. Although Dolphin Research did not see major institutions separately estimating the revenue from the automotive business, assuming the market would estimate the revenues of the other two businesses (battery and components business and R&D business) to be flat compared to the previous quarter, the market expectation of 24.28 billion for the fourth quarter implies a car sales revenue of 20.3 billion. Therefore, in terms of core automotive business performance, ZEEKR fell short of market expectations, and the issue lies in the selling price of the cars.

This quarter, the selling price of cars was 244,000 yuan, below the market expectation of 256,000 yuan. Dolphin Research believes there are two reasons for this shortfall:

a. Model structure impact: The proportion of the previously high-priced primary model ZEEKR 001 declined by 21 percentage points quarter-on-quarter to 25.4% in the fourth quarter, while the newly introduced mid-size SUV ZEEKR 7X increased its sales proportion by 31.4 percentage points to 41% this quarter. The overall pricing of ZEEKR 7X is lower than that of ZEEKR 001.

b. Promotional impact: Although ZEEKR did not directly lower the prices of models, it launched a financing plan for all models with a "20% down payment and 2 years 0 interest." However, the overall gross margin from car sales continued to rise compared to the previous quarter, increasing by 1.7 percentage points to 17.3% this quarter, mainly driven by the increased proportion of the high-margin ZEEKR 009 and the decrease in per-unit amortized costs driven by economies of scale (sales increased by 44% quarter-on-quarter).

② The second point that fell short of expectations is that operating profit and adjusted net profit were both below market expectations. Although the overall gross margin this quarter exceeded market expectations, due to a significant increase in R&D expenses (up 1.2 billion quarter-on-quarter), Dolphin Research believes that ZEEKR is still accelerating to address the shortcomings in intelligent driving and preparing for the launch of five new models in 2025, which is relatively understandable, but it still needs to be premised on achieving sales growth.

The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.