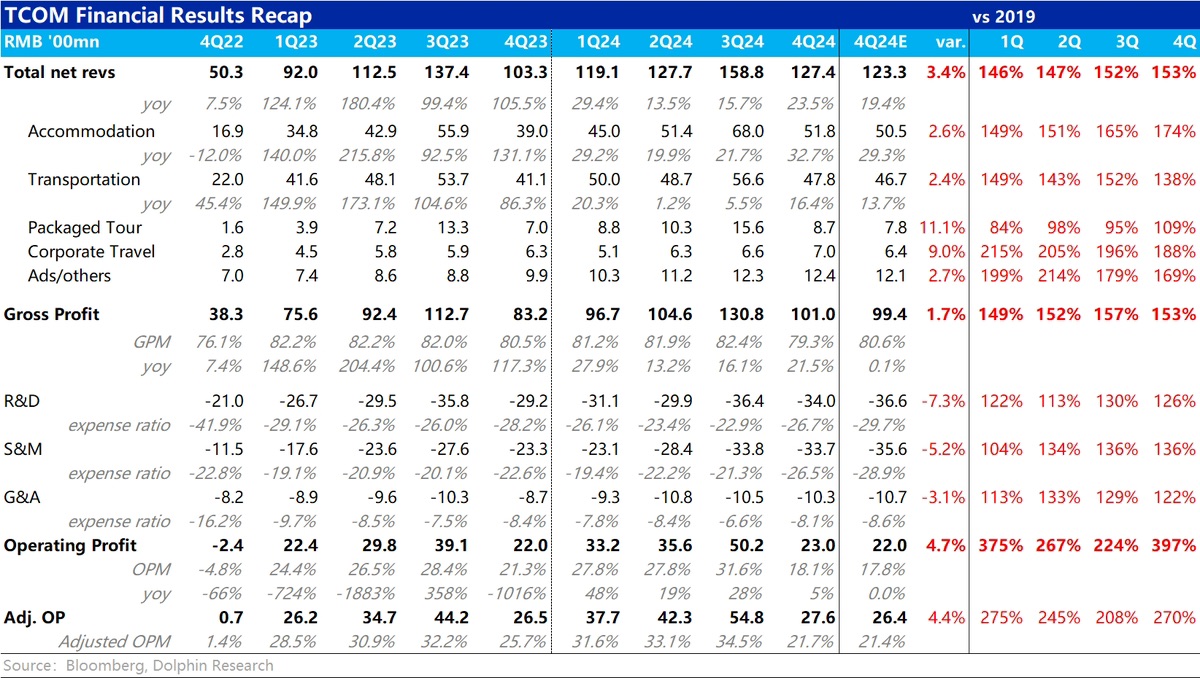

$Trip.com(TCOM.US) 4Q24 Quick Interpretation: Overall, from the perspective of expectation differences, Trip.com has delivered a performance that is comprehensively better than expected and the guidance previously provided by the company. Specifically, the revenue growth of the accommodation and ticketing businesses (the high base period of reduced income from services like insurance and VAT has passed) has accelerated again, reaching a new high for the entire fiscal year 2024, with overall revenue growth returning to over 20%.

However, we also noticed that while the gross margin slightly declined this quarter, various expense expenditures saw significant year-on-year growth between 18% and 45%. Although the actual operating profit of 2.3 billion this season was slightly better than the expected 2.2 billion, it was somewhat lower than market expectations. Excluding the expectation difference, a profit growth of only 5% is clearly not a good trend due to the significant expansion of expenses.

The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.