$Costco Wholesale(COST.US) Quick Interpretation: Overall, the financial report of the membership discount retail giant Costco shows strong growth, but profits fell slightly short of expectations.

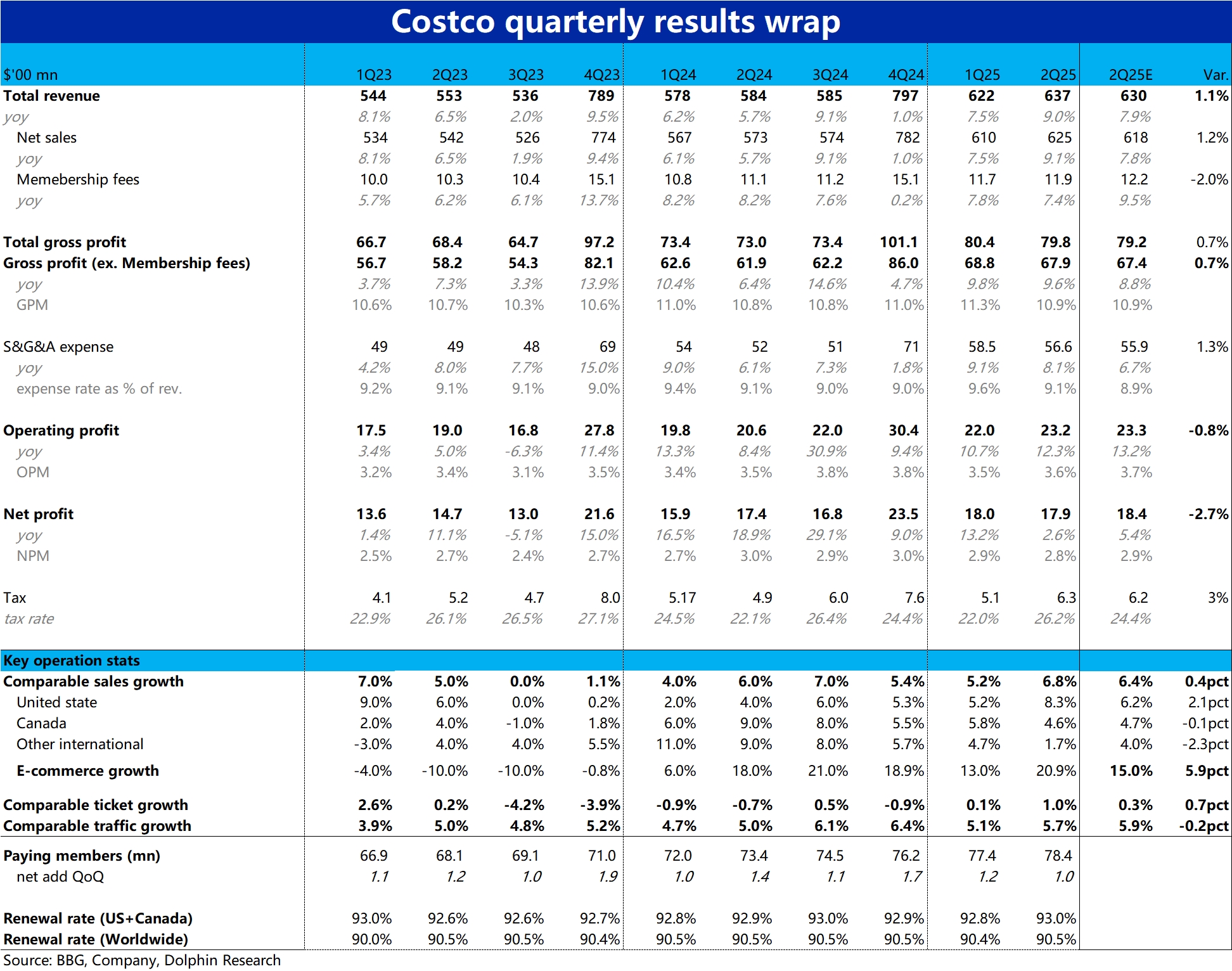

Total merchandise sales for the season increased by 9.1% year-on-year, significantly better than the consensus expectation of 7.8% from sellers. However, since the company previously announced that same-store sales in December and January were both above 9%, we speculate that buyers' actual expectations should be similar to the actual performance.

Regionally, the growth was primarily strong in the United States, with same-store comparable sales increasing by 8.3%, while non-North American regions saw weak growth of only 1.7%. It is also worth noting that the average transaction value in the U.S. increased by 2.6% year-on-year (the highest point since the 2023 fiscal year), while Canada and other countries experienced a year-on-year decline. This indicates that inflationary pressure on consumer goods in the U.S. is indeed significant.

However, on the profit side, net profit only grew by 2.6% year-on-year to $1.79 billion, which is below the consensus expectation of $1.84 billion from sellers. It seems there is an issue of increasing revenue without increasing profit. But according to the company's explanation, this is mainly due to a one-time tax benefit of about $94 million in the same period last year. Excluding this impact, net profit increased by 8.4% year-on-year, at least comparable to the revenue growth rate. Therefore, Costco's performance for the season is still quite robust.

The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.