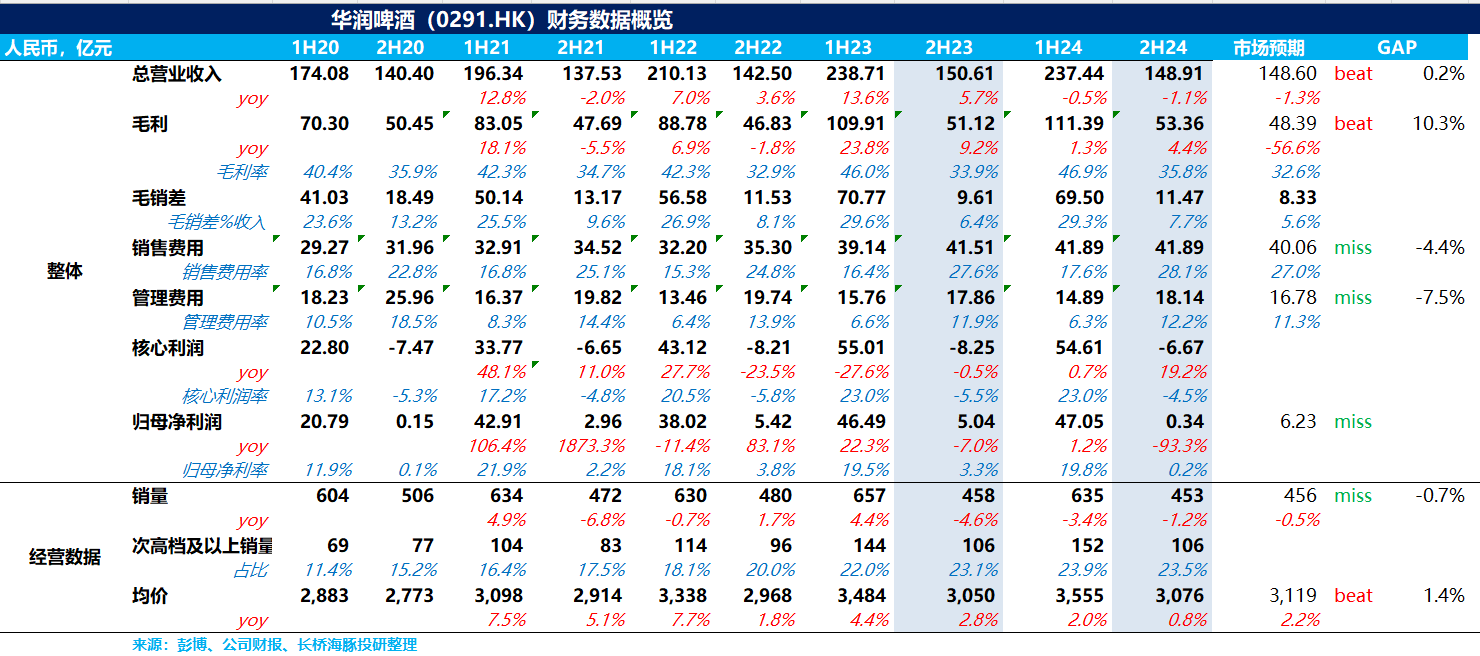

$CHINA RES BEER(00291.HK) Overall, China Resources Beer's performance in 24H2 is in line with expectations under low forecasts. Although the story of premiumization driving ton price increases is still unfolding, during the industry's deep adjustment period, the accelerated clearance of low-end beer has inevitably led to a decline in overall sales for China Resources, resulting in continued negative growth in revenue. In terms of profit, after excluding fixed asset impairment and one-time employee compensation, government subsidies, and other special items caused by factory closures, EBITDA increased by 17.4% year-on-year, and EBITDA margin improved by 1.3 percentage points year-on-year, mainly due to the improvement in product mix enhancing the company's profitability.

In terms of sales volume, China Resources achieved a sales volume of 4.53 million tons in 24H2, a year-on-year decrease of 1.2%. Although the decline in sales volume has narrowed compared to H1, it is still slightly below expectations due to unexpected rainfall during the summer peak season and the lack of significant improvement in on-premise consumption scenarios such as dining and nightlife, coupled with the accelerated clearance of low-end beer.

In terms of ton price, the ton price in 24H2 reached 3,076 yuan/ton, an increase of 0.8% year-on-year. This is significantly less than the single-digit increases seen in the previous two years, indicating that the pace of the company's premiumization is slowing down amid weakened consumer spending. However, due to generally low market expectations, the ton price slightly exceeded expectations (expected 3,119 yuan/ton).

In terms of gross margin, the improvement in the product mix of the beer business and the high growth of premium liquor products (up 35% year-on-year) drove the company's gross margin to increase by 1.9 percentage points year-on-year. From an annual perspective, the company's gross margin increased by 1.20 percentage points year-on-year to 42.6%, reaching a five-year high. The expense ratio remained stable compared to the same period last year.

Looking at the guidance for 2025, China Resources has raised its sales target for 2025 to low single-digit growth (from flat), reflecting management's optimism about the recovery of the beer industry in 2025. Additionally, based on the disclosed data for January-February 2025, the company's revenue and profit both exceeded expectations, with profit growth significantly outpacing revenue growth.

The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.