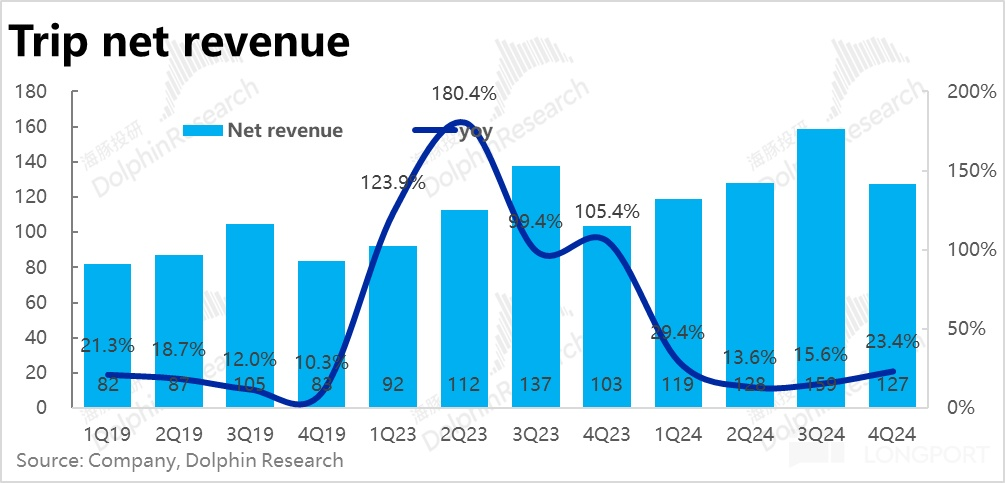

$TRIP.COM-S(09961.HK) The main driver of performance growth is strong inbound tourism and pure overseas business. However, while the pure overseas business is growing rapidly, it also requires high costs and investments, so the pace of profit release will not be very fast. As a result, Trip.com's profit growth this quarter was almost stagnant, with revenue growth but no incremental profit. In addition, the company's previous guidance for full-year 2025 profit growth was quite conservative, leading to weak market confidence.

This quarter, Trip.com's outbound travel bookings for flights and hotels exceeded 120% of the same period in 2019 (last quarter, this metric was close to 120%). Pure overseas business bookings grew 70% year-over-year, better than the 60% growth last quarter. Inbound travel bookings grew over 100% year-over-year.

From a financial perspective, the two main pillar businesses:

