$Alibaba(BABA.US) FY3Q25 (CY4Q24) Quick Interpretation: After a significant recovery of 60% from the bottom, the market's attention on Alibaba is almost unprecedented. But to be honest, this round of revaluation has little to do with fundamentals; good performance is just icing on the cake, and mediocre performance won't shake foreign investors' confidence in increasing allocations to Chinese assets centered around Alibaba Cloud.

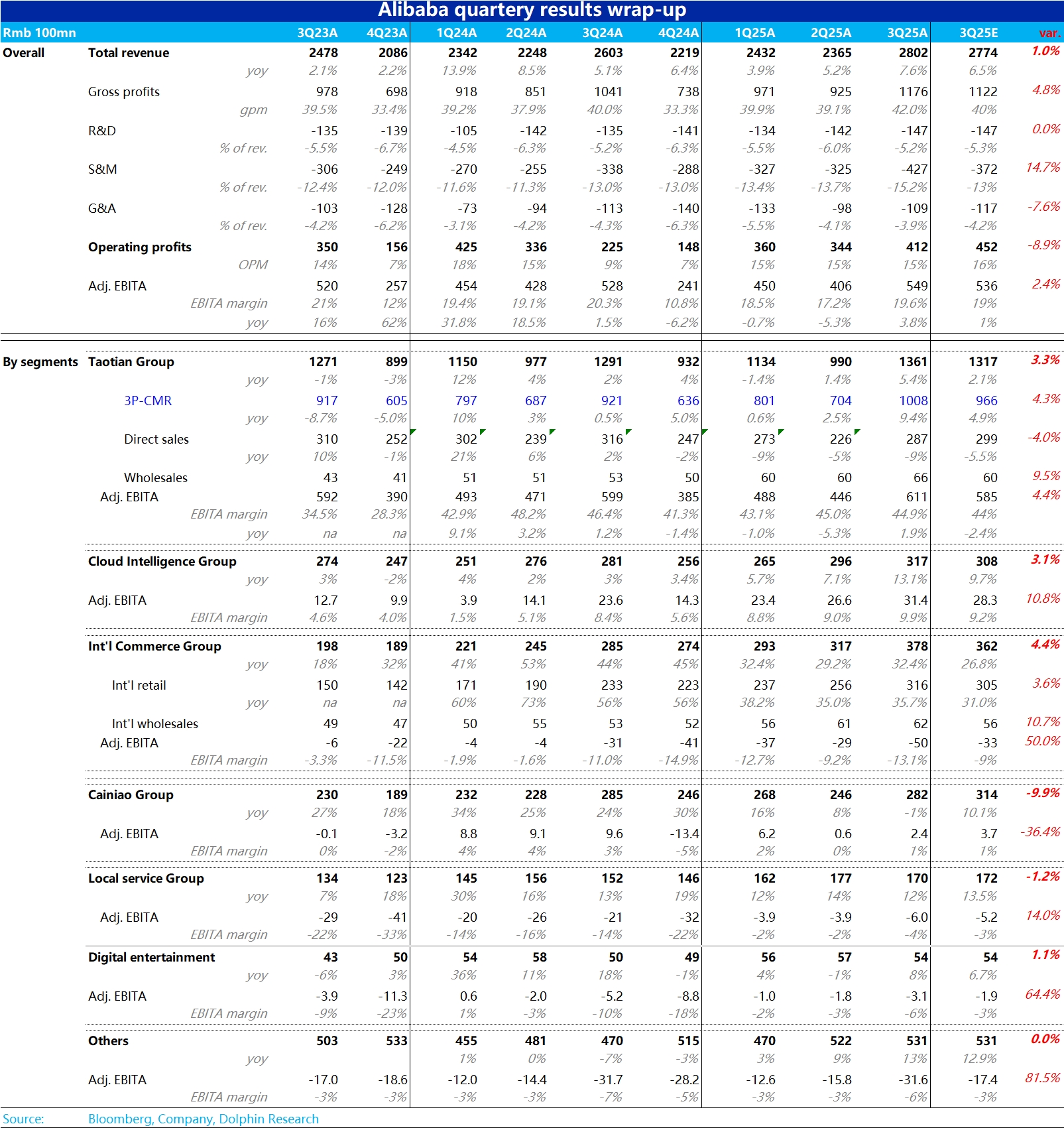

As for this quarter's performance, the operating profit of 41.2 billion looks significantly below expectations, due to over 6 billion in goodwill and intangible asset impairments. This will continue during Alibaba's divestiture of low-margin capital-intensive businesses, but it's hard for the market to estimate, so at this stage, Alibaba's GAAP operating profit is essentially just noise.

The key is to look at the core asset business:

a: Taotian Group: 9.4% CMR growth, 2% profit (adjusted EBITA) growth; revenue is expected to exceed expectations, but profit performance can only be described as barely exceeding, as some outsiders have already adjusted profits to positive growth close to the earnings report. However, unless the newly appointed CEO has a new strategic change, this positive growth should still be hopeful within a year.

Additionally, profit growth is lower than revenue growth, which can be seen from the soaring marketing expenses, as part of the revenue taken from merchants is returned to users for incentives. It is estimated that profit growth will continue to lag behind CMR growth.

b: Alibaba Cloud: The core asset of this revaluation, revenue growth accelerated from 7% last quarter to 13%, which still does not include the revenue acceleration impact from the Deep Seek incident. The company previously indicated double-digit growth for the new year, and it seems that expectations are accelerating to be fulfilled. In a market where the general expectation for the new year is only 10-15% growth, under the influence of Deep Seek, both the company's guidance and market expectations are likely to be revised upward, which is definitely a positive.

Another noteworthy point is that Alibaba Cloud's profit this quarter is 3.1 billion, with a profit margin close to 10%, which also exceeds market expectations, perhaps alleviating concerns that the scaling of AI business will negatively impact Alibaba Cloud's profit growth trajectory.

Overall, in this report, what is truly good is exactly what the market cares about most: Alibaba Cloud.

Not bad, Alibaba's revaluation story can continue!

$BABA-W(09988.HK)

The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.