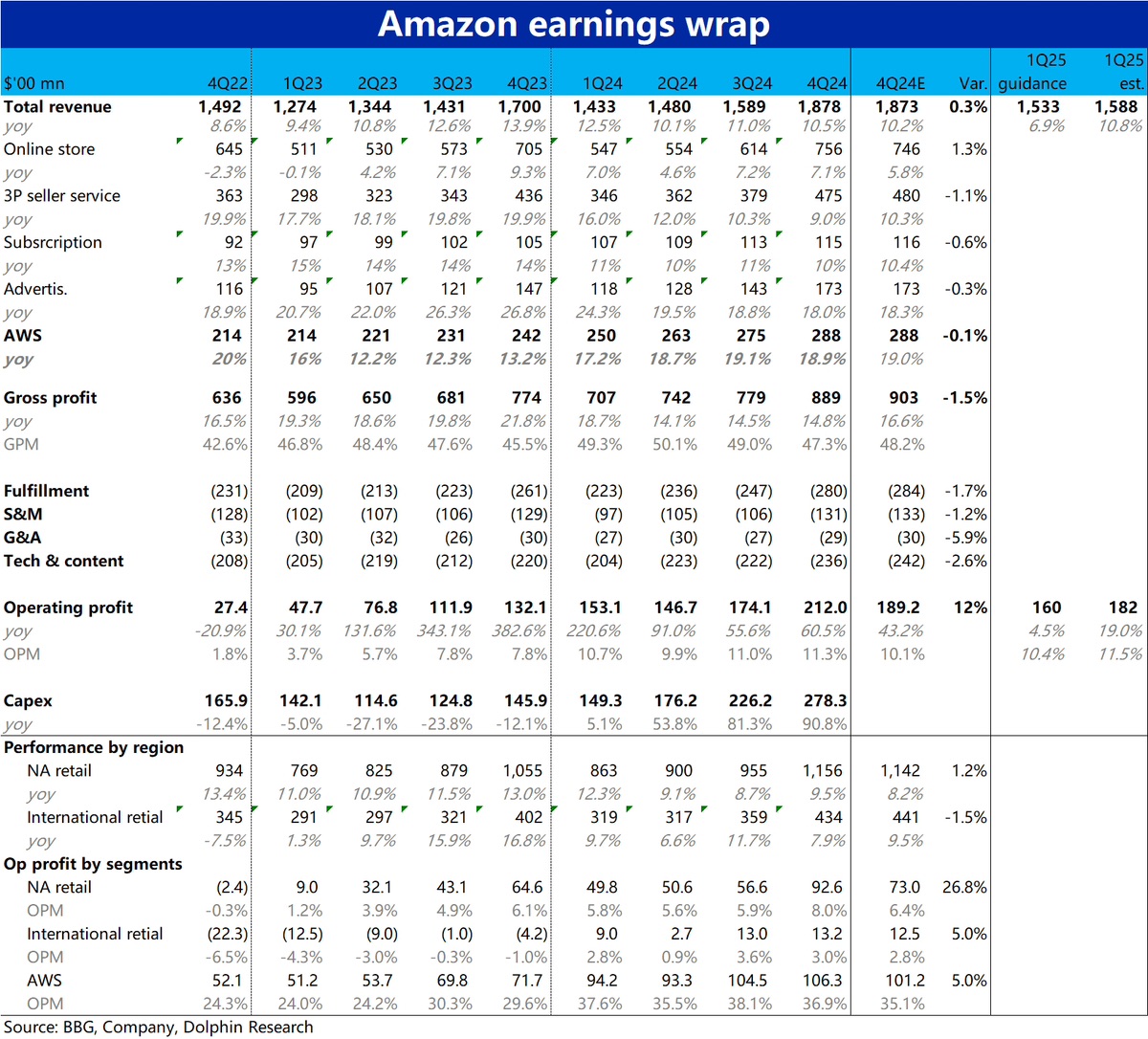

$Amazon(AMZN.US) 4Q24 Quick Interpretation: Amazon's performance this time has both highlights and flaws. In summary, profit release remains strong and better than expected, while revenue growth is slightly disappointing. Specifically:

1) Although overall revenue slightly exceeded expectations, the structural outperformance entirely comes from the low-margin self-operated retail business. Other higher-margin businesses, such as 3P business and advertising, actually grew slightly below expectations. Therefore, gross profit realization is also slightly worse than expected.

Among them, the market is particularly concerned about the AWS business growth rate, which is only 18.9%, while according to Dolphin Investment Research, buyers expected a growth rate of 20% or higher.

2) Operating profit this time was $21.2 billion, exceeding the company's guidance upper limit of $20 billion and the sell-side expectation of $18.9 billion. According to our understanding, buyers expected it to be above $20 billion. The actual performance is obviously satisfactory.

By segment, North America, international retail, and AWS profits all exceeded expectations. Among them, North America is the biggest contributor, with OPM increasing by a full 1.9 percentage points to 8%, far exceeding the market expectation of 6.4%. Combined with cost indicators, the improvement in operational efficiency and cost control should be the key contributors behind this.

3) Additionally, it is worth noting that Amazon's capex spending this quarter rose to $27.8 billion, increasing by about $5 billion sequentially, with both the absolute value and growth rate climbing. This may also be something that medium to short-term funds do not want to see.

4) The company's guidance for the next quarter indicates that both revenue and profit are below expectations based on the median. However, considering that Amazon generally delivers at the upper limit of guidance, the guidance for both indicators is roughly in line with expectations, albeit slightly lower. The seemingly weak guidance is likely one of the points that investors do not favor.

The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.