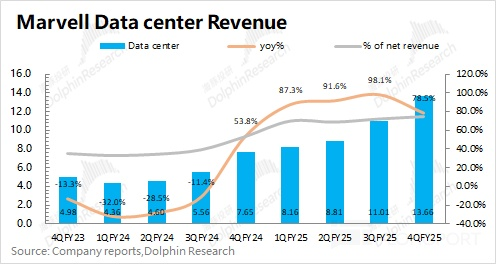

The market is most concerned about the AI segment of $Marvell Tech(MRVL.US)'s data center business. The significant improvement in the company's performance over the past year is mainly attributed to the incremental growth brought by AI. With the release of this financial report, the market is primarily worried about the growth potential of the AI business.

This quarter's revenue was $1.366 billion, with AI business revenue reaching around $700 million, mainly driven by increased demand for customized ASIC products from clients like Amazon. The growth of the AI business this quarter was still quite good, but combined with the guidance for the next quarter, it is recommended that AI business growth will significantly slow down next quarter.

As a major player in the ASIC market, Marvell Technology also faces two risks:

1. For capital expenditures in 2025, major companies are generally showing a "low first, high later" trend, and Marvell's major ASIC client, Amazon, will shift its focus from Trainium 2 to Trainium 3;

2. Marvell faces competition from Alchip in its customized AISC products for Amazon.

The company has repeatedly stated that AI revenue for the fiscal year 2026 will exceed the previous guidance of $2.5 billion, but buyers have generally raised this expectation to around $3.5 billion, which could shake the market's confidence in the company's AI and ASIC businesses.

The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.