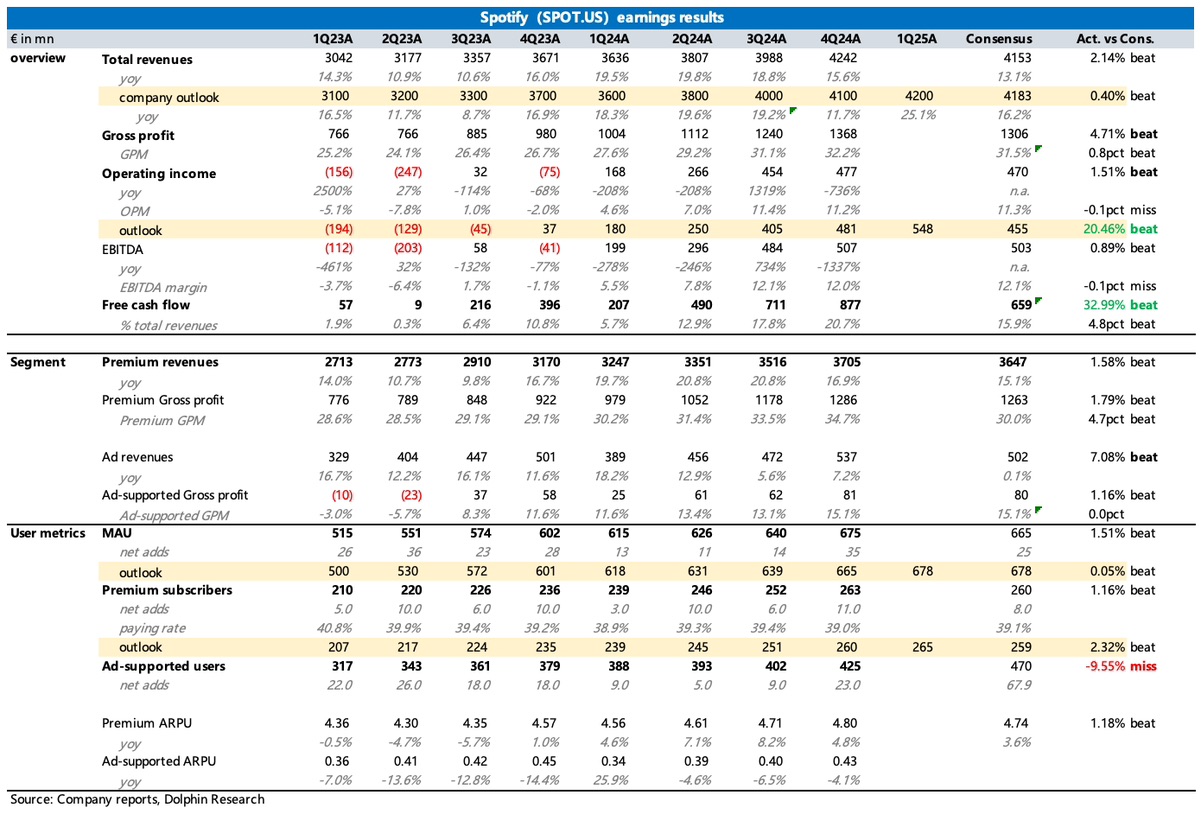

$Spotify(SPOT.US) quick Interpretation: The performance in the fourth quarter was good, overall meeting the growth targets and operational KPIs set in the previous quarter. The main highlights include the number of subscription users and profitability, with guidance for the next quarter also significantly exceeding expectations in both subscription numbers and operating profit.

1. User growth is impressive: reflected in MAU and the scale of paid subscription users exceeding expectations, but the growth of advertising users is average. In the fourth quarter, the Wrapped 10th Anniversary event accelerated user penetration in 184 regions worldwide. At the same time, in certain specific regions, video podcast content was introduced to enrich the service experience of membership benefits.

2. Subscription revenue met expectations, driven by both volume and price growth.

3. Although brand advertising demand itself was poor, Spotify's advertising revenue in the fourth quarter still managed to grow by 7%, exceeding market expectations, with growth mainly driven by exposure.

4. The current profit is actually good, but the significantly increased equity incentive costs and related taxes (Social charge) of €96 million (about 2% of revenue) due to the rise in market value put some pressure on current profits. As the current market value remains high, the company expects this part of the benefit costs to also be nearly €80 million in the next quarter.

The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.