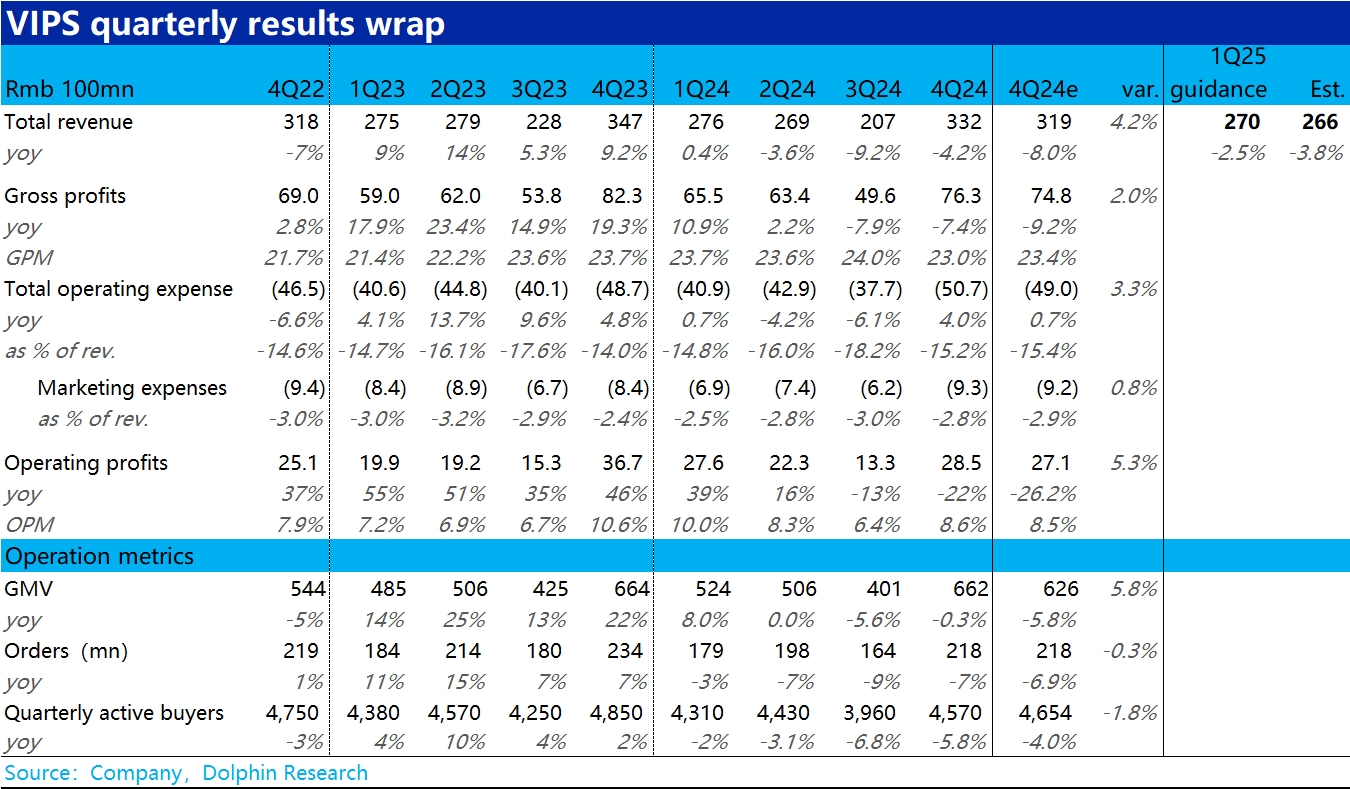

$Vipshops(VIPS.US) 4Q24 Quick Interpretation: In summary, Vipshop's performance this quarter exceeded expectations, as it was not as bad as feared under a low base and weak expectations. The main point is that in the past few quarters, the company's order volume and GMV have continued to decline, and user attrition has led to a generally pessimistic market expectation for Vipshop, believing the previous trend would persist. Therefore, it was anticipated that GMV and order volume would still shrink by -6%~-7% this quarter. However, the actual GMV was flat year-over-year, and while zero growth is not great, it still represents a significant beat from an expectations perspective.

Combined with the fact that order volume still declined by 7% year-over-year and the company's explanation, the main driver should be strong consumption of high-ticket winter goods by core groups such as SVIPS. According to the company, in 4Q, the core category of wearable goods returned to positive year-over-year growth.

Although, apart from the GMV beat, Vipshop's revenue, user count, and profit metrics still showed year-over-year declines, indicating continued weakness in the cycle. However, the company announced that the previous $10 buyback quota has been fully utilized and introduced a new $1 billion buyback program valid until February 2027, along with a special dividend of $0.48 per ADS, totaling $250 million. This is commendable from a shareholder return perspective.

The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.