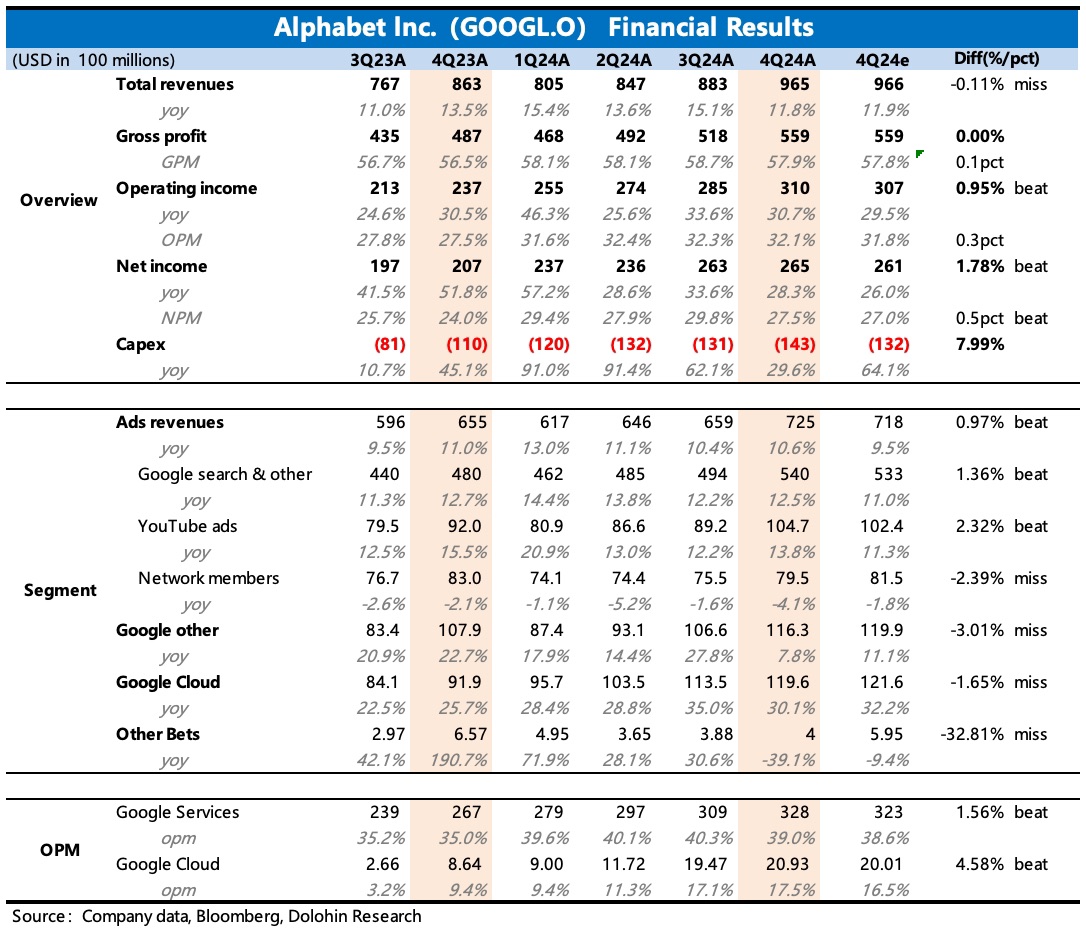

$Alphabet(GOOGL.US) interpretation: The main issue with the fourth-quarter performance is that the cloud business fell short of expectations, and the company expects to significantly increase capital expenditures this year. From a medium to long-term perspective, there is still debate over whether AI will clearly disrupt Google's search entry, and under regulatory concerns, the first two quarters were actually supported by the outstanding performance of the cloud business, allowing the market to temporarily set aside medium to long-term worries and choose to enjoy the current fruits. This has also led to a wave of catch-up since last quarter, with the release of Gemini 2.0, quantum chips, Waymo, and AI search advertising feedback exceeding expectations, among other positive factors.

Rationally speaking, the performance of the cloud business in the fourth quarter, although not too large in terms of the actual miss, will still slightly cool the market's recent "compensatory enthusiasm" for Google. Additionally, the high-profile announcement of a $75 billion Capex for 2025 (a year-on-year increase of 43%) exceeded market expectations, which may cause some funds to start worrying about the impact of over-investment on profitability.

1. Overall performance of the advertising business met expectations: Search grew strongly as per channel feedback, and YouTube advertising continued to recover. However, mobile affiliate advertising fell short of expectations and did not see more recovery due to the suspension of third-party cookies, instead accelerating its decline.

2. Cloud business growth rate slowed more than expected: Cloud growth was 30%, while the market expected over 32%. The performance of the cloud business was a key factor that allowed the market to temporarily set aside medium-term concerns, so this performance will undoubtedly disappoint some funds.

3. Profit improvement focused on efficiency: Operating profit margin remained stable, slightly exceeding expectations. This was mainly due to the company's control over expenses, especially a year-on-year decline in sales and management expenses. In the fourth quarter, the number of employees continued to increase month-on-month, but overall it was controllable. By business segment, the cloud business profit margin further increased to 17.5%, with market expectations for steady growth to 20% over the next two years.

4. Significantly increased capital expenditures: Regarding the excitement of spending money, the market mainly discussed Meta before the earnings report, with little expectation for Google, and Google has never provided quantitative guidance. However, this time the management has unprecedentedly provided a clear and significant increase in quantitative guidance—an expected Capex investment of $75 billion in 2025, exceeding the market expectation of around $60 billion.

The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.