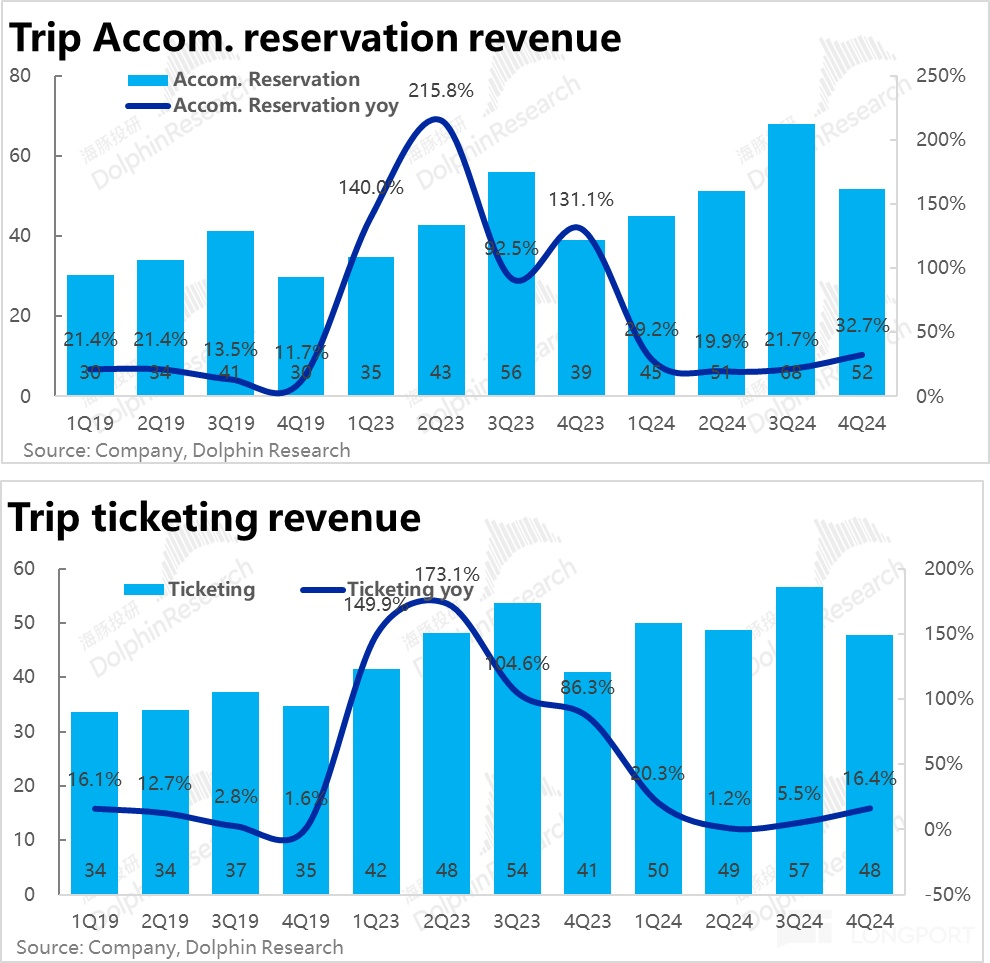

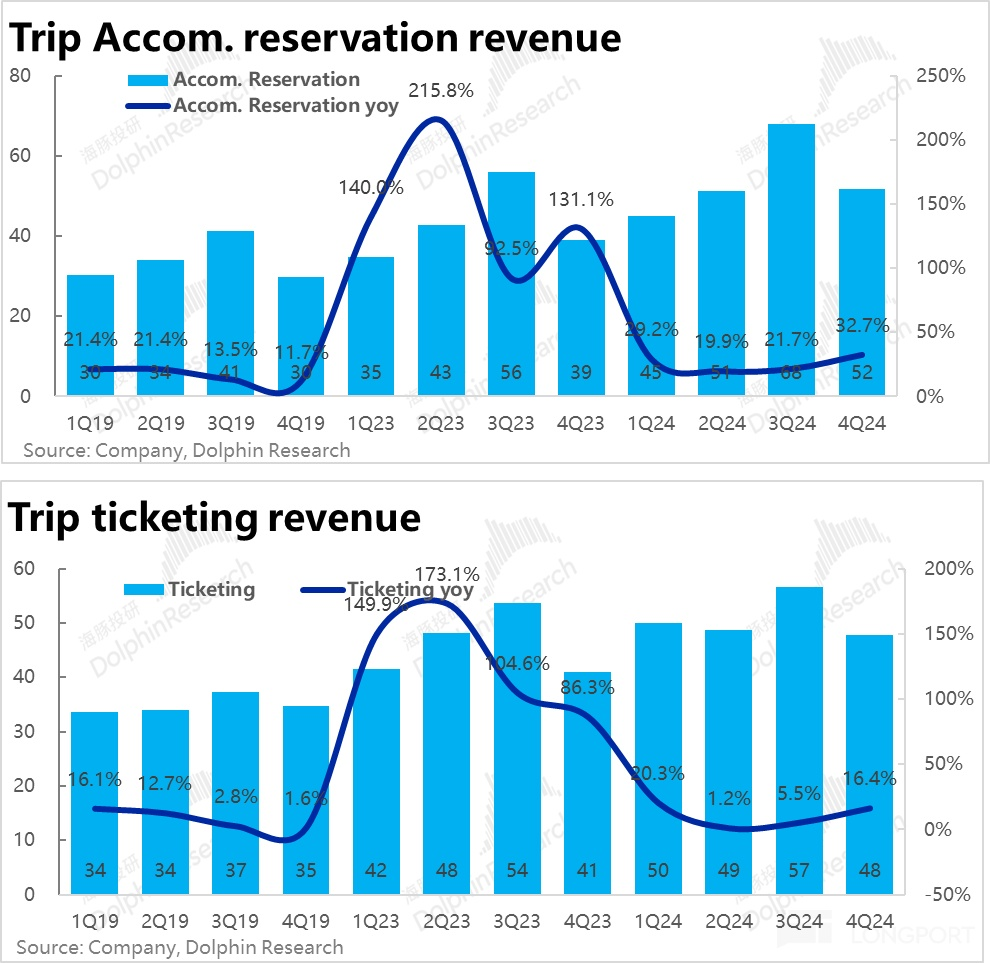

1) Hotel booking revenue grew nearly 32.7% year-over-year, at the upper end of the company's previous guidance. The growth rate jumped by a full 11 percentage points compared to last quarter. Combined with the company's previous guidance, domestic travel booking revenue this quarter grew about 20% year-over-year, while outbound and pure overseas businesses both saw strong growth above 50%, driving overall growth.

2) The growth rate of ticketing revenue also recovered to 16.4%, better than the expected ~14% growth. On one hand, the impact of the company's voluntary reduction of bundled sales items like insurance tied to flights is nearing its end in the base period. On the other hand, higher-priced international flights for inbound and outbound travel will also bring greater revenue elasticity.

The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.