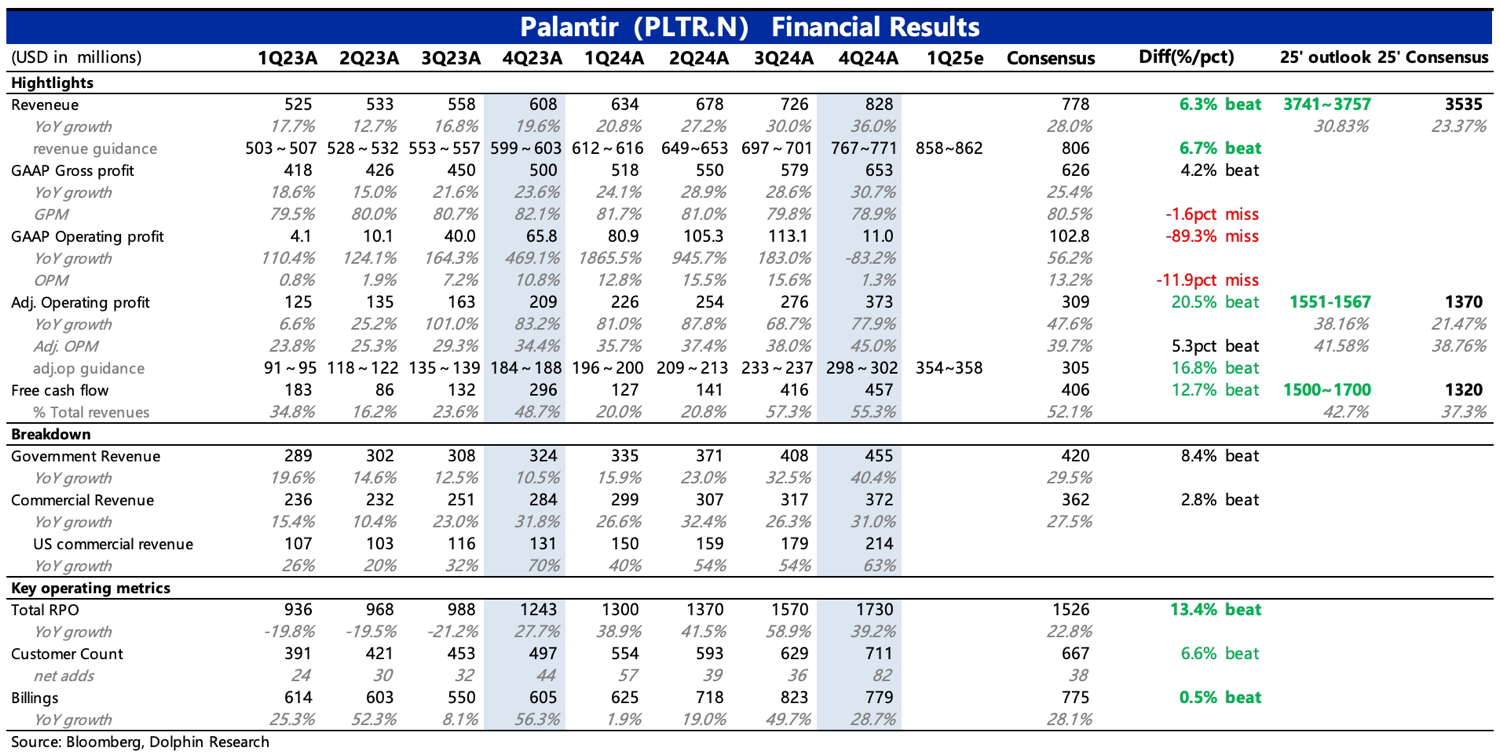

$Palantir Tech(PLTR.US) Quick Interpretation: Palantir is undoubtedly the leader in AI faith stocks! Despite a notably high valuation, the strong short-term fundamentals are undeniable + multiple favorable non-fundamental factors have led to continuous face-slapping of short sellers. This performance once again exceeded expectations, especially the guidance for 2025, as the company effectively countered some investors' concerns about intensified competition leading to growth slowdown and peak profitability, further enhancing investment confidence.

1. The biggest highlight is the guidance: The most impressive aspect of the Q4 financial report should be the company's guidance for Q1 and the entire year of 2025. On one hand, the annual revenue growth of 30% has not slowed compared to 2024, significantly exceeding market expectations, with the most concerning aspect for the market being the U.S. commercial revenue, which provided a beautiful guidance of at least 54% growth; secondly, the operating profit margin continues to improve by 3 percentage points, contrary to some investors' concerns about it leveling off or weakening due to intensified competition.

2. The current performance is also excellent: In Q4, both U.S. government and commercial revenues accelerated, benefiting from strong demand for Foundry and AIP. The significant growth in the number of customers and remaining performance obligations (RPO) also indicates that Palantir's customer base grew substantially in the fourth quarter, far exceeding the performance of the previous three quarters. Among them, the net increase in enterprise customers even doubled. RPO also maintained nearly 40% growth despite a high base, and the overall expansion rate of existing customers (NDR) further increased to 120%.

At the same time, the expenditure control that has always been synchronized with revenue expansion did not show signs of slowing down in Q4. Although from the perspective of SBC (total scale increased by 100% quarter-on-quarter, influenced not only by the doubling of market value but also by an increase in the number of employee incentives), there may be some personnel expansion, but overall it remains within a controllable range. Meanwhile, capital expenditures in Q4 did not change much, thus the profitability (adj. OPM) reached the company's guidance of over 40%, which is not difficult under controllable competition.

The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.