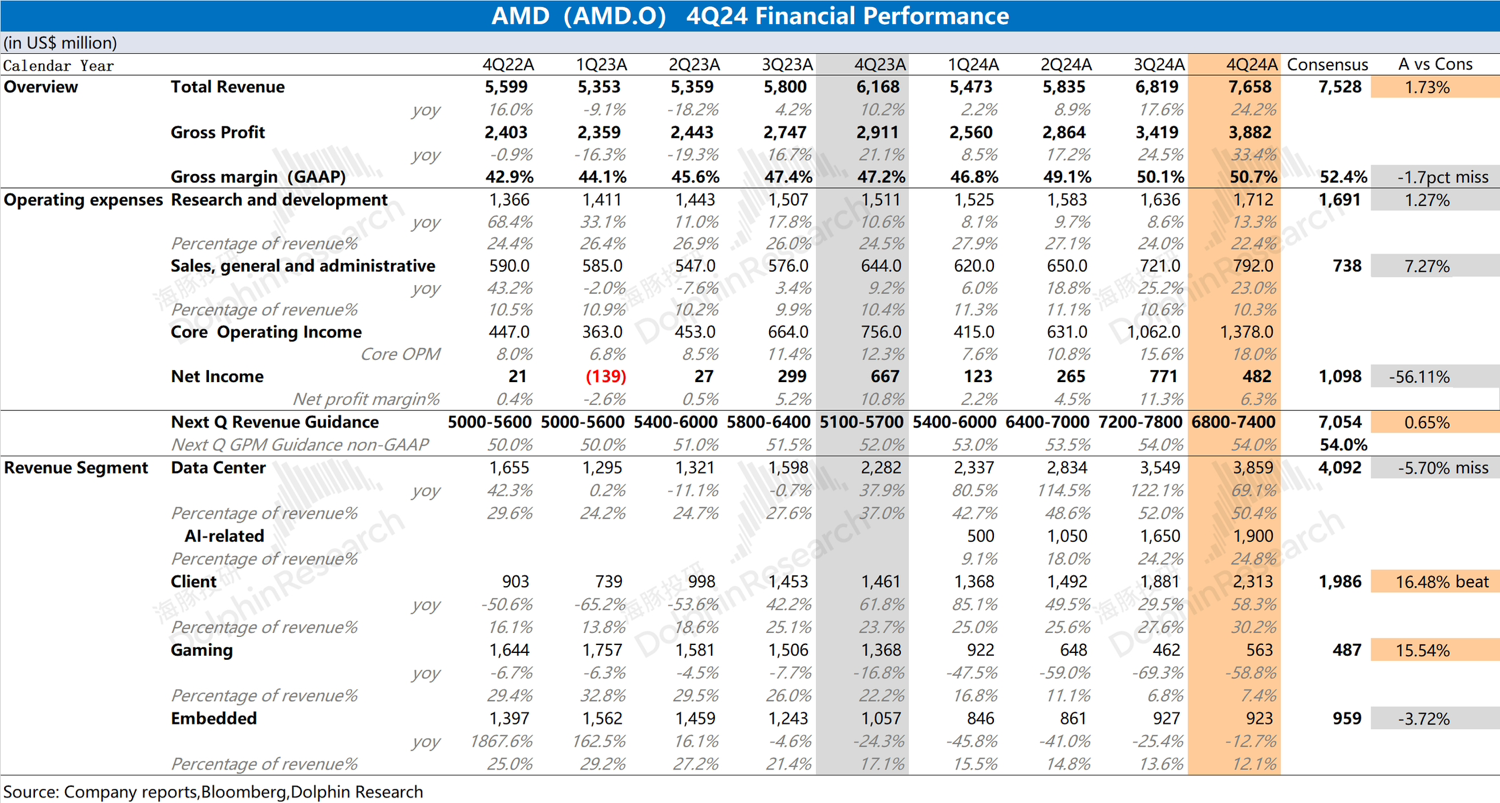

$AMD(AMD.US) 4Q24 Interpretation: This financial report is not very ideal. The company's revenue and operating profit both increased this quarter, mainly driven by growth in the data center and client businesses. By segment, although the company's client business performed better than expected, the data center business, which the market is most concerned about, clearly underperformed expectations.

In addition, the guidance provided by the company for the next quarter is also quite mediocre. The company expects revenue of $6.8-7.4 billion for the next quarter, with a gross margin (non-GAAP) of 54%, both of which meet market expectations.

Under the dual impact of "Deepseek's effect on overall capital expenditure" and "custom ASIC's impact on the GPU market," AMD's data center business has not provided convincing data and may experience a quarter-on-quarter decline in the next quarter. This financial report from the company is likely to further erode market confidence. For more detailed information, you can continue to follow Dolphin Jun's subsequent comments and conference call summary.

The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.