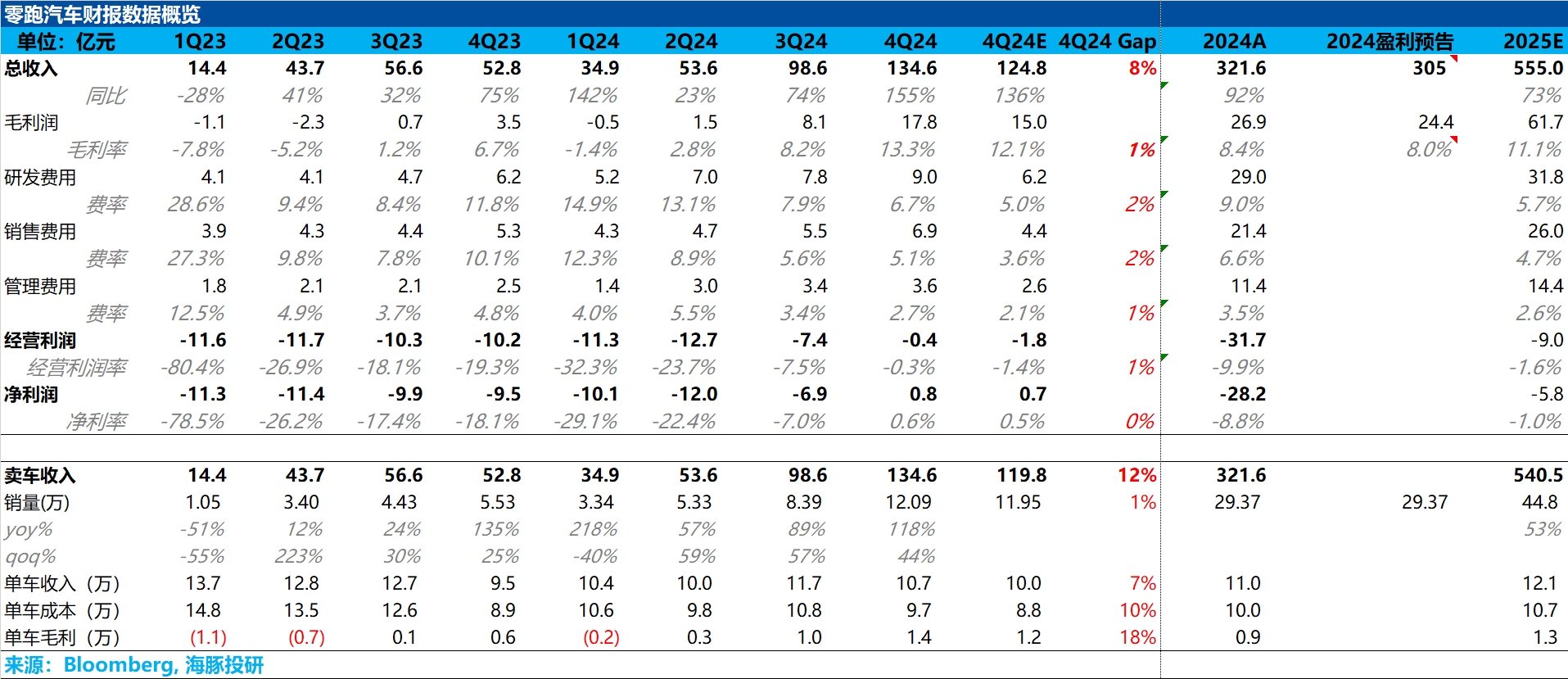

$LEAPMOTOR(09863.HK) Quick Interpretation: Leapmotor delivered a good report card in the fourth quarter. Since Leapmotor released its profit forecast for Q4 2024 in advance, the market has already priced in some expectations for profit improvement. However, this quarter's actual revenue and gross margin performance still performed well, slightly exceeding market expectations and profit warnings.

From the revenue perspective, this quarter's revenue was 13.46 billion, exceeding Leapmotor's profit warning of 11.8 billion for Q4 and the market expectation of 12.5 billion. Dolphin Research believes the main reason for the better-than-expected performance is due to the single-vehicle revenue exceeding market expectations, with single-vehicle revenue this quarter around 107,000 to 109,000 yuan (excluding the service revenue estimated by Dolphin Research), surpassing the market expectation of 100,000 yuan.

The market originally expected that due to the increase in the proportion of the lower-priced model T03 by 2 percentage points in the model structure, single-vehicle revenue would decline by 17,000 yuan quarter-on-quarter. However, the actual performance still exceeded market expectations. Dolphin Research believes that the impact of the rise in T03 models was somewhat offset by the increased proportion of Leapmotor's higher-priced C11.

From the gross margin perspective, this quarter's gross margin was 13.3%, exceeding market expectations of 12% and the profit forecast. Dolphin Research believes this is mainly due to single-vehicle revenue exceeding market expectations, and the quarter-on-quarter increase is mainly due to:

1) The scale effect released by sales growth, with a quarter-on-quarter sales increase of 44%;

2) The results of the company's ongoing cost reduction efforts;

3) The increase in service revenue, which also has a relatively higher gross margin (service revenue in the second half of the year approached 530 million, exceeding the first half by only about 10 million).

However, although the net profit margin successfully turned positive this quarter, when the gross profit was significantly higher than market expectations, the net profit was only basically in line with market expectations (actual 80 million vs. market expectation 70 million), mainly due to high R&D expenses and high sales expenses this quarter.

The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.