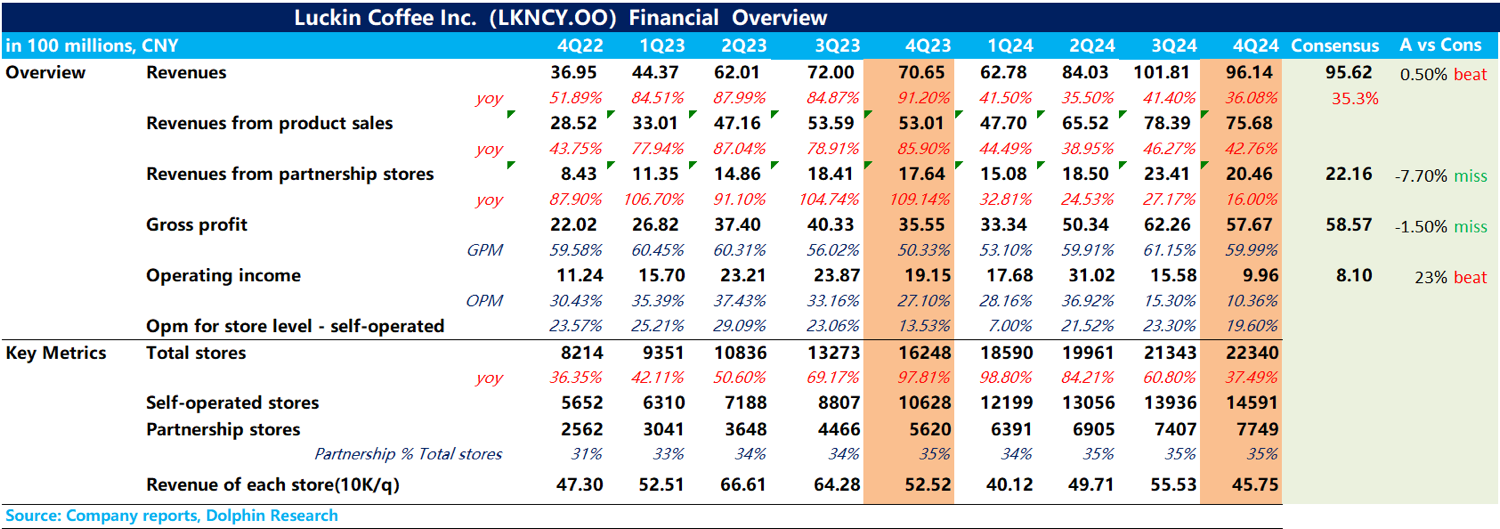

$Luckin Coffee(LKNCY.US)Q4 2024 Quick Interpretation: Overall, Luckin Coffee's performance this quarter was mixed. While revenue slightly exceeded expectations, core operating profit reached 1 billion yuan, significantly surpassing market consensus expectations by 23% (market consensus was 810 million yuan). However, due to the continued acceleration in coffee bean prices in Q4, the company's gross margin fell short of expectations. Additionally, monthly active paying users saw a slight decline in Q4 after two consecutive quarters of sequential growth, raising concerns at Dolphin Research about declining user stickiness after subsidy reductions.

1. In terms of store openings, Q4 saw a net increase of 997 stores, slowing down again compared to Q3, in line with Dolphin Research's expectations. (Luckin currently has over 22,000 stores, approaching the ceiling of 30,000 stores. The company's proactive slowdown to reduce the impact of new stores cannibalizing existing ones is a rational move.) Furthermore, after testing the waters in Singapore, the company is preparing to expand into Malaysia, making overseas expansion something to look forward to.

2. Same-store sales declined by 3.4% year-over-year, narrowing further from Q3 (-13.1%), mainly attributed to the weakening impact of new store cannibalization and reduced company subsidies, coupled with an increase in average cup prices.

The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.