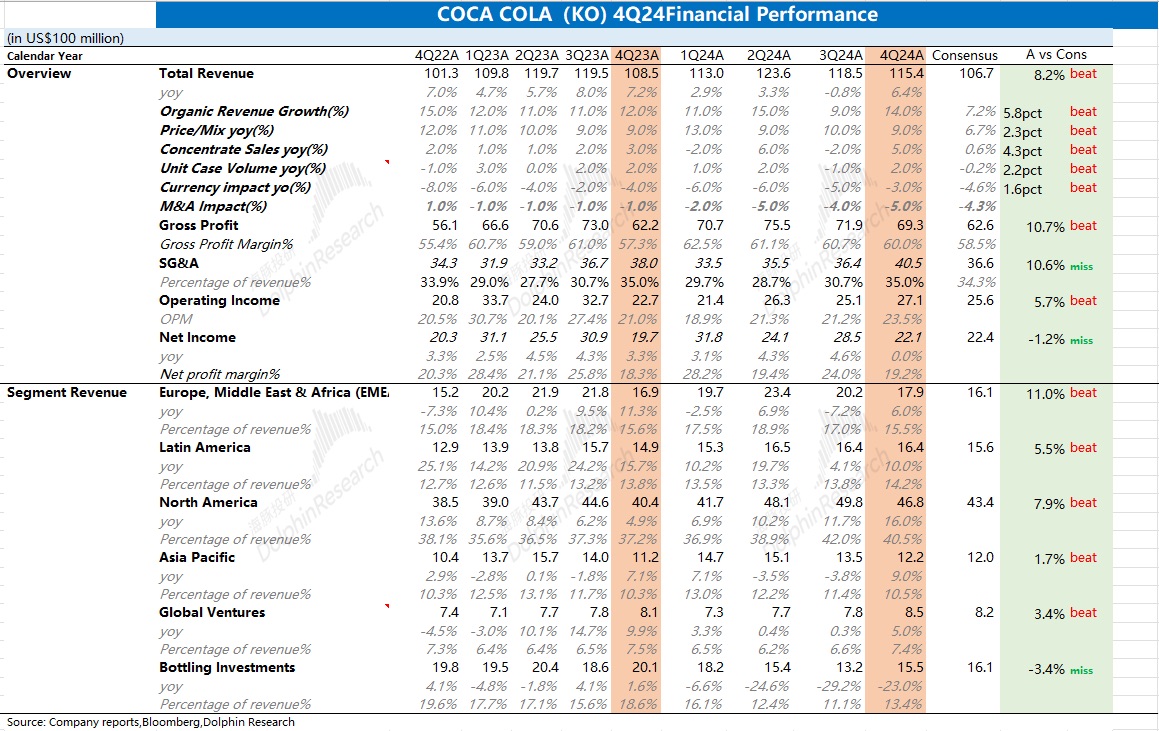

$Coca Cola(KO.US) Quick Interpretation: The company's financial report overall exceeded expectations, with a year-on-year increase of 14% in organic revenue for Q4 (expected 7%). Breaking it down, both the sales volume of concentrate and overall pricing performed well, with pricing contributing more significantly. The impact of foreign exchange headwinds has also weakened against the backdrop of easing inflation.

Thanks to the company's strong brand power, it successfully passed on cost pressures to consumers through measures such as launching small bottles and direct price increases, maintaining a gross margin that remains robust at over 60%. Although the company's marketing expense ratio increased in Q4 (speculated to be due to increased marketing efforts for Christmas), core operating profit still performed steadily.

In terms of guidance, the company expects organic growth of 5%-6% in 2025, which is consistent with previous expectations. Additionally, the company continues its tradition of the past 62 years by increasing dividends, distributing $8.4 billion in dividends and repurchasing $1.1 billion in stock in 2024 to enhance shareholder returns. For more detailed information, please continue to follow Dolphin Jun's specific commentary and conference call content on the company.

The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.