Revisiting the Revaluation of Chinese Assets!

Yesterday, I talked about Alibaba. Today, let's discuss the revaluation of Chinese assets.

In terms of countries that can enter the competition in AI, only the United States and China are on the table. In the face of a worse global competitive environment,

a. China can produce Deepseek;

b. The explosive popularity of Nezha 2 and Black Myth: Wukong is not only a matter of cultural consumption breaking out but also reflects China's action production level and even the overseas expansion of Chinese games, which has demonstrated that China's animation production level is already top-tier. Based on the technical level, it adds the narrative soul of Chinese elements.

c. The success of TikTok and the breakout of Xiaohongshu are the results of the combined promotion of technology and cultural consumption.

Moving beyond short-term geopolitical games, the long-term competitiveness of society and enterprises constitutes the core underlying valuation.

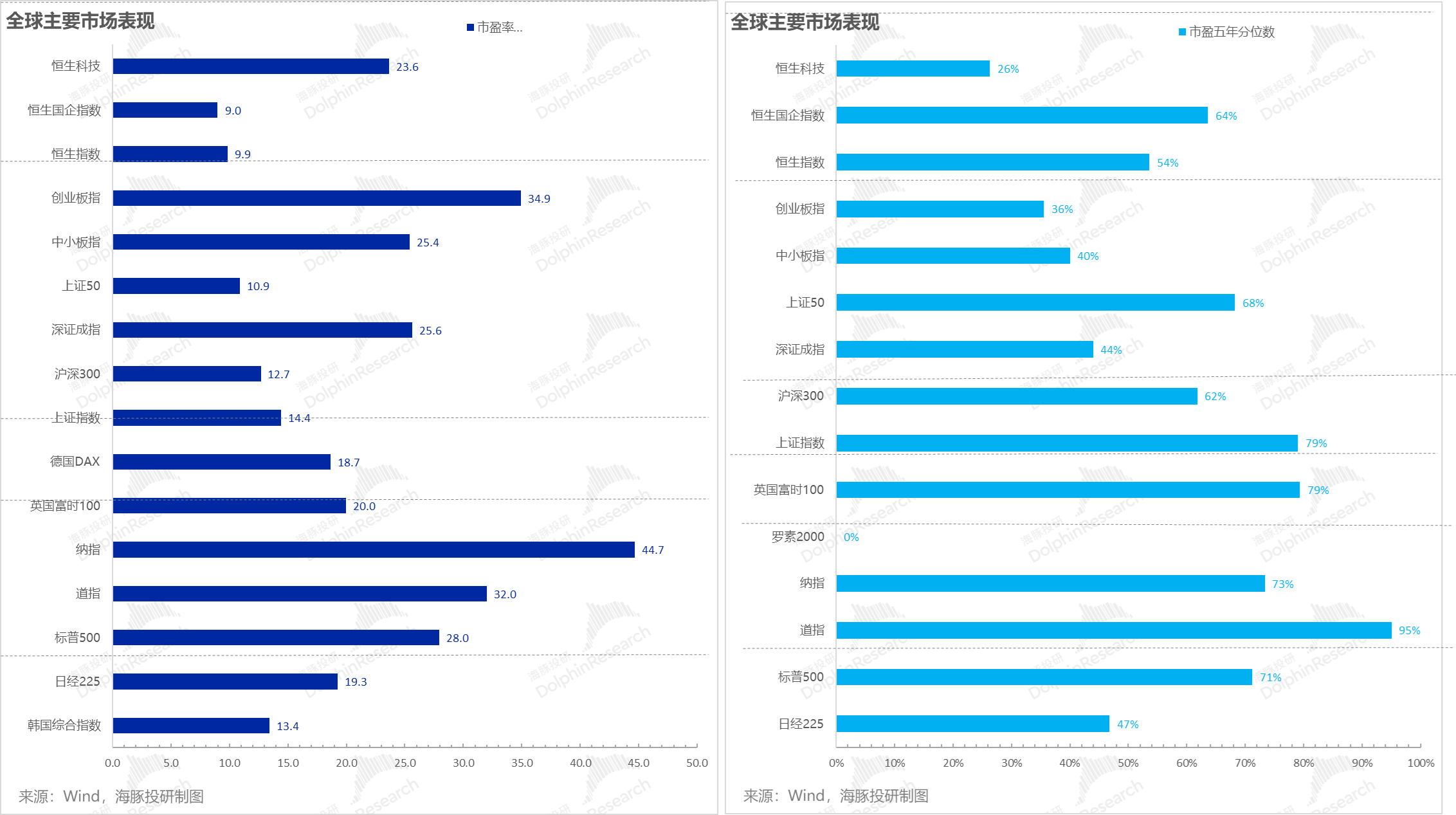

The competitiveness of Chinese private enterprises demonstrated in a harsh environment is completely comparable to that of Europe and Japan, so the core question is, why are Chinese assets continuously undervalued compared to their overseas counterparts?

Therefore, in this round of revaluation of Chinese assets, especially Chinese technology assets, we first need to level the country-specific asset discount.

Then, we can discuss whether the fundamentals are facing deflation as a cyclical issue.

So here, Dolphin Research reiterates that by 2025, there will be a continuous revaluation of Chinese assets.

In 2026, it will connect with the fundamental bottoming rebound.

So next, if you look at Chinese assets with colored glasses and do not take them off, your excess returns will be at risk!

https://longportapp.com/zh-CN/topics/27088036

The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.