$NVIDIA(NVDA.US)转:

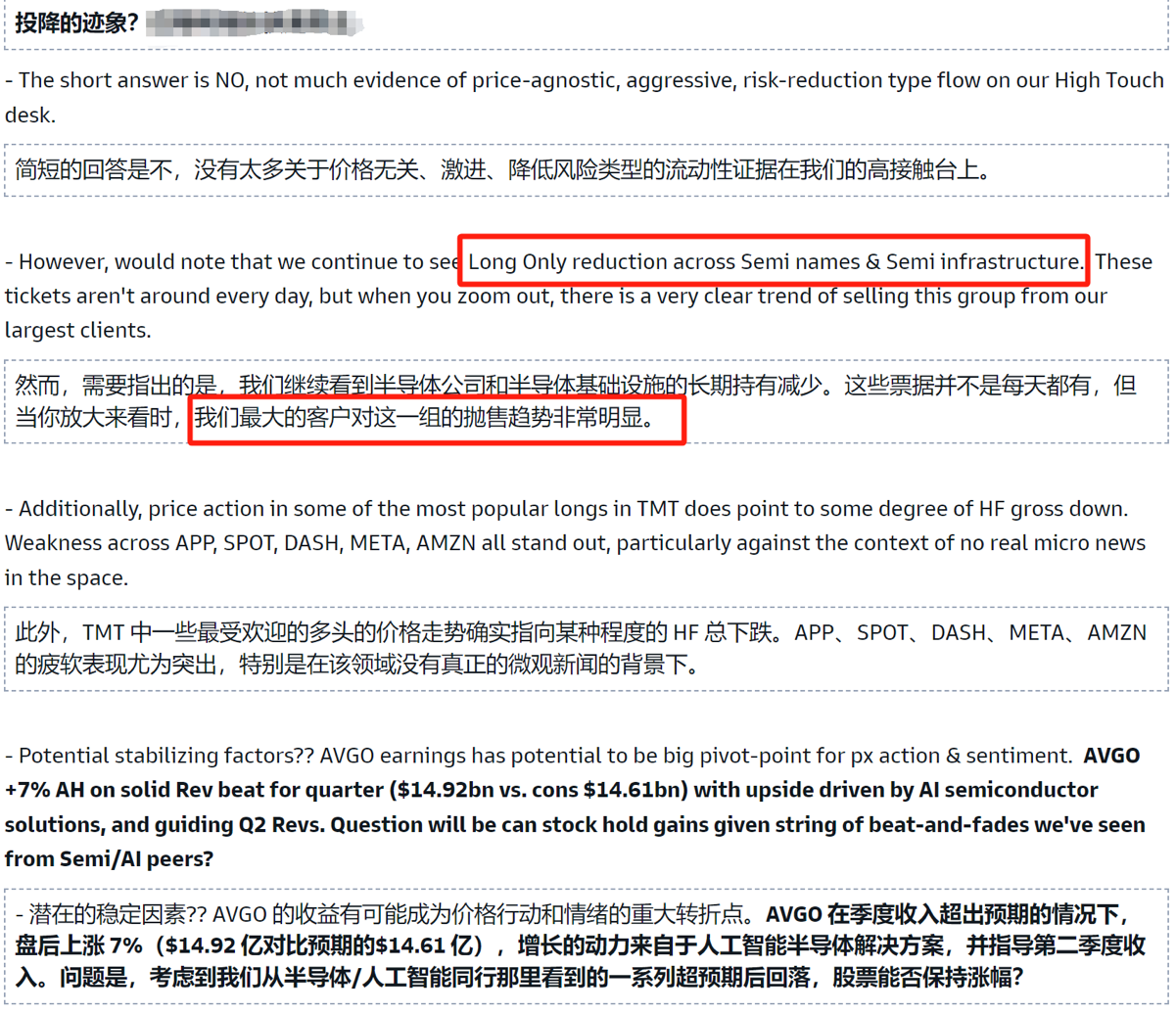

“Those large Long Only funds in the U.S. are steadily reducing their positions in U.S. semiconductor stocks (explaining NVDA's 30% pullback from the peak).

Check the chart below—'largest clients' are continuously selling. $AppLovin(APP.US)$Spotify(SPOT.US) $Doordash(DASH.US)$Meta Platforms(META.US) $Amazon(AMZN.US) These are hedge funds de-grossing, but NVDA is long-term capital reducing positions.

Today, Broadcom's earnings beat expectations by +11%, not a huge beat but a nice one, and after such a big drop, a rebound is likely. Watch tonight—if $Broadcom(AVGO.US) also gaps up and sells off, it means the AI semiconductor sentiment isn't over yet...

Long Only funds will always look for assets to reallocate. AI semiconductors have accumulated trillions in the past 2-3 years—even a slight outflow of this capital is massive.”

(Nvidia still has growth potential, so there should be a floor; also, where is the Long Only outflow going—some into Chinese stocks?)

The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.