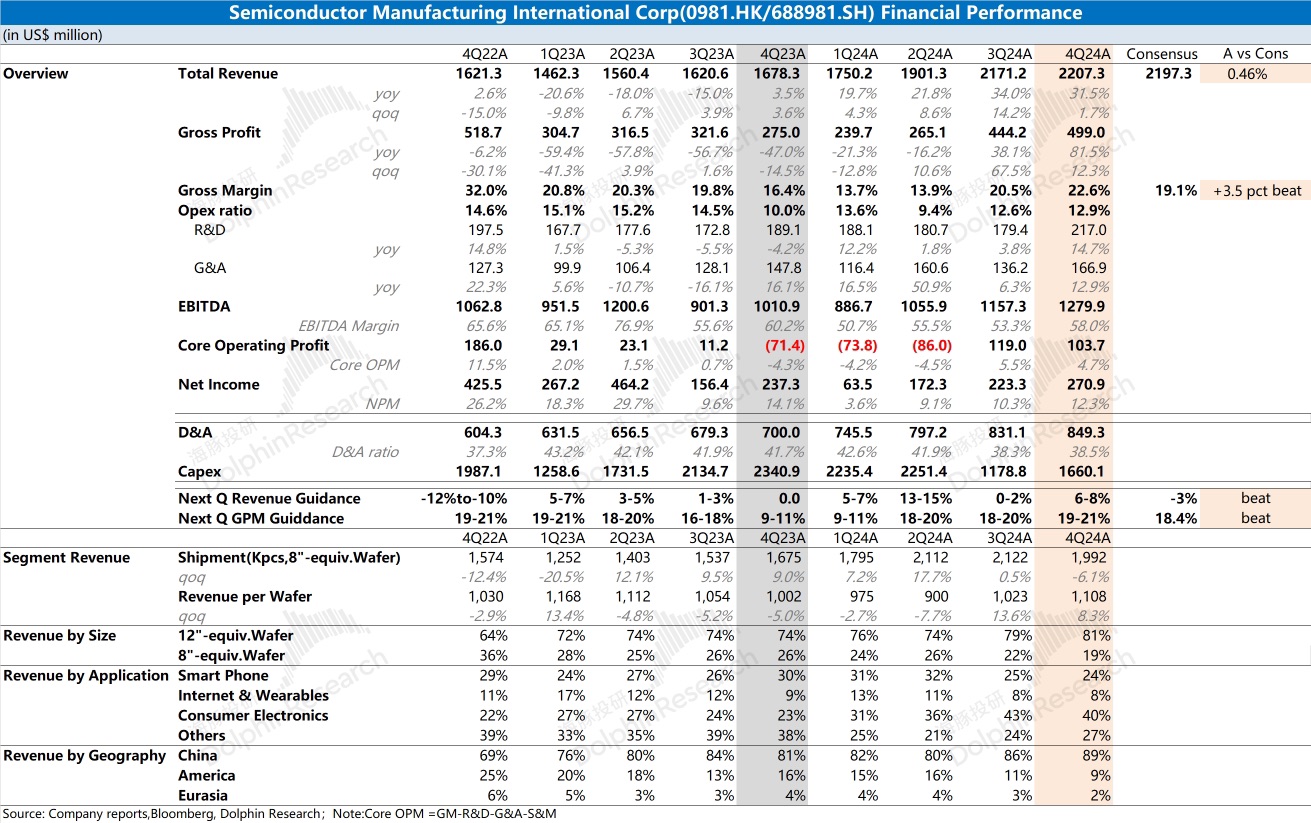

$SMIC(00981.HK) Quick Interpretation: The company's financial report is overall good. Revenue and gross margin both increased quarter-on-quarter, reaching the guidance expectations previously provided by the company. In particular, the company's gross margin continued to rise to 22.6% this quarter, mainly benefiting from the increase in the proportion of 12-inch wafers, which drove the growth in the average selling price of the company's products.

Although the company's operating expenses have increased, they remain stable at 12.9%. Driven by revenue growth and the recovery of gross margin, the company's EBITDA continued to rise to USD 1.28 billion this quarter.

Compared to this quarter's data, the guidance provided by the company is even better. The company expects revenue to continue to grow by 6-8% quarter-on-quarter next quarter, with gross margin maintained at 19-21%, both figures better than market expectations. Revenue growth is mainly driven by domestic demand, and although the company's gross margin is affected by seasonal fluctuations, it remains around 20%.

With the support of national subsidies and other policies, the domestic electronics market is expected to recover, and the corresponding domestic demand is likely to continue to support the company's capacity utilization and profitability. For more detailed information, please continue to follow Dolphin Jun's specific comments and conference call content regarding the company.

The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.