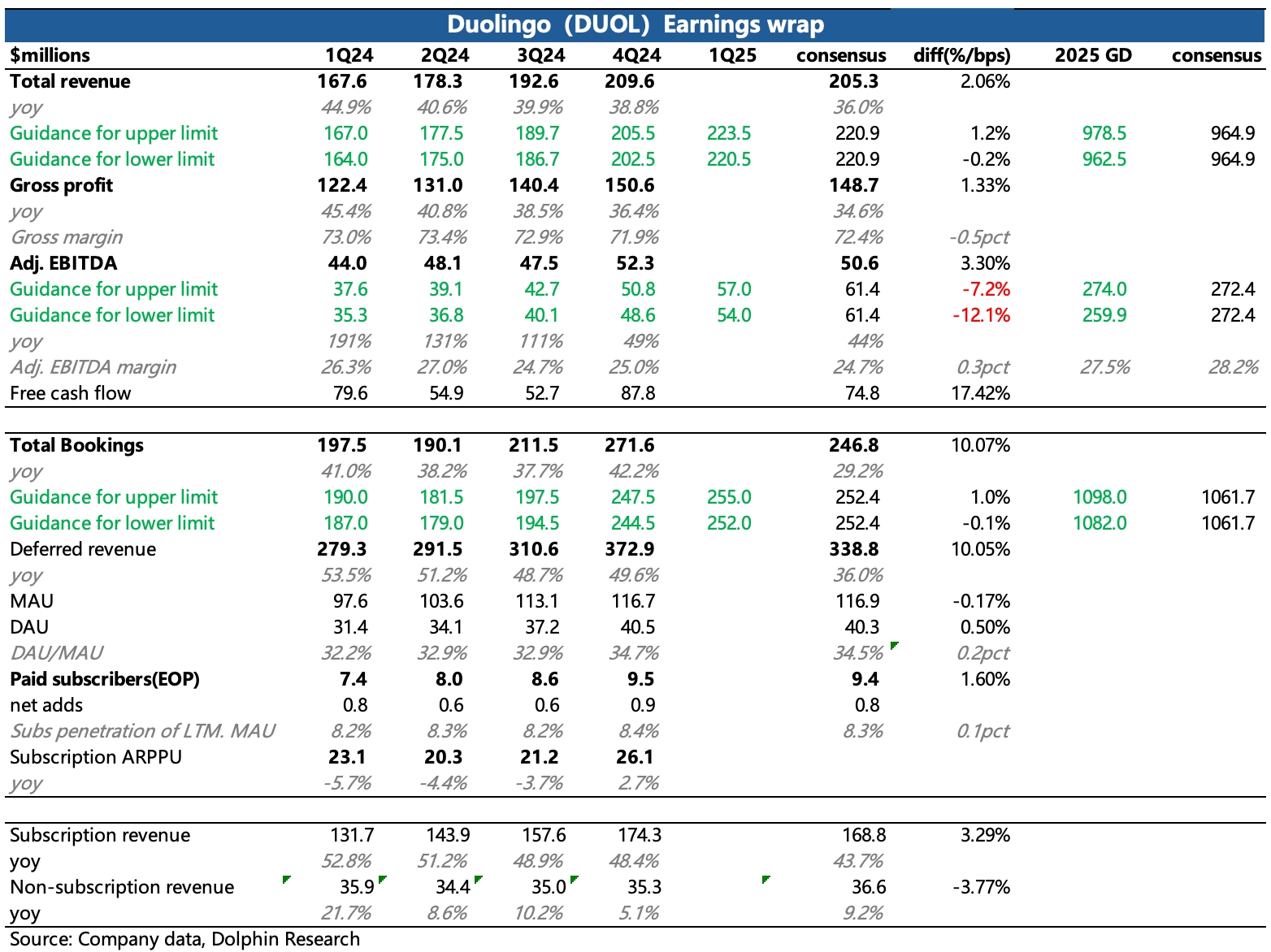

$Duolingo(DUOL.US) Quick Interpretation: Q4 performance remains strong, but market expectations are also high. Overall, it basically meets expectations, with only individual indicators like Bookings slightly exceeding expectations, mainly because the expectations of buyers with pricing power are higher than those of the investment banks included by BBG. However, the guidance is poor—without surprises on the revenue/income side, the pace of profit improvement will lag behind market expectations.

1. Subscription revenue performance is the most impressive. Q4 revenue grew by 50%, driven by both volume and price.

(1) From the perspective of user operation metrics, the platform's high growth is stable and continuous. In Q4, the total user scale MAU increased by 32% year-on-year, with a net increase of 3.6 million quarter-on-quarter, approaching 117 million, while user stickiness DAU/MAU further improved to 34.7%. In terms of willingness to pay, the net increase in paying users at the end of the year was 900,000, and the overall payment rate slightly increased, slightly exceeding market expectations.

(2) The average subscription fee finally returned to growth in Q4. Previously, the penetration of the Family plan (calculated based on 5 people in the family plan, the per capita payment is only 30% of the Super individual plan) and the faster expansion of low-priced region users led to a continuous decline in per capita payment. Q4 returned to positive growth, and Dolphin Research believes this is mainly due to the faster increase in payment rates for the higher-priced MAX plan or more users purchasing the video call feature separately.

2. Other non-subscription revenues, mainly from advertising, English testing, and in-app purchases, grew slowly, mainly due to poor advertising performance in some regions.

3. Q4 profit performance is relatively normal, also due to good subscription performance, with the adjusted EBITDA profit margin (excluding SBC) slightly improving quarter-on-quarter. However, regarding the guidance for Q1, the company previously mentioned that the increase in MAX penetration would lead to increased amortization of Gen-AI investments, thereby affecting short-term gross margins. Therefore, the market has certain expectations, but the actual pressure is still somewhat greater.

4. The conference call mainly focuses on management's current performance of the Max feature, Family plan, and international expansion, as well as this year's strategic goals and related actions, along with more explanations regarding the pressure on profit margins.

The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.