$Robinhood(HOOD.US) Quick Interpretation: It is definitely a true Trump concept stock! Since the company announces various asset trading volumes directly related to revenue indicators on a monthly basis, the monthly trading volume of virtual assets has surged from around $5 billion to over $30 billion after Trump took office. This has also boosted trading in options and other derivatives (such as election bets) along with the underlying stock trading, so the sharp rise in HOOD's performance has been anticipated in advance.

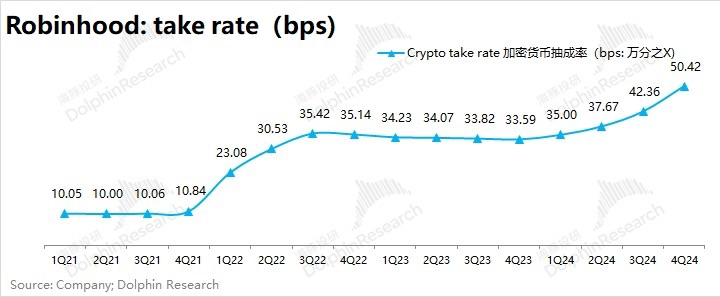

Unexpected but also within reason: The combination of Trump taking office and Musk's endorsement has not only brought prosperity to virtual asset trading but also improved the monetization rate of virtual asset trading based on supply and demand matching, further amplifying the trading revenue of virtual assets.

What is truly reflected in the financial report is HOOD's stable cost and expenditure control ability in a bull market:

a. The additional revenue brought by the prosperity of platform trading in virtual assets has almost all entered into profits;

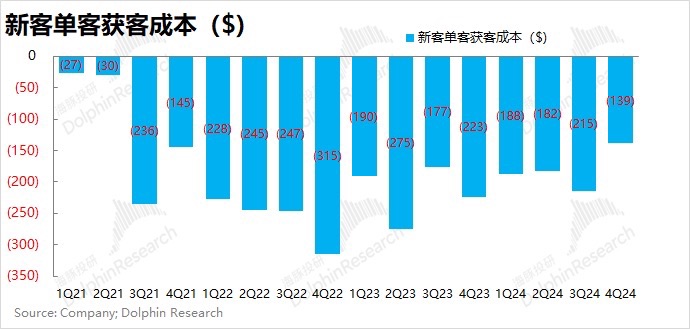

b. The boost from virtual assets has led to an increase of 900,000 new users for HOOD in the current quarter, while the customer acquisition cost for new customers has significantly decreased.

Therefore, in this financial report, it seems reasonable to Dolphin that although the company has already entered a soaring mode after Trump took office, the strong profit delivery this time, with a post-report surge of 15CM, is also justified.

The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.