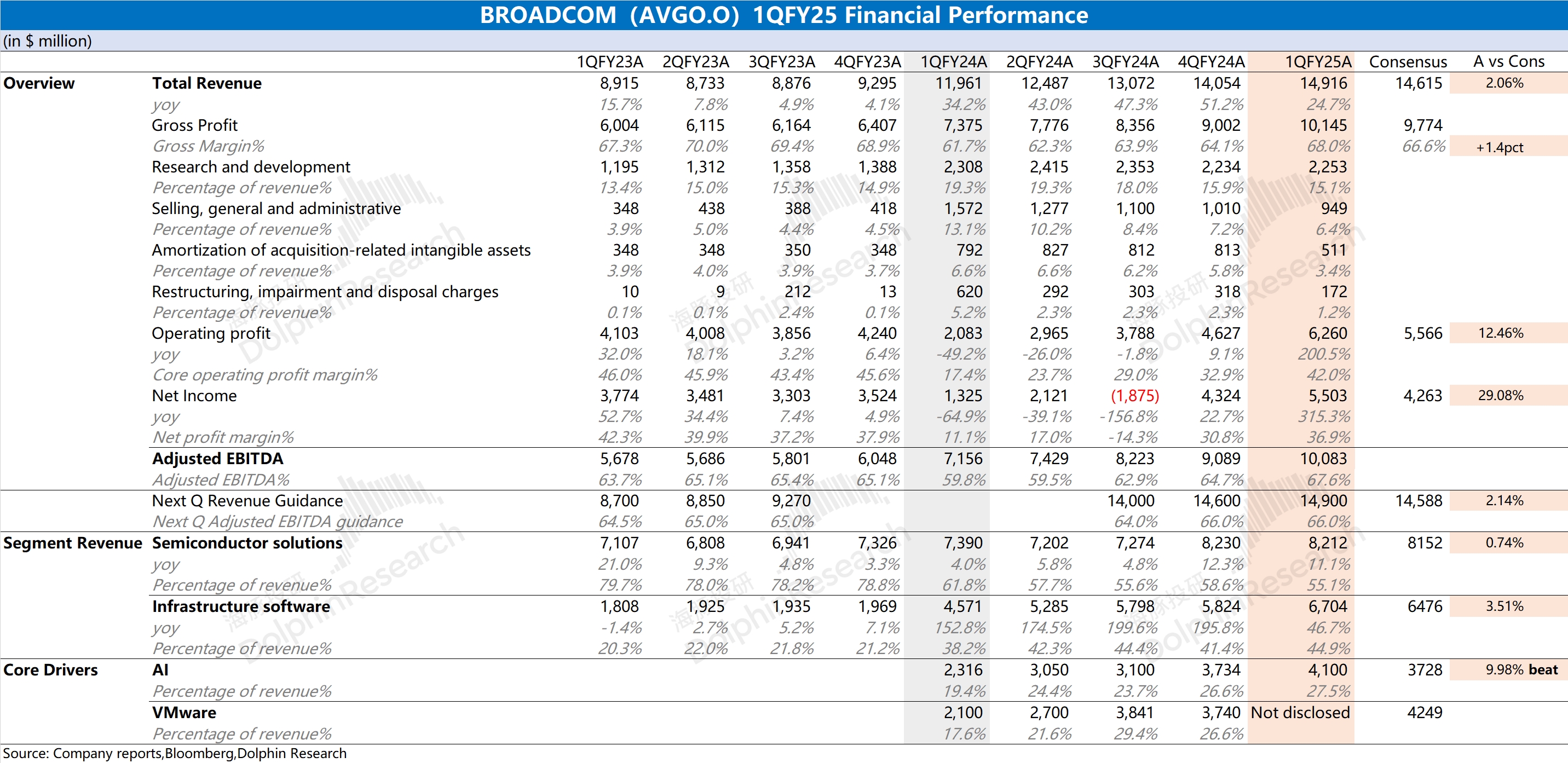

$Broadcom(AVGO.US) Quick Interpretation: The company's quarterly financial report is good, with revenue and profit meeting market expectations, driven mainly by AI and VMware businesses. The company's operating expenses are relatively stable, and the impact of acquisition amortization is gradually weakening, indicating an overall improvement in the company's operating situation. The market is focused on the company's AI revenue and the integration of VMware:

1) The company's AI revenue reached $4.1 billion this quarter, maintaining double-digit growth quarter-over-quarter, better than market expectations ($3.7 billion);

2) VMware's revenue was not disclosed separately this quarter. Based on the software business structure, VMware still contributes the main incremental revenue for software this quarter;

3) Adjusted EBITDA%, Dolphin Research estimates that the company's Adjusted EBITDA% this quarter reached 67.6%. Considering the company's total debt, the Total Debt/LTM Adjusted EBITDA has decreased to 2.7 times, indicating that the impact of VMware's consolidation has been gradually digested.

More concerning than the financial report is the company's guidance. The company expects next quarter's revenue to be $14.9 billion, with an Adjusted EBITDA% of 66%. The company's AI revenue is expected to reach $4.4 billion next quarter. Previously, the market was worried that the company's major customers' current TPU is in a product transition phase, and the company's AI revenue would be relatively flat in the past six months. The company's guidance for continued growth will also continue to instill confidence in the market. For more detailed information, please follow Dolphin Research's specific comments and conference call content on the company.

The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.