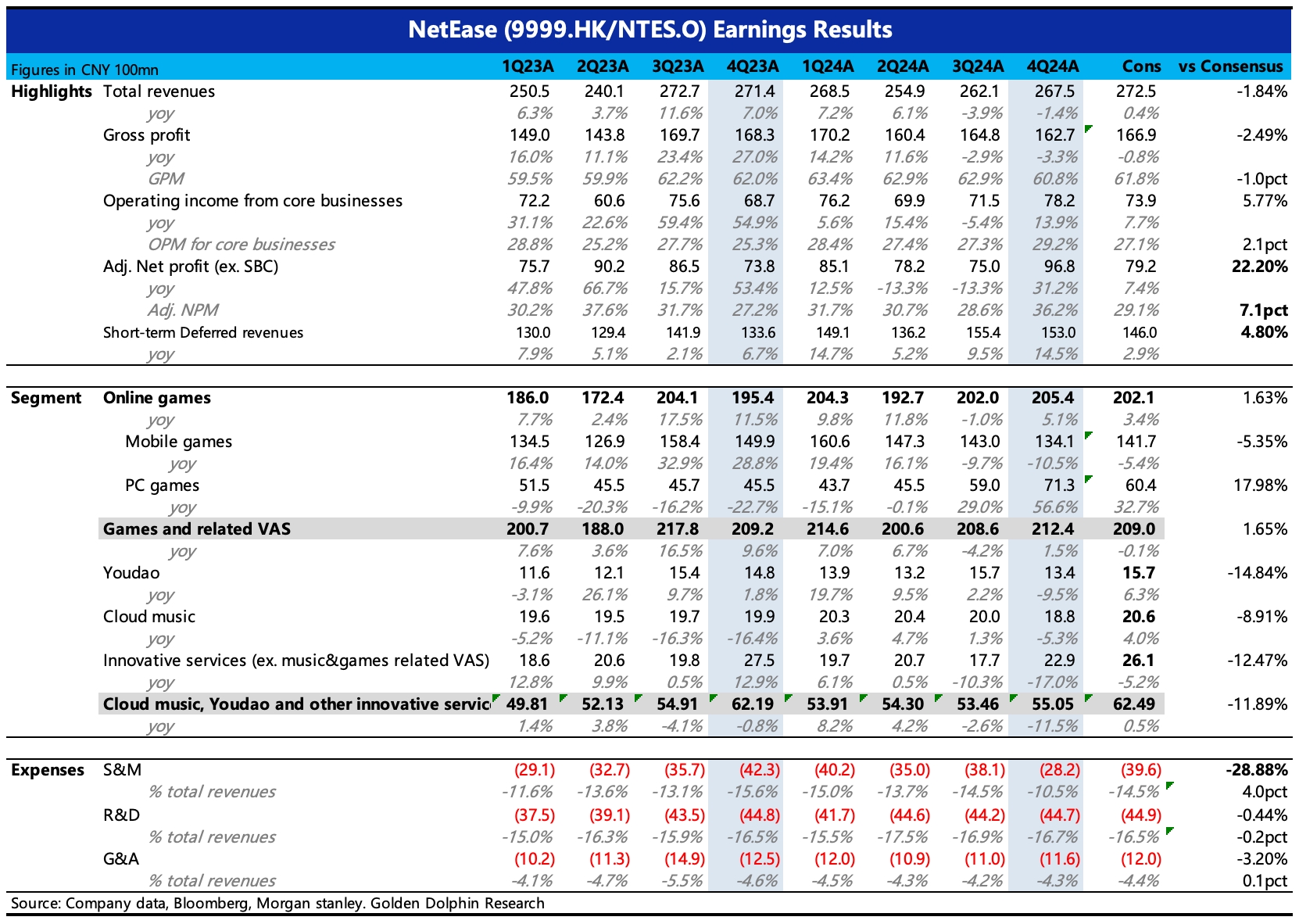

$NTES-S(09999.HK) Q4 2024 Quick Interpretation: The performance in the fourth quarter has both good and bad aspects. Revenue shows that mobile games underperformed expectations, while PC games exceeded expectations. Youdao and Cloud Music were relatively weak, but profits significantly beat expectations, mainly due to a substantial decrease in sales expenses. This may be related to NetEase's recent internal marketing corruption rectification and distribution strategy, leading to some one-time impacts on marketing expenses.

1. Mobile games miss: A year-on-year decline of 10%, worsening from the previous quarter, mainly due to a high base and lack of new games. However, the market originally expected the slowdown to ease to around 5%. Last year's fourth quarter had "Nirvana in Fire Mobile," which set a very high base. This year, there are no new mobile games in the fourth quarter, and the performance of "Marvel Ultimate Reversal" in the third quarter was average, while older games like "Eggs" and "Nirvana in Fire" showed year-on-year weakness. The Q4 performance may weaken some market confidence, and 2025 will still face base effects. However, Dolphin Research believes there is no need to be too pessimistic, as the pipeline is gradually returning. The mobile game "Yanyun" has already launched in January, with good user activity and revenue. The mobile game "Seven Days World" will have a public test in April, and there may be another 2-3 new games this year, including "Code: Infinite."

2. PC games beat: A year-on-year increase of 57%, mainly due to contributions from new games. Blizzard's "World of Warcraft" and "Hearthstone" returned in the third quarter, and the new game "Marvel Showdown" performed exceptionally well in the fourth quarter, along with the year-end release of "Yanyun," which also received a good response. This year's growth in PC games may still outperform mobile games, partly because the base in the first half of the year is not high, and there are new reserves in the pipeline. Yesterday, "Overwatch" returned, and the well-received "Outsider Tide" will have a public test in March, with "Code: Infinite" also having PC/console versions.

3. Youdao, Cloud Music, and other innovative businesses miss: Youdao online learning continues to decline, while advertising has seen significant growth due to technological improvements; Cloud Music experienced a year-on-year decline of 5%. Since the fourth quarter, Douyin's aggressive music promotion has been strong, and according to QM data, the DAU has exceeded 25 million by the end of the year, surpassing Cloud Music.

4. Profit significantly beats: Mainly due to a much larger-than-expected decrease in marketing line expenditures, which may have a one-time impact from internal corruption rectification (the team underwent significant adjustments, possibly affecting normal marketing activities in the short term, as evidenced by an 80% year-on-year decrease in SBC expenses within marketing costs). Gross margin decreased by 2 percentage points, mainly due to the revenue share from Blizzard games being a "drag." Recent investigations by relevant authorities into Apple's tax may provide medium to long-term optimization and improvement space for mobile game gross margins.

5. It is recommended to pay attention to the management's outlook for mobile games in 2025 during the conference call, the reserve of new games, and the revenue expectations for the currently launched key game "Yanyun." Additionally, focus on the management's explanations regarding changes in marketing expenses, how much of it is a one-time impact, and the outlook for subsequent steady-state situations. $NetEase(NTES.US)

The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.