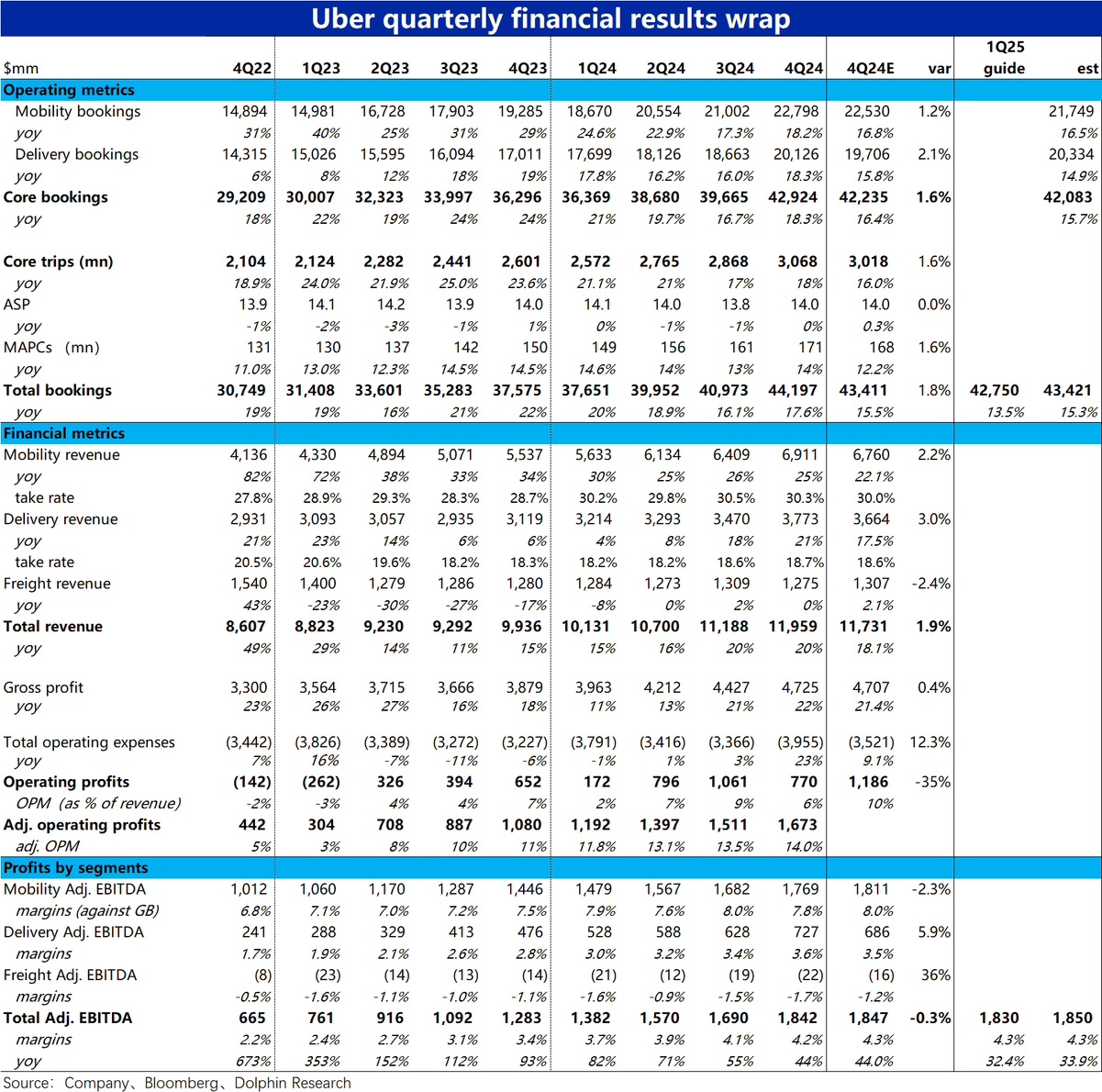

$Uber Tech(UBER.US) 4Q24 Quick Interpretation: Uber's performance this quarter is actually quite good, although it has both highlights and drawbacks, the highlights are relatively more. The more glaring issue is that the guidance for the next quarter once again missed market expectations. Recently, due to the medium to long-term perspective that "autonomous driving" poses an unverifiable threat to Uber, the market is currently quite harsh on Uber, almost intolerant of any performance flaws.

Specifically, the biggest highlight of the quarter is that the rapid decline in ride-hailing business (Mobility) order volume seen in the previous quarter did not continue but instead reversed. The order volume growth rate increased from 17.3% in the previous quarter to 18.2%. Although this was mainly due to a reduction in negative foreign exchange impacts, it at least dispelled market concerns that the slowdown in Mobility business growth would continue and worsen.

Similarly, the order volume growth rate for the delivery business (Delivery) also increased from 16.7% to 18.3% quarter-on-quarter, and even excluding the foreign exchange impact, the growth rate still improved by about 1 percentage point.

However, the flaw in this quarter's performance is that the adjusted EBITDA was $1.842 billion, slightly lower than the expected $1.847 billion. This is mainly because the profit margin of the ride-hailing business (based on Gross booking) was 7.8%, lower than market expectations and the previous quarter's 8%. This suggests that the business may be experiencing a decline in platform profitability due to competitive pressures.

A more significant defect is that the company's guidance for the next quarter indicates a median year-on-year growth of about 13.5% in overall order volume, which is significantly lower than the market expectation of 15.3% (with foreign exchange causing a negative impact of 5.5 percentage points, which is the main drag). Furthermore, due to the total order volume miss, although the company's guidance for the next quarter's adjusted EBITDA margin is consistent with market expectations at 4.3%, the absolute value is still about $20 million less than expected.

The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.