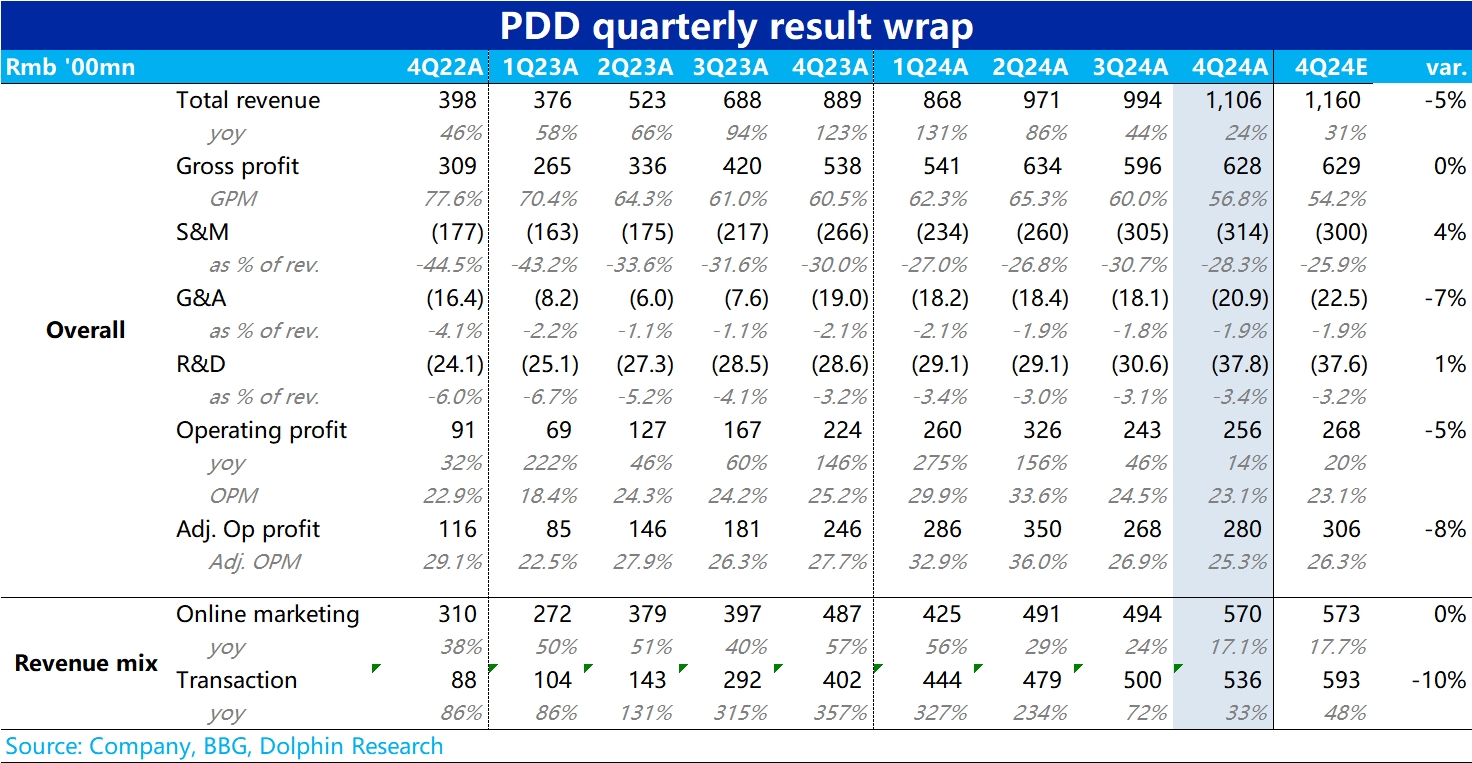

$PDD(PDD.US) 4Q24 Quick Interpretation: As many investors are concerned and have anticipated, Pinduoduo's performance this quarter was poor. Both total revenue and operating profit fell short of the consensus expectations from sell-side analysts.

Specifically, total revenue was 110.6 billion (up 24% year-over-year), which was about 5.4 billion lower than expected. What is "somewhat reassuring" is that the more closely watched advertising revenue grew by 17% year-over-year, which was in line with sell-side consensus expectations. The revenue miss primarily stemmed from the highly volatile commission income (including Temu, grocery delivery, and other businesses), which the sell-side consensus did not have much confidence in.

However, Dolphin Research also noted that some leading sell-side analysts had expected advertising revenue growth to be between 20% and 24% (corresponding to an expected domestic main site GMV growth of around 20%). From this perspective, the actual performance was at least below the expectations of some overly optimistic funds.

Additionally, due to Pinduoduo subsidizing national policies early in Q4 and the company's proactive measures to reduce costs, the market had low profit expectations for this quarter, generally believing that the operating profit margin would continue to decline from Q3 (which had already narrowed significantly since the beginning of the year). The actual profit margin was generally in line with expectations, but due to the revenue miss, the actual profit amount was also slightly lower than expected, with year-over-year growth dropping to only 14%. Although the profit performance was not significantly worse than expected, it still leaned towards the negative side.

The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.