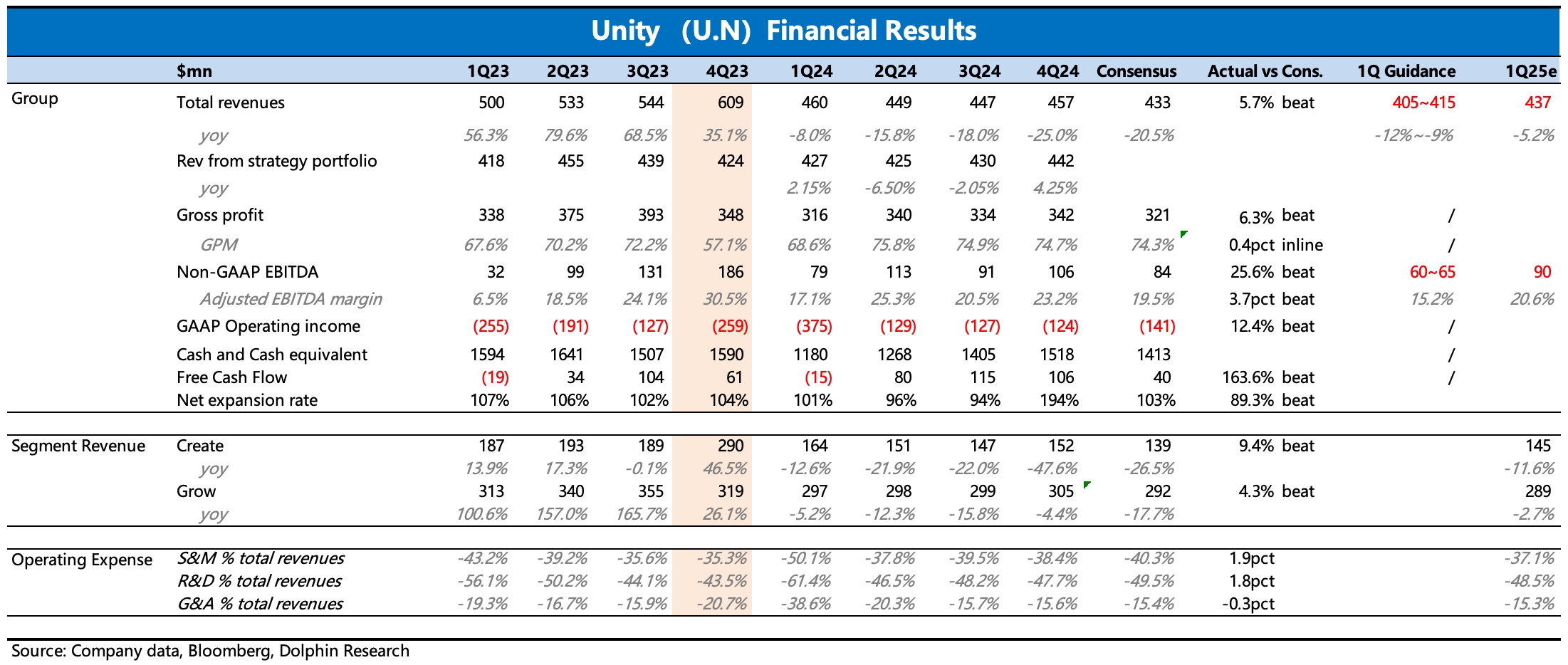

$Unity Software(U.US) Quick Interpretation of 4Q24: Overall, the current quarter's performance was fine, with most core financial metrics exceeding expectations. However, the bomb lies in the Q1 guidance. The company's guidance for 1Q25 not only shows revenue below expectations but also indicates weaker projected profitability, which is somewhat disappointing.

For Unity in 2025, the focus is on the inflection point. Since internal technological progress is hard to reflect in performance, short-term performance guidance and this earnings call are actually more critical. Earlier this year, Dolphin Research mentioned in its Comparative Study of Applovin and Unity that Unity might experience a fundamental inflection point this year—steady penetration of Unity 6 + price hikes, AI accelerating ad algorithm optimization. Although Unity saw a short-term surge in November after the Q3 earnings release and the addition of a new ad lead in September, funds looking for a reversal would need to see 1-2 quarters of performance before truly committing. Therefore, risk-averse investors shouldn’t rush to jump in unless they find a good entry point, such as near Dolphin Research’s pessimistic expectation (around $7.3 billion).

Based on recent advertiser surveys by institutions, Unity Ads' ROAS hasn’t shown much improvement yet. The partial recovery of the mobile gaming market and Applovin’s expansion into non-gaming advertisers without increasing ad inventory have potentially pushed up CPM bids, leading some small-to-medium game developers to explore platforms other than Unity Ads, such as IronSource Ads, which has slightly better ad conversion rates. Although it’s only small-scale testing for now, it at least offers Unity and IronSource a chance to turn things around—a change worth monitoring.

The weak Q1 guidance aligns with the survey findings (clients’ attitudes toward Unity Ads haven’t shifted yet), so hopes now rest on Unity’s new ad algorithm model. The company plans to launch it mid-year. As for the current progress—whether it’s on track, whether any clients are conducting internal tests, etc.—these questions are expected to be focal points for analysts during the earnings call. Investors are advised to pay close attention to this call.

The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.