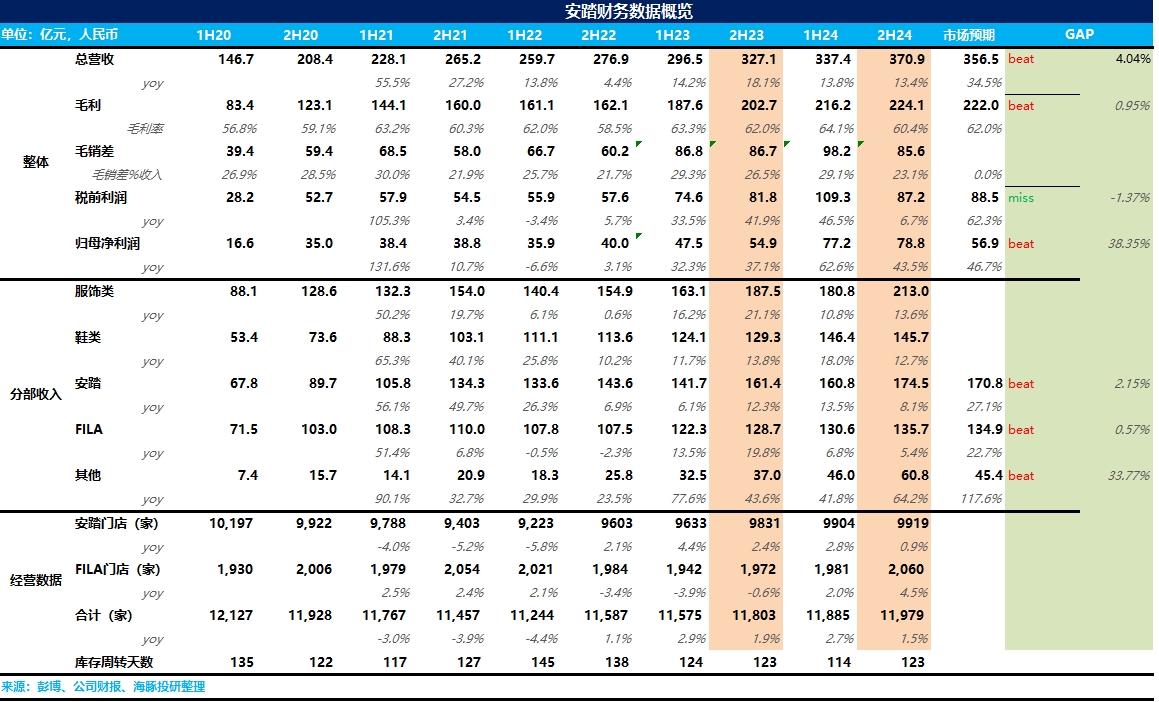

$ANTA SPORTS(02020.HK) 24H2 Quick Interpretation: Overall, Dolphin Research believes that Anta's performance this time is mediocre. Although revenue and gross profit slightly exceeded expectations, due to intense market competition, Anta increased its market spending and related expenses, resulting in core operating profit slightly falling short of expectations, raising concerns among some investors.

On the revenue side, whether it is Anta, FILA, or other brands, under the backdrop of weak consumer spending, all increased the launch of high-cost-performance products (such as PG7 running shoes) in 24H2, introduced store types like Super Anta with high cost-performance, and appropriately increased discount intensity through e-commerce to attract a large number of price-sensitive consumers, leading to revenue exceeding market expectations. Anta's market share in the entire sports footwear and apparel sector further increased to 23%.

However, the result of this is that the gross profit margins of various brands under Anta experienced varying degrees of decline in 24H2, with FILA and the main Anta brand's gross profit margins decreasing by 3.3 percentage points and 1.5 percentage points year-on-year, respectively, while high-end brands like Descente and Kolon Sport saw relatively lower declines.

On the expense side, on one hand, due to fierce market competition, Anta increased its marketing efforts; on the other hand, factors such as store upgrades and new store openings also led to an increase in the company's expense spending, causing Anta's core operating profit margin to decline to some extent.

Regarding the guidance for 2025, the company plans to promote the high-cost-performance store type of Super Anta. Although the company claims in the announcement that the efficiency of Super Anta stores is more than three times that of ordinary stores, Dolphin Research believes that Super Anta also faces challenges of large size and high costs, and ultimately, it will depend on specific profitability. More information can be followed up in the subsequent conference call.

The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.