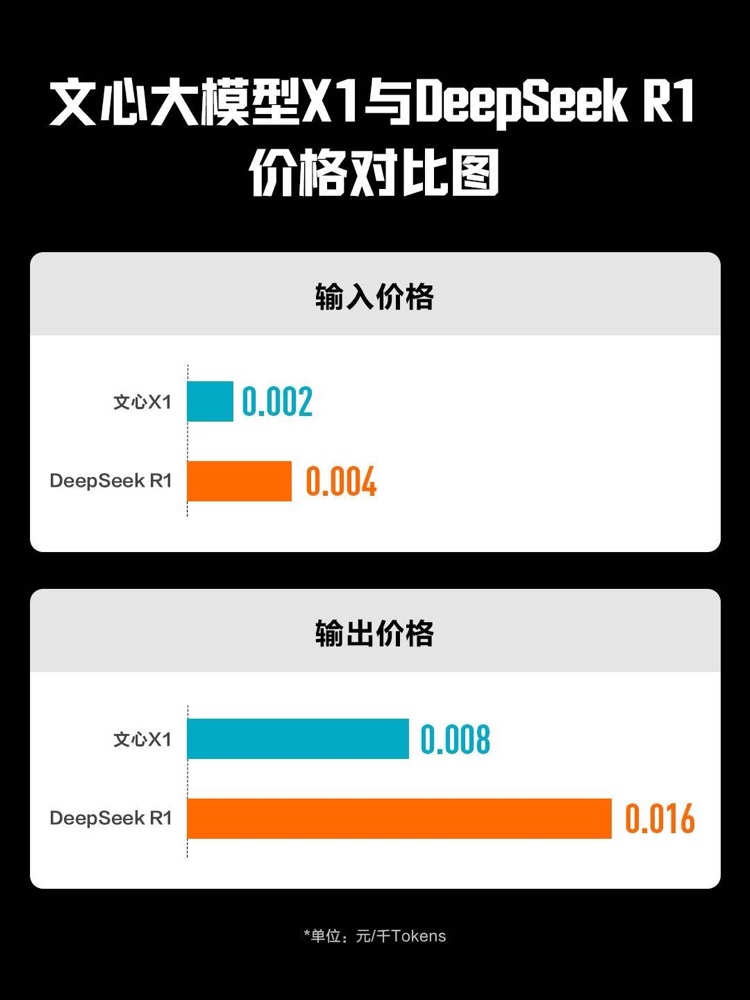

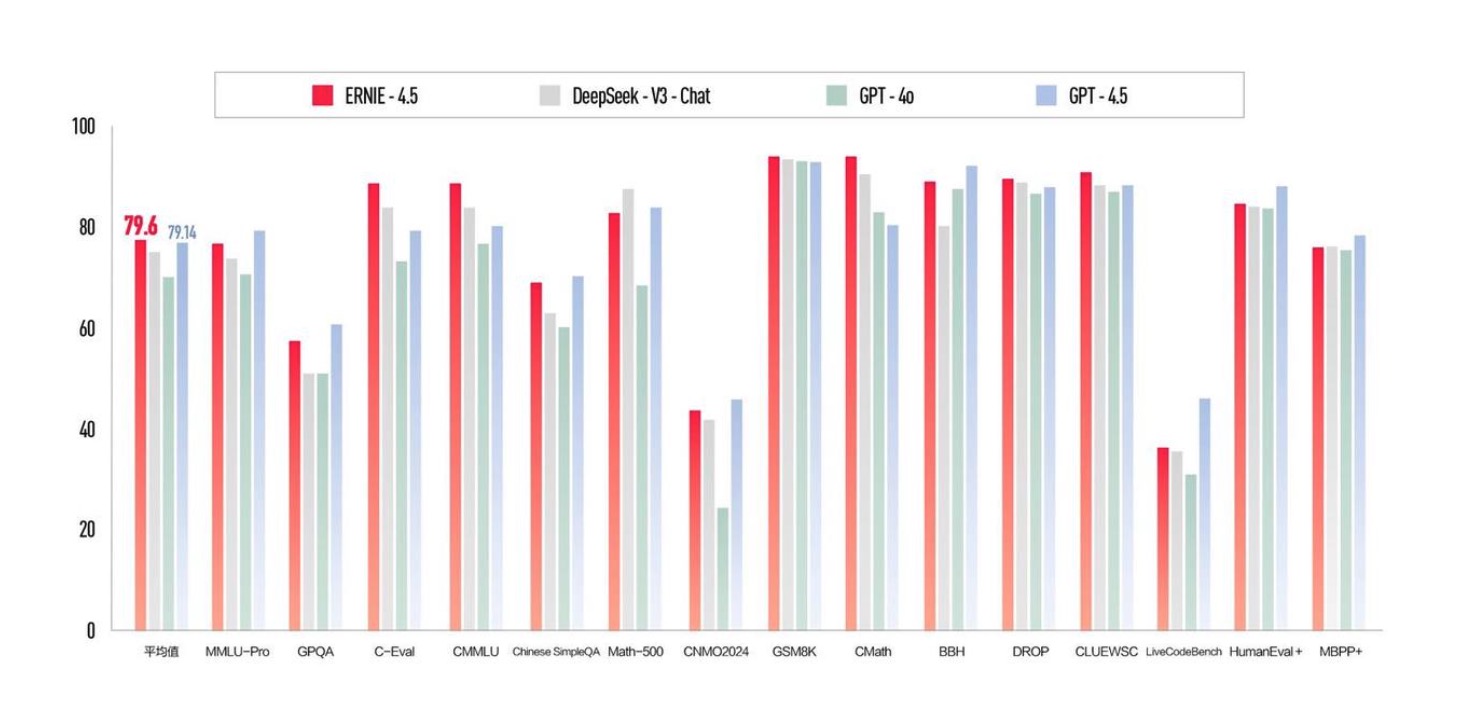

$Baidu(BIDU.US) Baidu surged last night, mainly due to the release of ERNIE Bot 4.5 and X1 over the weekend, which correspond to ChatGPT 4.5 and DeepSeek R1, respectively. In terms of model performance scores, they slightly outperform the latter two while being more competitively priced—X1 is only half the price of DeepSeek R1, making the cost-performance ratio of ERNIE Bot 4.5 compared to ChatGPT 4.5 even more significant.

Interestingly, Baidu's Hong Kong stock $BIDU-SW(09888.HK) did not show much movement during the day yesterday, possibly due to macroeconomic factors (credit and consumption data) dragging it down, or perhaps due to the incident involving the vice president's daughter. It seems that domestic investors are somewhat fatigued by the model performance competition and are focusing more on the AI entry battle and stable stocks. However, foreign investors are still very excited, including some tech influencers who have tweeted their recognition of the logic behind model performance rankings.

In the short term, besides Baidu, Kuaishou also faces issues with its traditional business, albeit to varying degrees. Baidu's problems are currently evident, while Kuaishou's issues mainly appear in future expectations. However, both companies have solid technology and products in the AI field, rather than merely riding on concepts. The recent signs of a rebound, according to Dolphin Research, mainly stem from the revaluation of Chinese concept internet stocks and the fact that we are not in a period of imminent crisis, leading funds to pick up some undervalued stocks with lower crowding, especially those with higher AI components, to diversify risks and seek some excess returns.

The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.