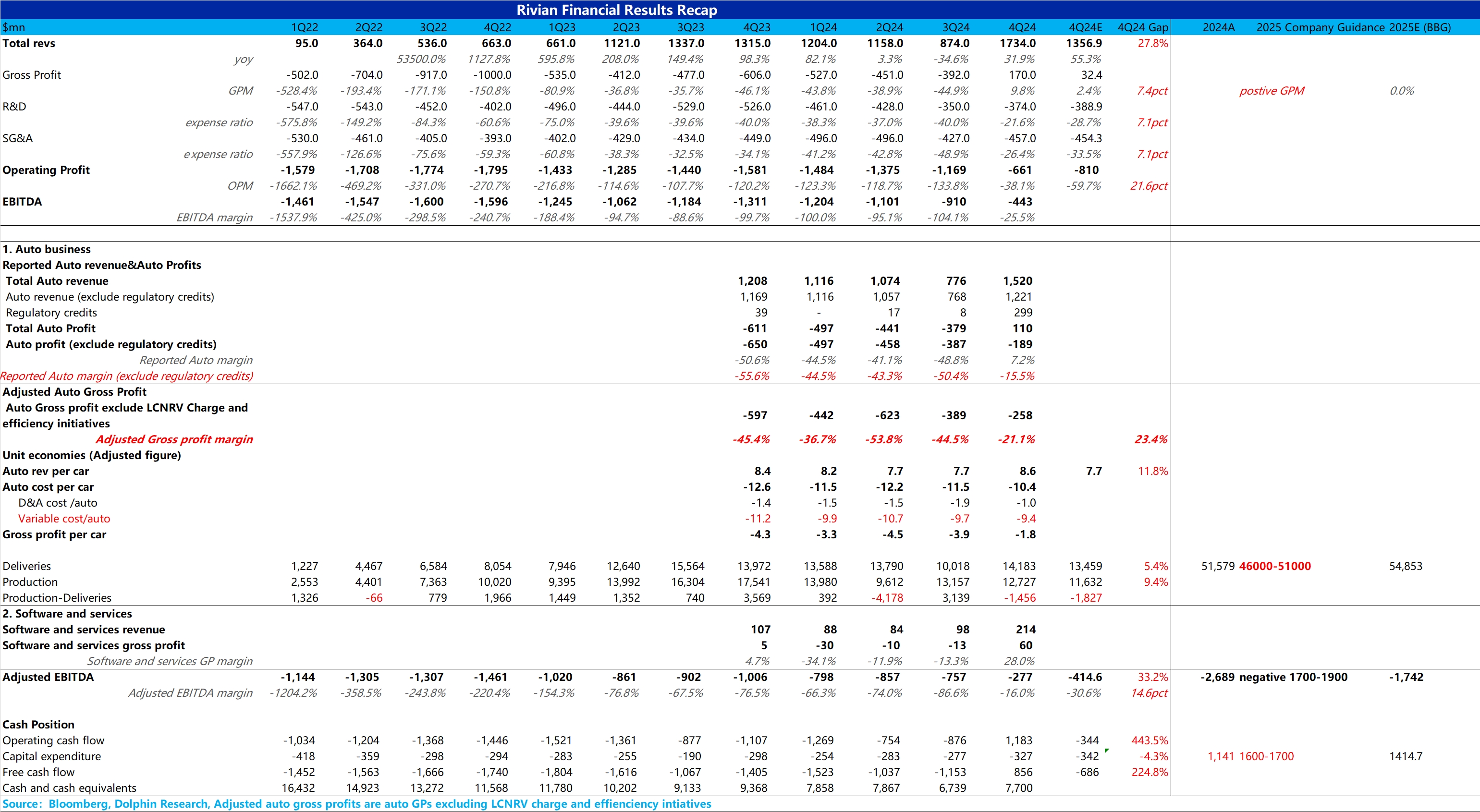

$Rivian(RIVN.US) 财报火线解读:总体而言,单论四季度业绩表现来看,业绩全面超预期,更关键的是报表端的毛利率如公司反复强调的一样,成功实现转正,甚至达到了 9.8%,高出市场一致预期 2.4%。

由于 Rivian 本次报表调整幅度相对较大,市场也最关心的是 Rivian 核心的汽车业务表现,海豚君把这份业绩拆分出来汽车业务单独分析。

从汽车业务来看,本季度报表端汽车业务毛利率成功实现转正(7.2%),但实际上是一笔大额的监管积分收入在 2024Q4 确认(与管理层上季度指引一致),剔除这笔监管积分后的汽车业务毛利率-15.5%,虽然仍然没有转正,但比上季度还是提升了 35 个百分点,是一个很不错的提升了。

但其实报表端的汽车毛利还有存货和合约减值冲回,以及一次性成本因素影响,但由于存货和合约减值可重回金额在 2025 年已经非常少,且一次性成本(主要和第二代 R1 更新有关的成本)几乎也不会在 2025 年复现,所以为了观测持续性,海豚君剔除了这两个影响,观察真实的汽车业务毛利率。从本季度真实的汽车业务毛利率来看(同样剔除监管积分),也算一个不错的提升,四季度真实汽车业务毛利率-21.1%,环比上季度提升了 23 个百分点。

而环比提升的核心原因:

① 最主要:单车收入 Q4 8.6 万美元,环比提升了 0.94 万美元,大幅超市场仅环比持平的单车收入预期。而单车收入提升的主要原因在于:a. 本季度基本都在交付最新款 R1,最新款 R1 基本没有提供折扣,而二季度和三季度还在大量交付库存车(更新之前的 R1 版本 - 提供了较大的折扣);b. 销售结构上三电机的 R1 推出(价格更贵的版本),带动单车 ASP 提升,但部分被 EDV 的占比提升所抵消(商用货车的单价更低)。

② 其次:单车摊折成本环比下降了 0.8 万美元,一方面是由规模效应影响,但最主要还是因为公司在 Q2-Q3 对第二代 R1 的升级做了提前折旧,以及工厂的运营效率有所提升。

③ 但其实最关键的在于,可变成本的降幅,也是市场最关心的点,还记得 RIVIAN 之前反复强调此次 R1 升级,更换了 50% 的供应商,但带来的 BOM 成本的大幅降低(Rivian 之前预计 2024 Q4 相比 2024Q1 BOM 成本下降 20%)。

但实际上,本季度可变成本降幅并不大,环比下降了不到 3000 美元,而相比 Q1 也仅下降了 5000 美元,而本季度同时还有成本更低毛利率更高的 EDV 贡献,让投资者怀疑是不是 Rivian 第二代 R1 成本降幅并不如之前公司指引。

同时结合 2025 年低于预期的交付指引,仅 4.6-5.1 万辆,低于市场预期 5.5 万辆,甚至还要低于 2024 年的实际交付 5.16 万辆,背后隐含的对 R1 的需求薄弱,市场也担心本季度上升的单车收入并不能维持,后续还会持续下行。

再结合降本不及预期,可以预见 2025 年的真实汽车业务毛利率预期可能并不好,2024 Q4 的提升趋势可能并不能维持,详细分析请看海豚君之后的点评。

本文版权归属原作者/机构所有。

当前内容仅代表作者观点,与本平台立场无关。内容仅供投资者参考,亦不构成任何投资建议。如对本平台提供的内容服务有任何疑问或建议,请联系我们。