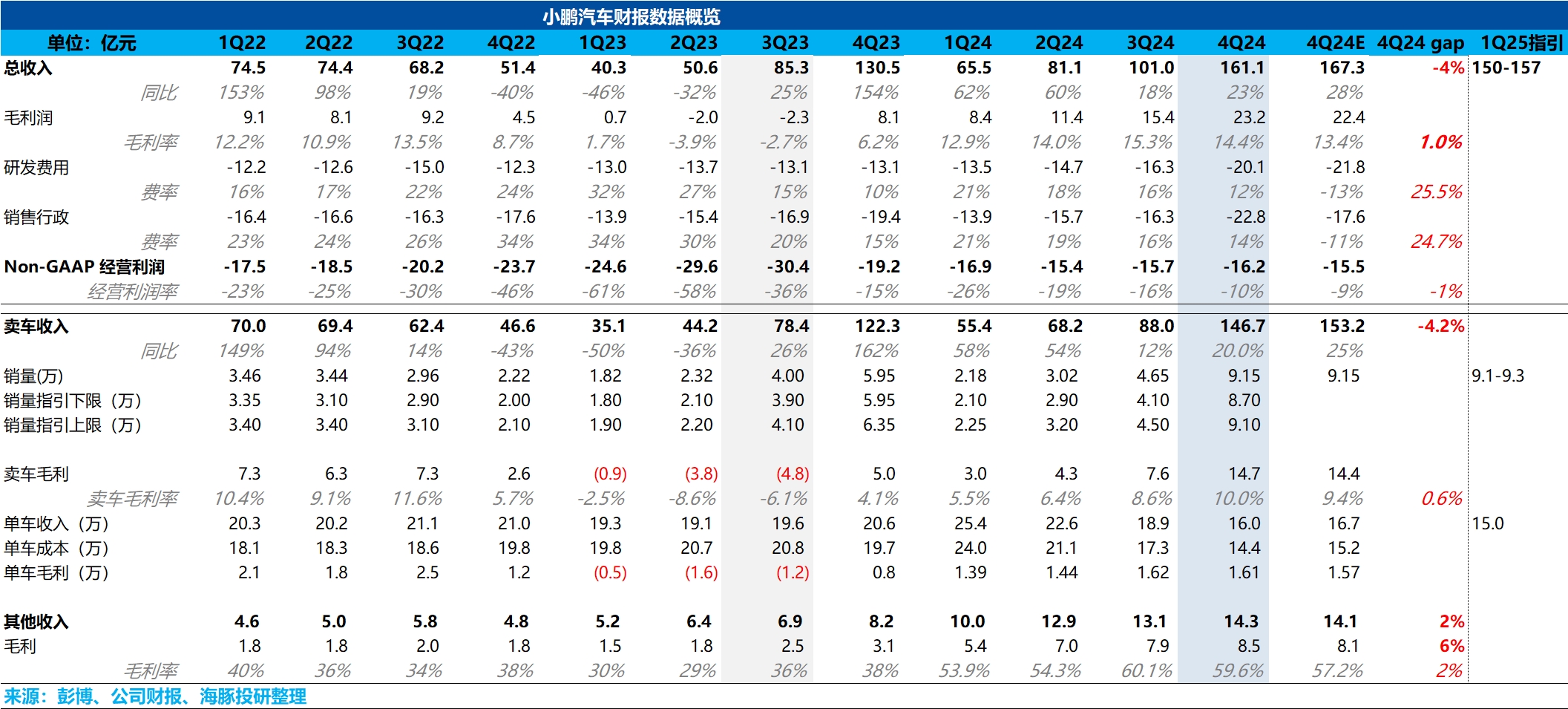

$XPeng(XPEV.US) 4Q24 Quick Interpretation: Overall, as the market is still most concerned about XPeng's car sales business, the revenue from XPeng's car sales this time was below market expectations, but the automotive gross margin performed well, reaching 10%, slightly higher than the market expectation of 9.4%.

Breaking it down, the reason for the automotive revenue missing market expectations is that the revenue per vehicle decreased by 29,000 yuan quarter-on-quarter, to 160,000 yuan this quarter, lower than the market expectation of 167,000 yuan, as well as the implied unit price expectation of 162,000 yuan.

However, Dolphin Research believes that the decline in unit price and the shortfall in expectations are mainly due to changes in the model structure. The proportion of the low-priced M03 (priced at 119,800-155,800 yuan) increased by 19 percentage points quarter-on-quarter to 42% in the fourth quarter, and the M03 intelligent driving version will only start deliveries in May 2025, which dragged down the unit price. Additionally, some promotional discounts were offered for the hot-selling models M03 and P7+ in preparation for the 2025 model updates.

From the perspective of automotive gross margin, it reached double digits this quarter, at 10%, higher than the market expectation of 9.4%. This is still due to strong cost control capabilities, which allowed the gross margin of P7+ to reach double digits, and the release of scale effects, which drove the automotive gross margin to continue to increase by 1.4 percentage points even as revenue per vehicle declined.

Looking at the first quarter guidance, the sales guidance is relatively flat, while the revenue guidance implies a unit price below expectations. From the sales guidance, the car sales guidance is 91,000-93,000 units, implying monthly sales of 31,000-33,000 units in March, which is an increase of 1,000-3,000 units compared to 30,000 units in February. The market may be concerned that when the updated G6 and G9 models start to be launched and delivered, such sales guidance seems relatively flat. However, Dolphin Research understands that there may be bottlenecks in the production capacity of the updated G6 and G9, and the ramp-up speed is not that fast, so attention should be paid to the performance meeting regarding the ramp-up guidance for the updated G6 and G9.

As for the implied unit price in the revenue guidance, the revenue per vehicle is expected to continue to decline by 10,000 yuan quarter-on-quarter to 150,000 yuan. On one hand, this is due to the continued increase in the delivery proportion of the Mona M03, and on the other hand, XPeng is still reducing prices for older models (excluding P7+ and M03) in the first quarter to clear old inventory, which is understandable. Therefore, although XPeng's performance this time is relatively average and even slightly below expectations, as long as the sales momentum of the models does not encounter problems (currently the hot-selling M03 and P7+), it should not be a big issue.

The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.