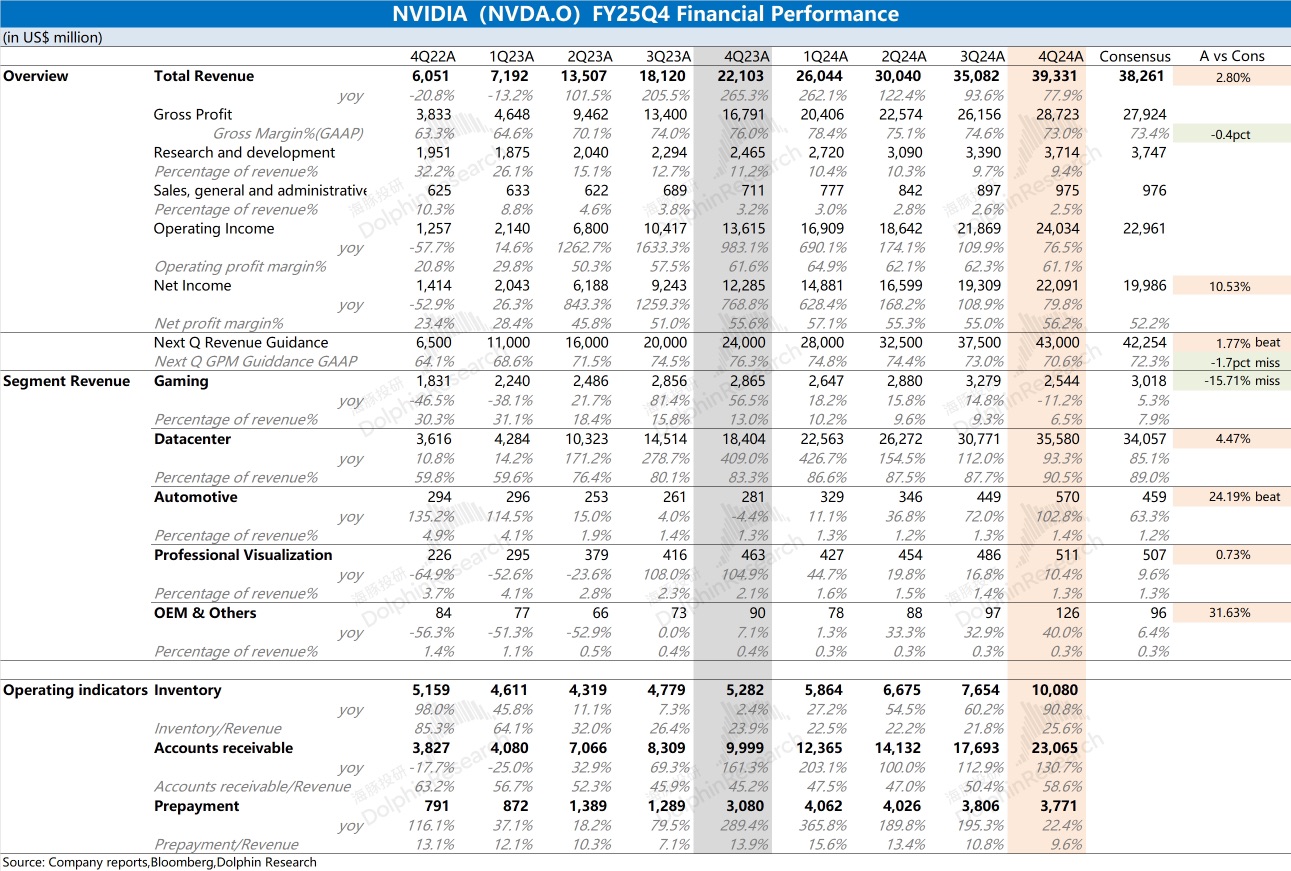

$NVIDIA(NVDA.US) Quick Interpretation: The company's financial report data for this quarter is average, with revenue failing to maintain the previous beat guidance of “+2 billion USD,” and the gross margin slightly below market expectations. Although Blackwell provided incremental support for this quarter, the ramp-up situation of GB200 affected revenue growth and gross margin performance.

The company's operating expenses are relatively stable. Research and development expenses, as well as selling and administrative expenses, have increased, but both have been diluted by high revenue growth, resulting in a stable decline in overall operating expense ratio, with the company's net profit margin maintained at 56.2%.

For NVIDIA, the market is actually more concerned about next quarter's guidance and the progress of Blackwell. The company expects next quarter's revenue to be 43 billion USD, which is better than the lowered buy-side expectation (around 42 billion USD). However, the gross margin (GAAP) for next quarter is 70.6%, lower than the market expectation of 72.3%, indicating that the gross margin is still significantly affected by the ramp-up of Blackwell.

From the guidance perspective, the incremental support provided by Blackwell for the next quarter looks good. For more detailed data and the progress of GB300, please follow Dolphin Research for subsequent specific comments and conference call content.

The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.