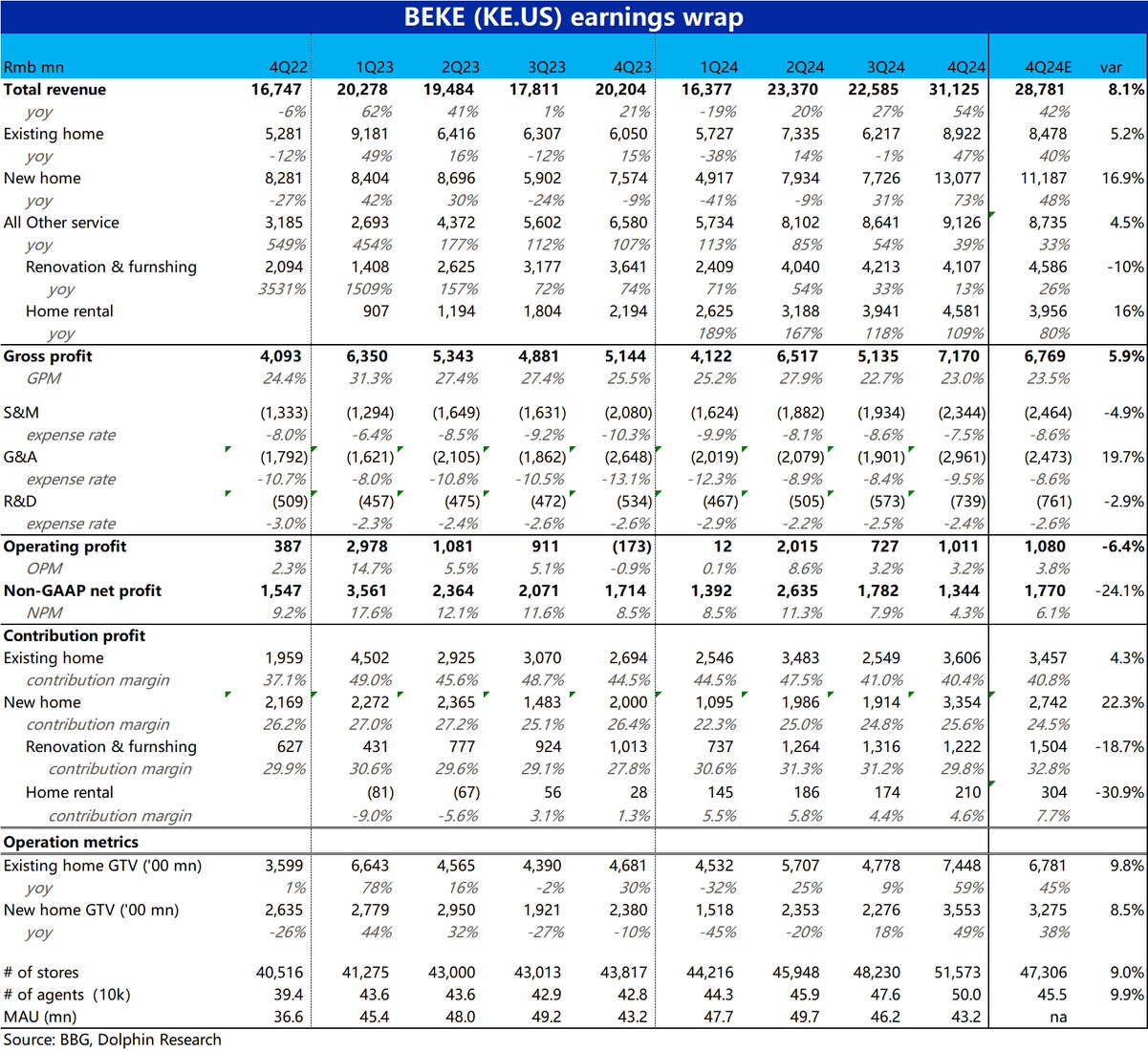

$KE(BEKE.US) 4Q24 Quick Interpretation: Due to significant policy support starting in September last year, the domestic real estate market has seen a remarkable recovery in transactions, and Beike's growth performance this quarter can be described as exceptionally strong. The transaction volume for new homes and existing homes both surged by about 50%, driving total revenue from over 22 billion in the previous quarter to over 31 billion this quarter, setting a record for the highest single-quarter revenue, significantly exceeding the consensus expectation of 28.8 billion in total revenue from analysts.

However, why did the market react with a sharp decline in pre-market trading despite this performance? The first minor reason is that there is abundant high-frequency third-party data on real estate transactions, and the hot transaction situation in the fourth quarter was fully anticipated by the market. The stock price exceeding $25 before the earnings report (equivalent to the peak in September last year) already reflected the market's high expectations.

The main incremental negative factor is that despite the market being hot and revenue increasing by nearly 9 billion quarter-on-quarter, Beike's core profit this quarter did not show the expected elasticity. The operating profit margin for this quarter was 3.2%, completely flat compared to the low point of the previous quarter. The adjusted net profit was only 1.34 billion, which was lower than the 1.78 billion in the previous quarter (the market's expectation for this quarter was also roughly at this level).

This reflects the issue that, despite the considerable industry dividends in a booming real estate market, the company's revenue surge did not translate into incremental profits. Ideally, profit growth should be more elastic than revenue, but profits decreased quarter-on-quarter instead of increasing. How should the market understand the growth prospects for the full-year profit of 25? Furthermore, what if the dividends fade and the real estate transactions decline? These are questions that need to be answered by the management to reassure the market.

The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.