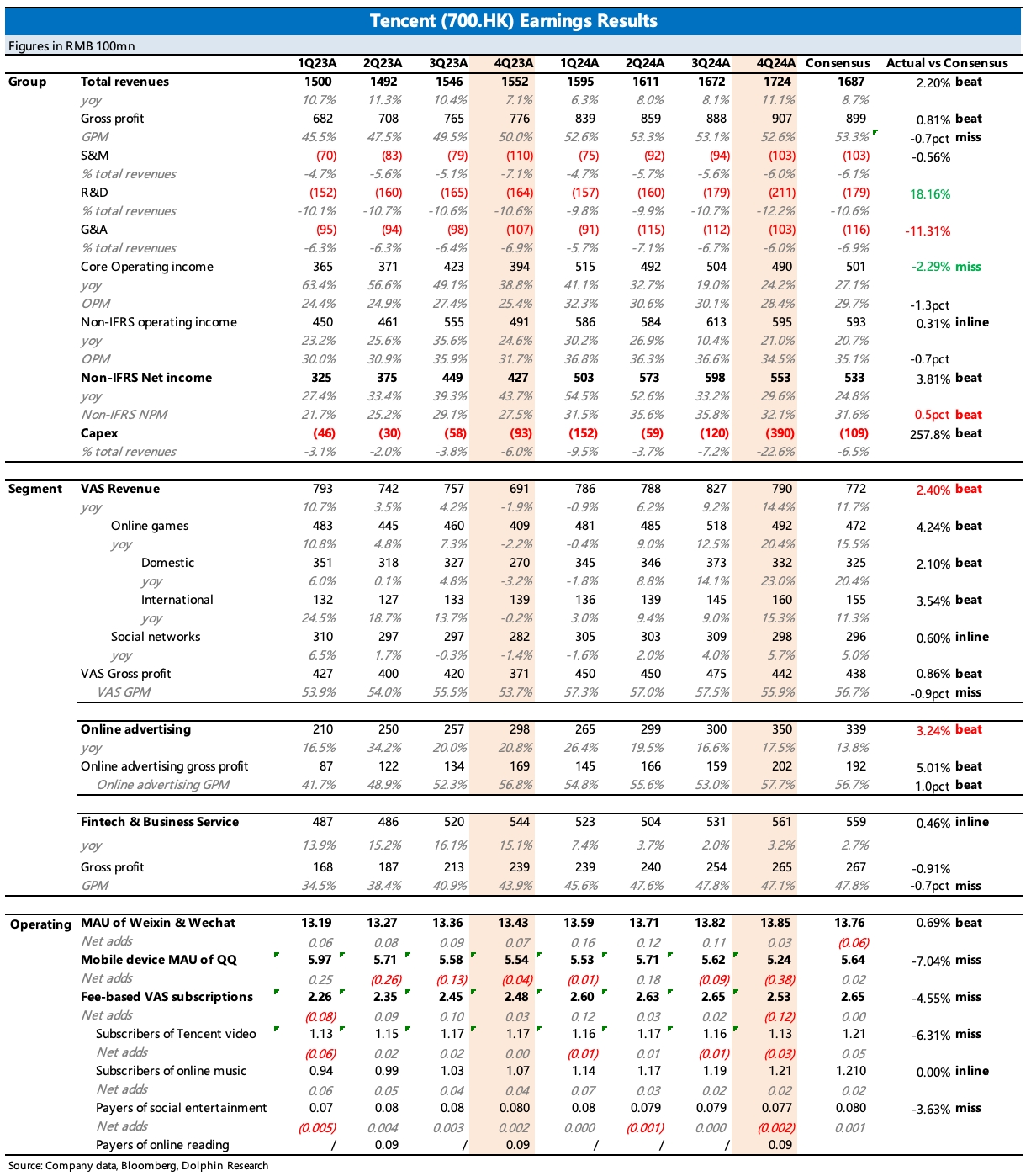

$TENCENT(00700.HK) 4Q24 Quick Interpretation: From the perspective of the business itself, the fourth-quarter performance is quite good, although the R&D expenses and capital expenditures for the period exceeded expectations significantly, which affected the profits and cash flow of the core business. However, it is well-known that since the fourth quarter, Tencent has almost mobilized the entire group to increase its investment in AI, so if the core profit performance is only affected by the expectations in this area, Dolphin Research believes it is not a serious issue.

On the contrary, what surprised Dolphin Research is that under high expectations, gaming still slightly exceeded expectations. Advertising also turned out to be not as bad as originally thought. Looking at JinKe Enterprise Services roughly, the payment business still faces pressure, while the enterprise (cloud + video account e-commerce commission) accelerated quarter-on-quarter. Looking ahead, although gaming in the second half of this year faces high base pressure from DnFM, there are still many promising games in the existing reserves, and several evergreen games showcased their strength during the Spring Festival, so it is possible that gaming can continue to achieve high growth.

The advertising outperformance is a more concrete reflection of Tencent's Alpha logic (social traffic is the cornerstone, with incremental sources compared to peers coming from video accounts, mini-programs, search ads, etc.). With policies tightening and the macro environment accelerating to the bottom, it is expected to bring more tailwinds. As for the super high Capex investment of 39 billion, what is its overall impact on Tencent? Different funds may have different opinions.

For Dolphin Research, standing at the present, we tend to face it with a relatively positive mindset and a medium to long-term perspective. After all, compared to the valuation of non-growing value stocks, a stock king with some growth potential is expected to soar higher.

However, we must also acknowledge that the expected Capex investment of over 100 billion this year and the increase in R&D personnel will undoubtedly affect shareholder returns and short-term valuation cost-effectiveness. Compared to last year's total return of over HKD 144 billion from buybacks and dividends, this year's budget is only HKD 80 billion for buybacks and HKD 41 billion for dividends, totaling HKD 121 billion in returns. Coupled with the rising market value, the return yield is less than 3%. Therefore, funds that valued Tencent's high shareholder returns and safe valuations over the past year may have a declining investment preference for Tencent.

The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.