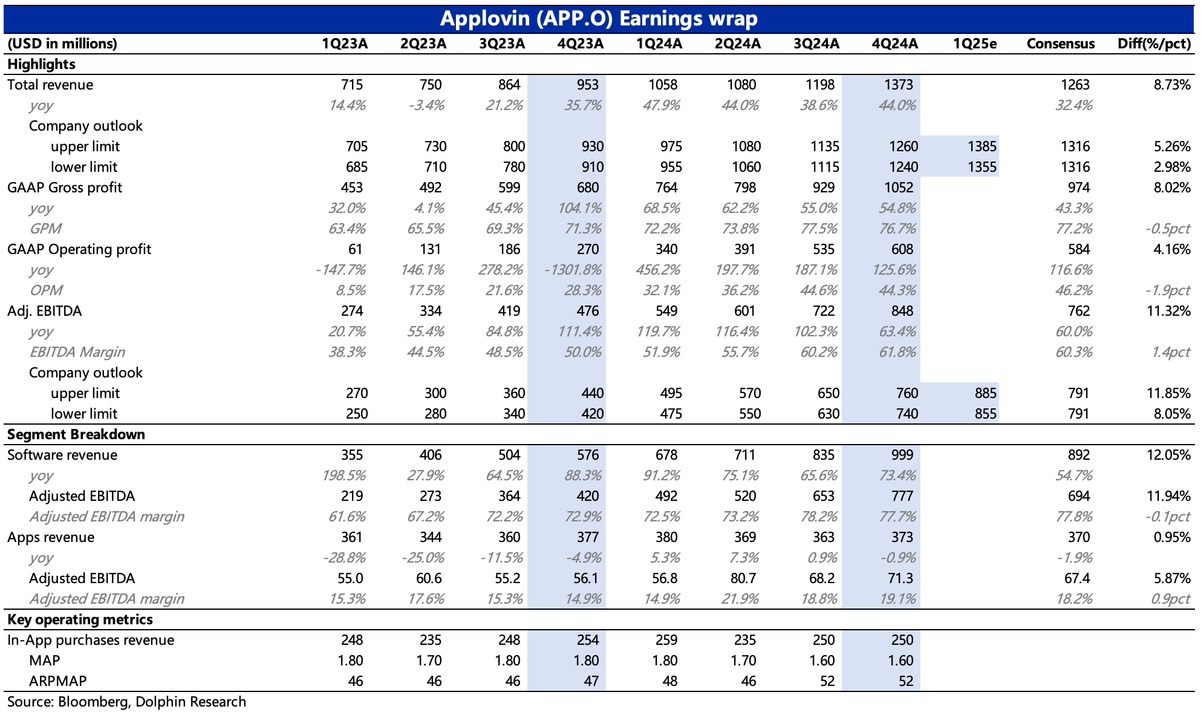

$AppLovin(APP.US) Quick Interpretation: Q4 performance is good, and the more important Q1 2025 guidance also exceeded BBG market consensus expectations, as well as relatively optimistic expectations from leading institutions (due to positive feedback from Applovin's testing of e-commerce advertising, expectations were slightly raised at the beginning of the year). Considering market expectations and trends in the gaming industry (slight deceleration in Q4), Dolphin estimates that a small portion of the revenue in Q4 already includes incremental gains from e-commerce advertising, which is also an important highlight for Applovin's growth drivers in 2025.

1. Guidance beat comes from advertising: The main areas where Q1 2025 revenue and EBITDA exceeded expectations are still in the advertising business (originally software services), implying smooth progress in e-commerce advertising. Revenue from proprietary apps is relatively weak and is still actively adjusting from a trend perspective.

2. The quarterly performance is also impressive: Although guidance is more important, the performance in Q4 also surprised the market. Ultimately, it stems from the unexpected advertising revenue, with advertising profit margins remaining stable. In addition, proprietary app services continue to adjust while improving overall operational efficiency (EBITDA), which has also led to further layoffs in Q4. Following the wave of over 60 layoffs in August, another 120 employees were optimized in Q4 (excluding the split of Adjust), resulting in more severance expenses.

Overall, behind the surface indicators of performance exceeding expectations lies a more critical point: while maintaining a solid position in the gaming advertising market, Applovin's new growth driver—the growth logic of e-commerce advertising—is expected to be gradually validated and implemented, which is what truly excites the market.

The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.