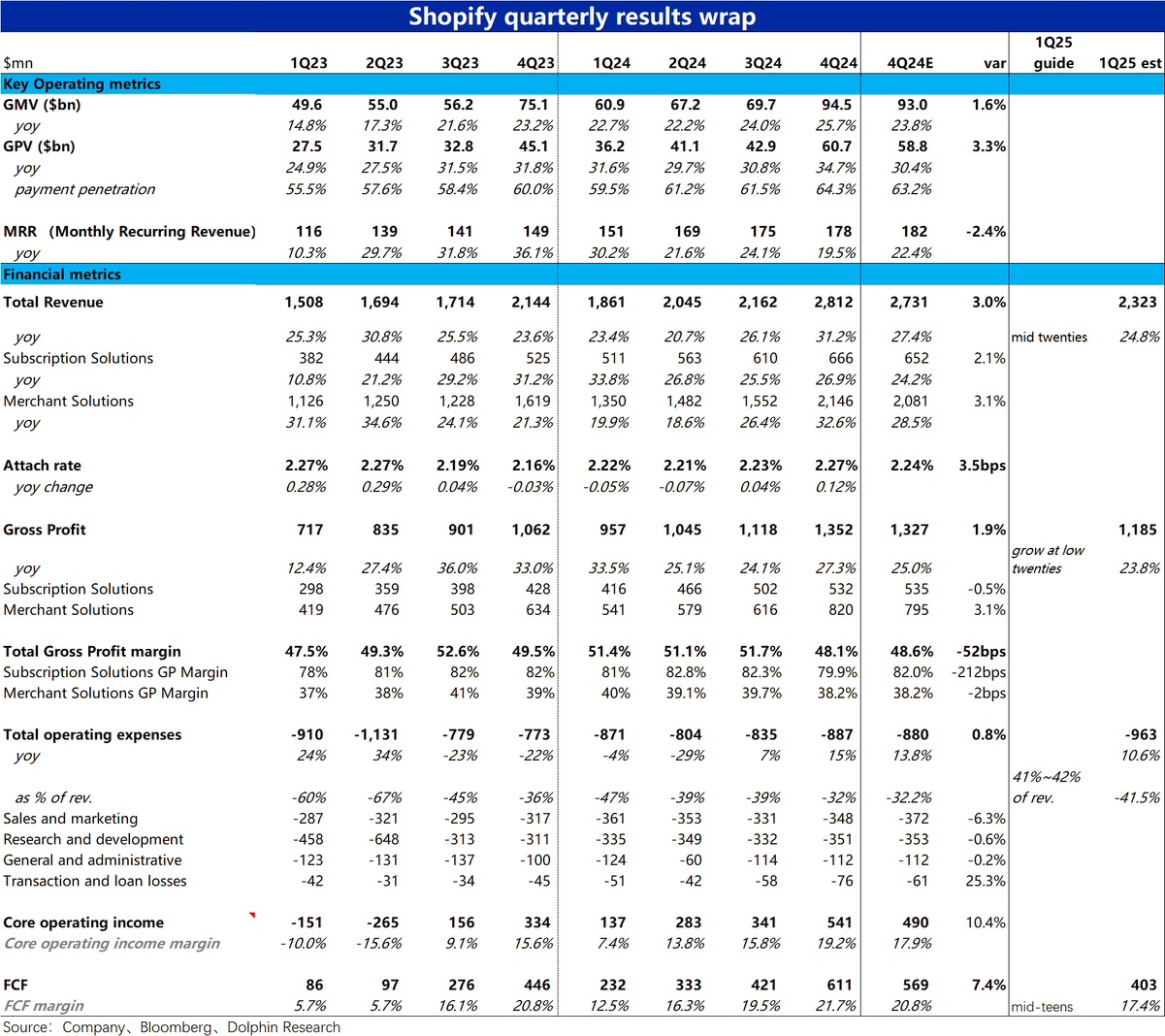

$Shopify (SHOP.US) 4Q24 Quick Interpretation: From an overall perspective, Shopify's performance this time is generally good. The core—GMV and GPV growth both reached or slightly exceeded expectations, continuing the positive trend of accelerating growth quarter-on-quarter. Other key indicators, including total revenue, gross profit, expense spending, and cash flow profit, also performed better than expected.

However, the pre-market reaction was a noticeable drop of over 5%. In Dolphin Investment Research's view, the biggest original sin is the company's currently high valuation, corresponding to the 2025 revenue expectations, with a pre-earnings market value still corresponding to about 15x P/S, which is relatively high even among SaaS stocks. High valuation means high expectations; for example, in terms of GMV, our understanding is that buyers' expected growth rate is actually between 25% and 26% or even higher, while the actual performance is just inline.

Additionally, as indicated by the declining MAU high-frequency data, this quarter's MRR (Monthly Recurring Revenue) metric underperformed market expectations, showing a significant slowdown, and some investment banks also pointed out this risk during the earnings period.

Corresponding to the slowdown in MRR, the gross profit from subscription services this season also underperformed expectations by about 2 percentage points, with specific reasons pending company explanation; we speculate it may be due to discounts offered to customers.

In terms of guidance, most indicators align with expectations, but the company guided FCF margin to be in the mid-teens, while the market expectation was 17.4% (which should fall within the low-high teens range), indicating a slight miss. @Shiguang (Hu Shuang)

The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.