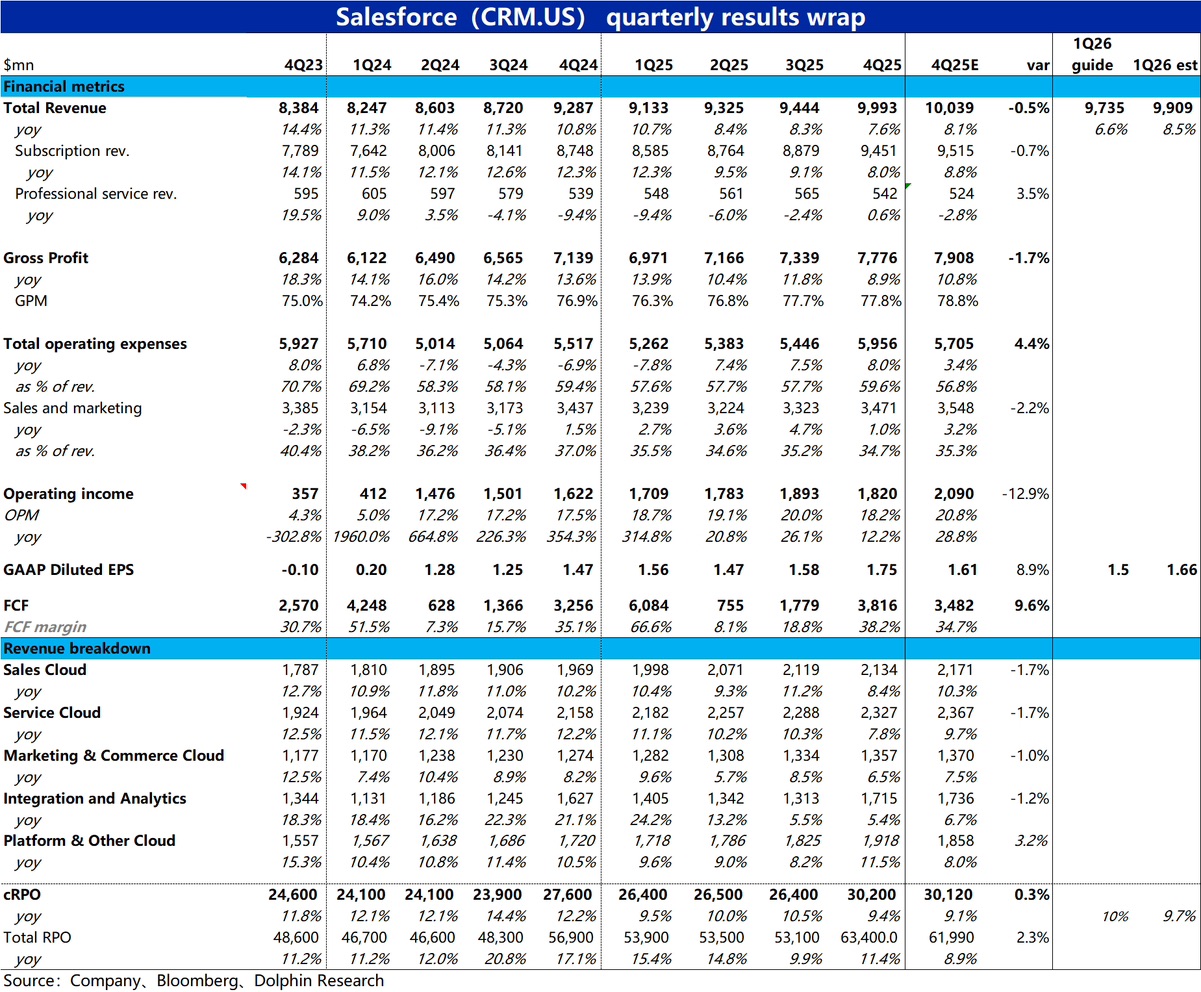

$Salesforce(CRM.US)4QF25 Quick Interpretation: The leading stock in SaaS and AI Agent concept, Salesforce, did not perform well this quarter. Almost all key indicators for the quarter were slightly below expectations. Specifically:

1) On the growth side, except for Platform Cloud, revenue growth in all other business lines slowed down quarter-over-quarter and fell short of expectations, dragging total revenue growth to 7.6% vs. the expected 8.1%.

2) Additionally, expenses were nearly $300 million higher than expected, dragging down GAAP operating profit, which was also below expectations. This was mainly due to the recognition of approximately $300 million in business restructuring costs this quarter. Although net profit was better than expected, this was mainly due to lower tax expenses recognized this quarter. Overall, GAAP profits were not good either.

3) In terms of guidance, the company expects next quarter's revenue growth to be around 6.6%, below the expected 8.5%. The GAAP diluted EPS guidance midpoint is $1.5, also below the expected $1.66. Both revenue and profit guidance were disappointing.

4) The only bright spot was cRPO (current remaining performance obligation), a leading indicator reflecting future revenue growth, which performed relatively well. This quarter's growth was 9.4%, and next quarter's growth is expected to be around 10%, showing slight acceleration and slightly better than expected.

The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.