$XIAOMI-W(01810.HK) 4Q24 Quick Interpretation: As a much-anticipated brand, Xiaomi's fourth-quarter performance looks impressive at first glance, but slightly underwhelming upon closer inspection. The reason is simple; at first glance, the revenue from various business lines appears to be flourishing from revenue to final net profit.

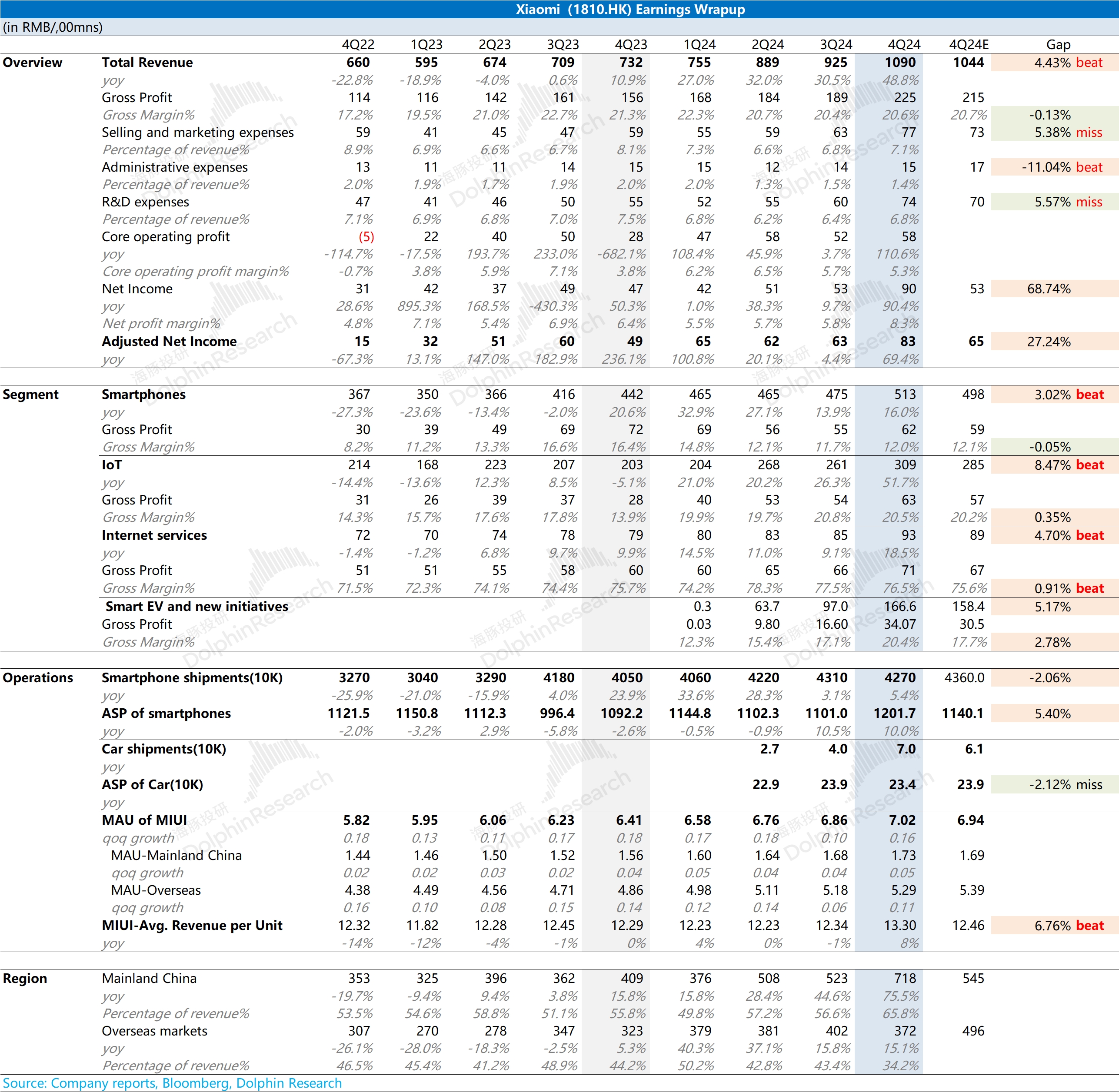

However, in reality, both net profit and adjusted net profit are entangled with some non-recurring profits and recurring but non-core financial gains. The core operating profit (revenue - costs - three expenses) that Dolphin Research is most concerned about is RMB 5.8 billion, which is basically within the latest market expectations.

Moreover, the revenue from various business lines exceeded the sell-side expectations on Bloomberg, mainly because the sell-side expectations were outdated or not thoroughly considered. Compared to Dolphin Research's estimates, the only areas that slightly exceeded Dolphin's expectations were the revenue from mobile phones and IoT, while the overall automotive revenue and gross profit were the same as Dolphin Research's estimates when updating Xiaomi's investment value a couple of days ago.

In the context of revenue exceeding expectations, the recurring operating profit did not release as expected, mainly due to slightly higher-than-expected marketing and R&D expenses. However, given the significant revenue release, there is no need to nitpick on the expense expansion issue.

Overall evaluation: Xiaomi's fourth quarter is still an excellent report card, although the degree of excellence is not as exaggerated as it appears at first glance or as portrayed by the media. From an investment perspective, Dolphin Research maintains the previous judgment that 60-70 is currently a relatively reasonable range, but in the short term, it is still in a high prosperity cycle, especially with mobile business profit releases in the first quarter and increasing automotive delivery volumes and orders on hand, further optimistic stock price performance cannot be ruled out.

However, when speculating on Xiaomi's financial report, it is important to note that Xiaomi can easily have good performance but may open high and close low, which requires attention.

The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.