$Airbnb(ABNB.US) 4Q24 Quick Interpretation: Airbnb's performance this quarter has notable highlights, both in terms of the current quarter's results and guidance for next year, with after-hours stock price surging approximately 15%. The specific highlights include:

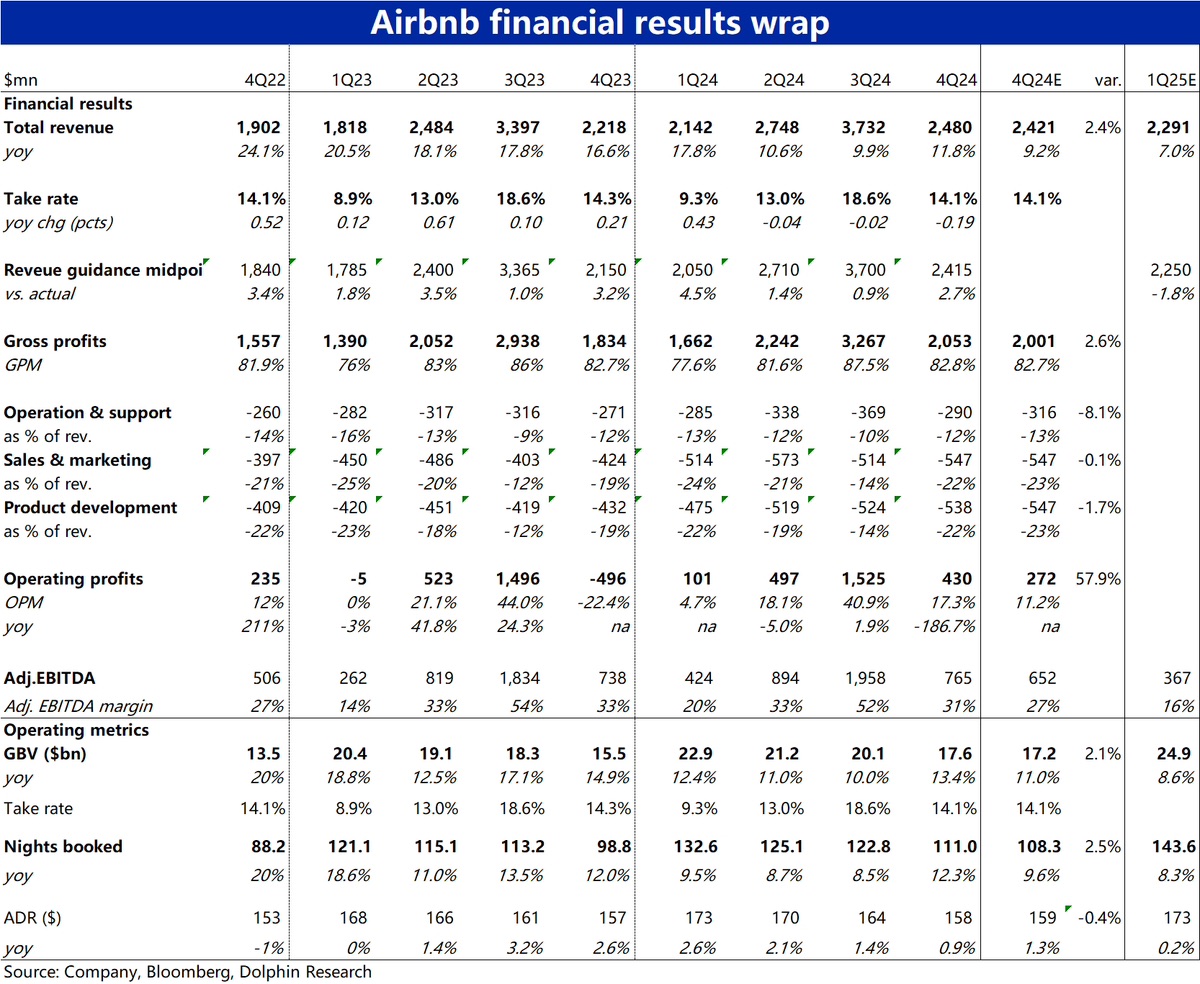

1) Core operating metrics performed strongly, with 4Q24 nights booked increasing by 12.3% year-on-year, a sequential growth rate of 3.8 percentage points, significantly higher than the market expectation of 9.6%. This reverses the trend of slowing growth seen in the past few quarters, suggesting potential signs of accelerated growth anticipated by the market. The sequential acceleration in bookings also drove total gross booking value (GBV) and total revenue to grow at an accelerated pace, exceeding market expectations by more than 2%.

2) Not only was the growth expectation strong, but the quarterly profit also exceeded expectations. Using the adjusted EBITDA metric primarily adopted by the company, the profit margin for this quarter reached 31%, far exceeding the market expectation of 27%. There were no signs of the significant decline in profit margins due to increased investment that the market was most concerned about.

3) In terms of guidance, the guidance for nights booked and revenue growth for 1Q25 generally aligns with market expectations. After excluding the impact of foreign exchange and leap year, the order volume growth for 1Q25 compared to 1Q24 is roughly flat. The highlight is on the profit side; the company guides that the adjusted EBITDA profit margin for 1Q25, after excluding the impact of foreign exchange and leap year, will be roughly flat compared to 1Q24. In contrast, the market originally expected a significant decline in profit margins, with 1Q25 at 16% vs. 1Q24 at 20%. Similarly, the market originally expected the full-year adjusted EBITDA margin to narrow by over 200 basis points to 33.5%, while the company's guidance is that 2025 will reach at least 34.5%. This somewhat alleviates the market's greatest concern that profit margins will continue to decline significantly in 2025.

The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.