$Baidu(BIDU.US) Q4 2024 Quick Interpretation: In the fourth quarter, Baidu Core's performance slightly exceeded expectations. However, Dolphin Research believes that the Q4 performance itself is not the current valuation focus. Although the cloud business will benefit from this round of Deepseek accelerating AI penetration, it also depends more on how the management interprets this year's advertising outlook and the impact of changes in the search landscape brought by Deepseek. Additionally, there is the age-old issue of the shareholder return plan. Therefore, the upcoming conference call is worth paying close attention to.

Regarding Q4 performance:

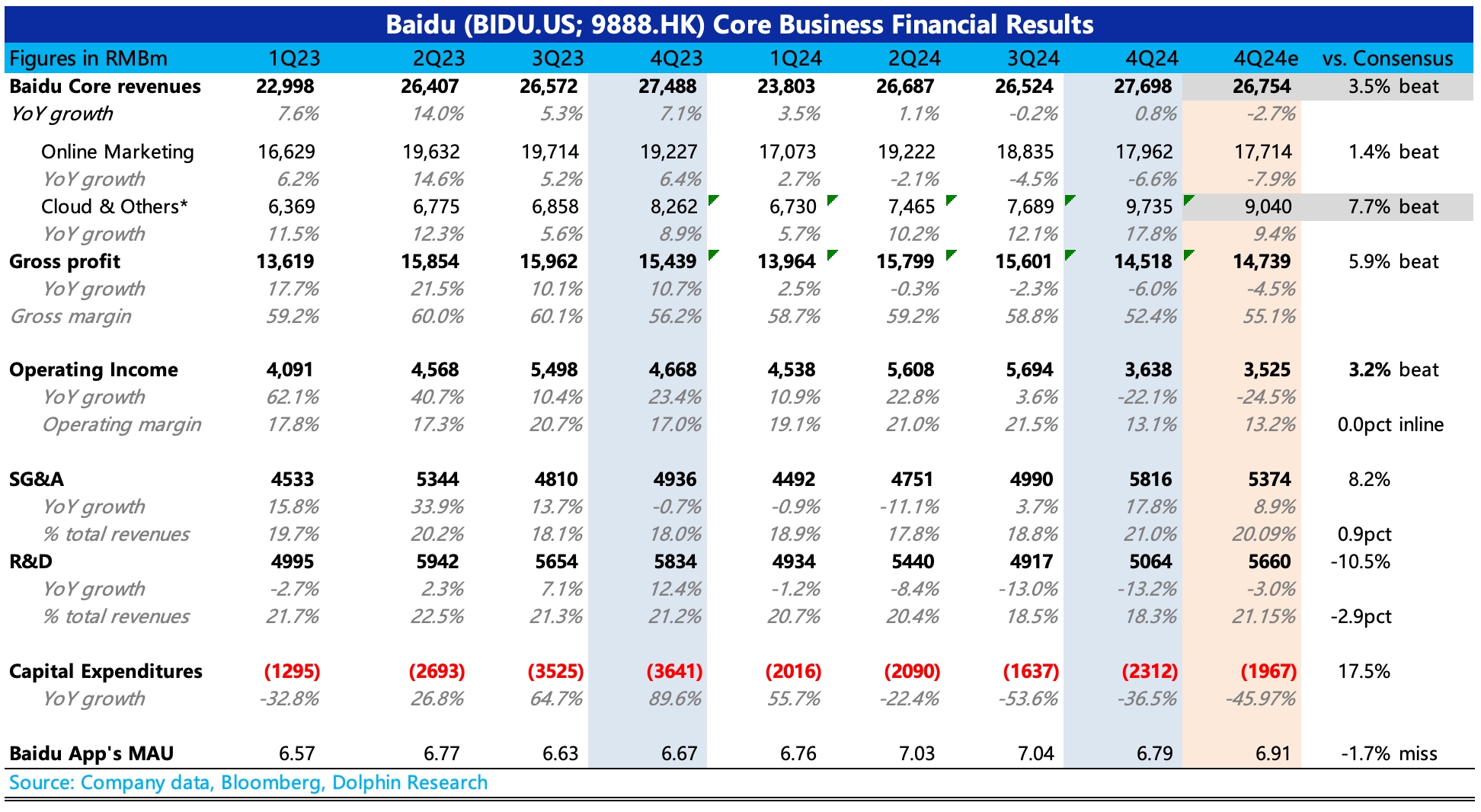

1. The main point of exceeding expectations is in the other business revenue primarily driven by the cloud business (which also includes Xiaodu speakers, Luobo Kuaipao, etc.), with a year-on-year growth of 18% in the fourth quarter. However, the consensus expectations in the chart below from Bloomberg are relatively lagging and have discrepancies, with top institutions' expectations (around 15%) being only slightly exceeded. Breaking it down, Dolphin Research believes that AI cloud growth is likely good, but the specific growth rate will be disclosed in the conference call. Core advertising declined by 6.6% year-on-year, aligning with the macro environment and the decline in monthly active users of the app, which basically meets the guidance in the company's preview and institutional expectations (high single-digit decline);

2. In terms of profit, apart from the pressure from advertising, there were also related costs from confirming the closure of Jiyue (one-time provisions for layoffs and related losses of about 1 billion), resulting in a 22% year-on-year decline in operating profit. However, these were basically within market expectations, and because revenue met expectations and R&D expenses were lower than expected, the overall operating profit slightly beat expectations.

3. However, although capital expenditure in the fourth quarter is still on a downward trend, there was a slight increase quarter-on-quarter, possibly based on the continuously increasing demand for AI cloud, leading to a moderate increase in investment in related infrastructure.

4. The pressure on profits and the increase in capital expenditure also had a certain impact on cash flow for the period. In the fourth quarter, Baidu's buybacks increased quarter-on-quarter, but due to the small total scale, the increase was not significant. As of the end of Q4, Baidu Core had RMB 134.7 billion in cash and short-term investments on its balance sheet, most of which are wealth management products. Therefore, during a period of performance pressure and damaged search logic, it is worth paying attention to whether the management has plans to increase buybacks or dividends.

The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.